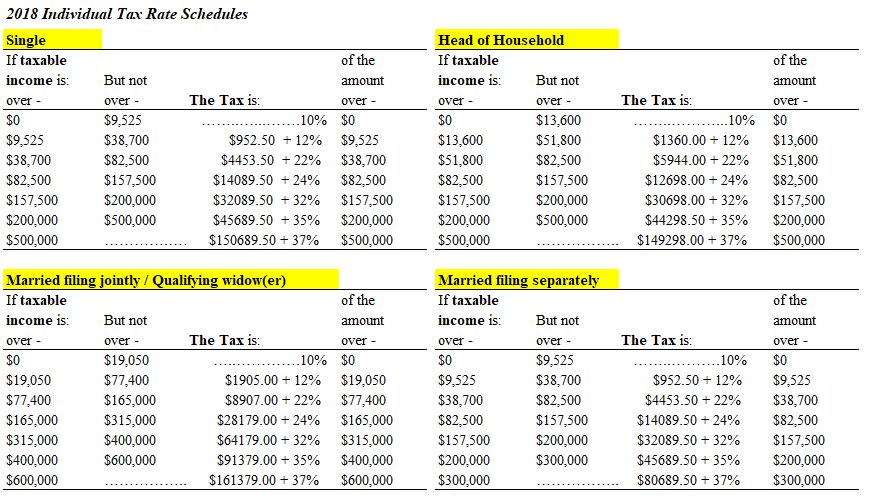

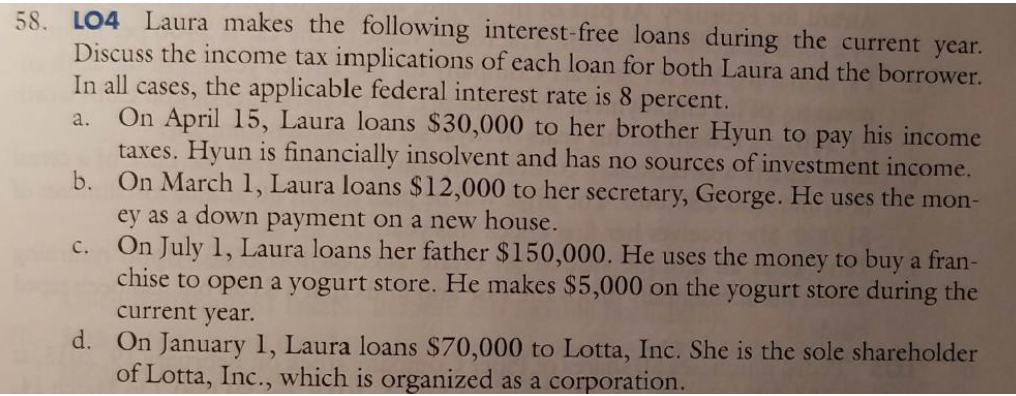

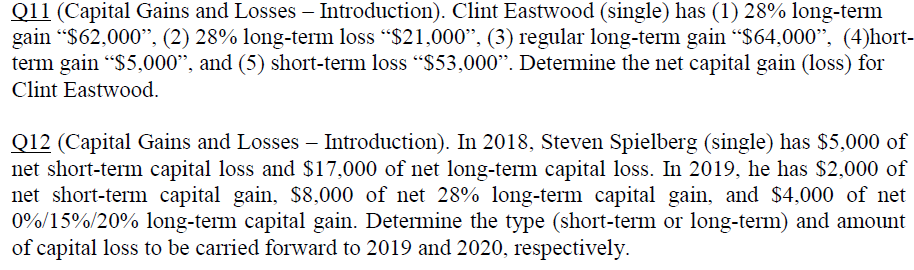

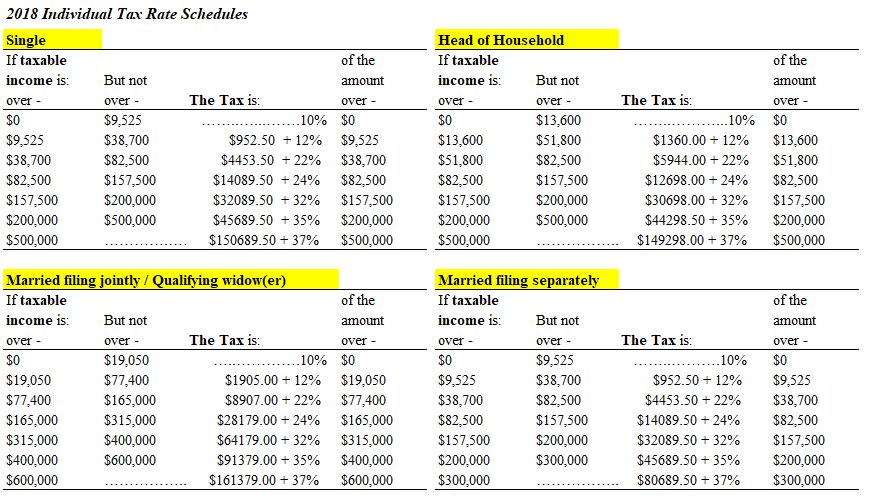

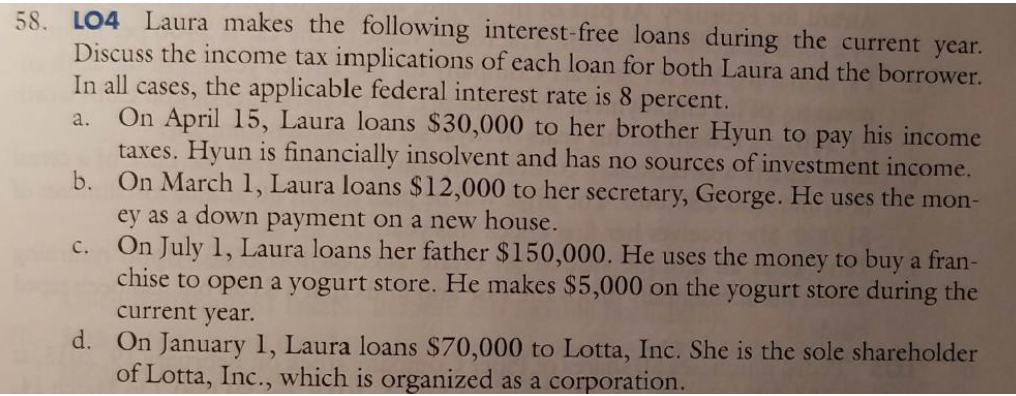

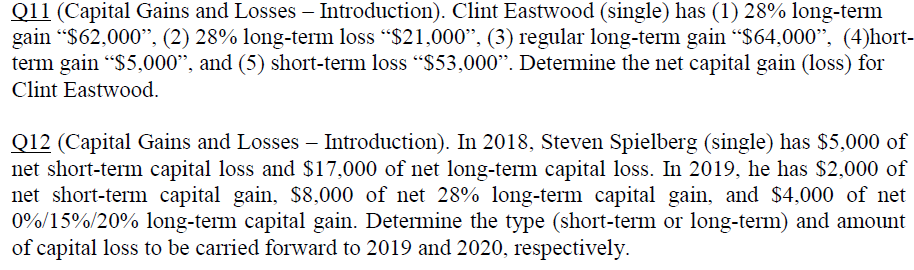

2018 Individual Tax Rate Schedules If taxable income 1s: over - S0 $9,525 $38,700 $82,500 $157,500 $200,000 $500,000 But not over - $9,525 $38,700 $82,500 $157,500 $200,000 $500,000 Head of Household If taxable income 1s: over - S0 $13,600 $51,800 $82,500 $157,500 $200,000 $500,000 amount But not over - $13,600 $51,800 $82,500 $157,500 $200,000 $500,000 amount The Tax is: The Tax is: $952.50+12% $4453.50+22% $14089.50+24% $32089.50+32% $45689.50+35% $150689.50+37% $9,525 $38,700 $82,500 $157,500 $200,000 $500,000 $1360.00 + 12% $5944.00 + 22% $12698.00 24% $30698.00 + 32% $44298.50+35% $149298.00 37% $13,600 $51.800 $82,500 $157,500 $200,000 $500,000 Married filing jointly/ Qualifying widow(er) If taxable income 1s: over - S0 $19,050 $77,400 $165,000 $315,000 $400,000 $600,000 But not over - $19,050 $77,400 $165,000 $315,000 $400,000 $600,000 Married filing separate If taxable income 1s: over - S0 $9,525 $38,700 $82,500 $157,500 $200,000 $300,000 amount But not over - $9,525 $38,700 $82,500 $157,500 $200,000 $300,000 amount The Tax is: The Tax is: $1905.00 + 12% $8907.00 + 22% $28179.00 24% $64179.00 + 32% $91379.00 + 35% $161379.00 37% $19,050 $77,400 $165,000 $315,000 $400,000 $600,000 $952.50 12% $4453.50 22% $14089.50+24% $32089.50 + 32% $45689.50+35% $80689.50+37% $9,525 $38,700 $82,500 $157,500 $200,000 $300,000 LO4 Laura makes the following interest-free loans during the current year. Discuss the income tax implications of each loan for both Laura and the borrower 58. In all cases, the applicable federal interest rate is 8 percent. a. On April 15, Laura loans $30,000 to her brother Hyun to pay his income Hyun is financially insolvent and has no sources of investment income. b. On March 1, Laura loans $12,000 to her secretary, George. He uses the mon- taxes. ey as a down payment on a new house. On July 1, Laura loans her father $150,000. He uses the money to buy a fran- chise to open a yogurt store. He makes $5,000 on the yogurt store during the c. current year d. On January 1, Laura loans $70,000 to Lotta, Inc. She is the sole shareholder of Lotta, Inc., which is organized as a corporation i l (Capital Gains and Losses-Introduction), Clint Eastwood (single) has (1) 28% long-term gain ..$62.000". (2) 28% long-term loss ..$21.000". (3) regular long-term gainS64.000", (4)hort- term gain ..$5,000", and (5) short-term loss $53,000". Determine the net capital gain (loss) for Clint Eastwood. Q12 (Capital Gains and Losses Introduction). In 2018, Steven Spielberg (single) has $5,000 of net short-term capital loss and $17.000 of net long-term capital loss. In 2019, he has S2,000 of net short-term capital gain, $8,000 of net 28% long-term capital gain, and $4,000 of net 0% 15%/20% long-term capital gain. Detemine the type (short-term or long-term) and amount of capital loss to be carried forward to 2019 and 2020, respectively