Answered step by step

Verified Expert Solution

Question

1 Approved Answer

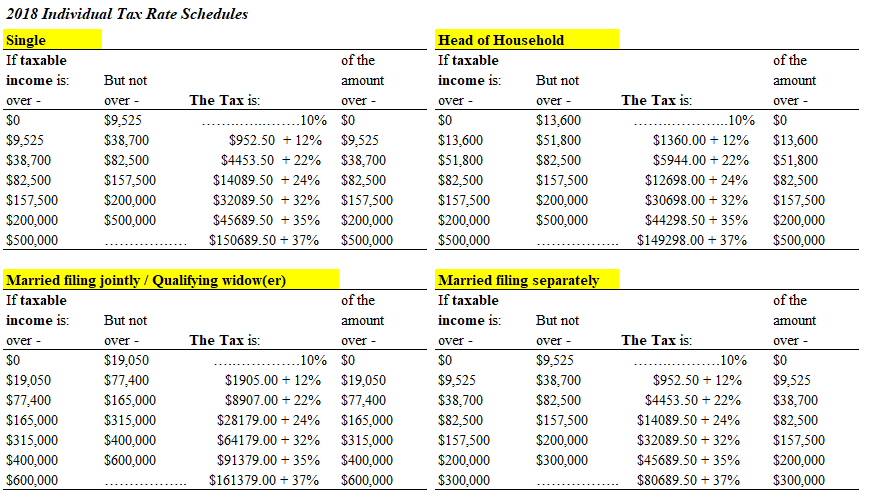

2018 Individual Tax Rate Schedules If taxable income 1s: over - S0 $9,525 $38,700 $82,500 $157,500 $200,000 $500,000 But not over - $9,525 $38,700 $82,500

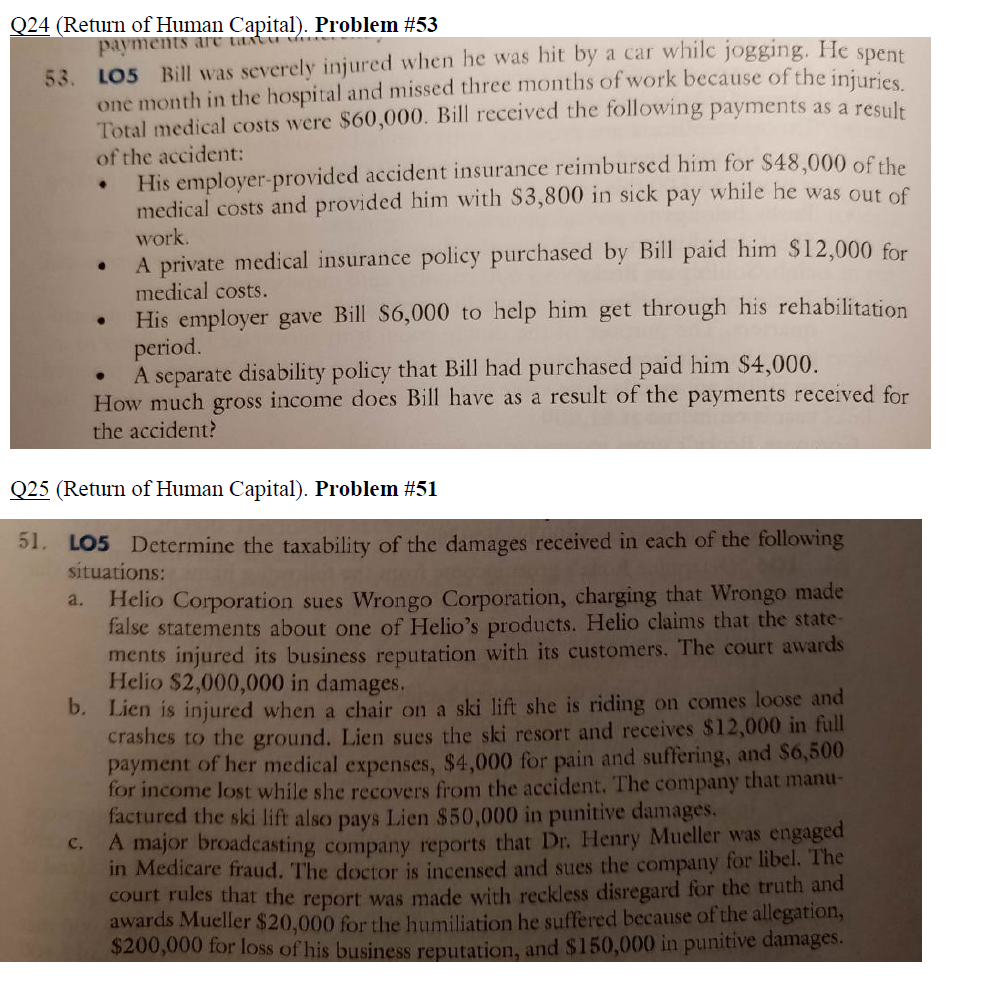

2018 Individual Tax Rate Schedules If taxable income 1s: over - S0 $9,525 $38,700 $82,500 $157,500 $200,000 $500,000 But not over - $9,525 $38,700 $82,500 $157,500 $200,000 $500,000 Head of Household If taxable income 1s: over - S0 $13,600 $51,800 $82,500 $157,500 $200,000 $500,000 amount But not over - $13,600 $51,800 $82,500 $157,500 $200,000 $500,000 amount The Tax is: The Tax is: $952.50+12% $4453.50+22% $14089.50+24% $32089.50+32% $45689.50+35% $150689.50+37% $9,525 $38,700 $82,500 $157,500 $200,000 $500,000 $1360.00 + 12% $5944.00 + 22% $12698.00 24% $30698.00 + 32% $44298.50+35% $149298.00 37% $13,600 $51.800 $82,500 $157,500 $200,000 $500,000 Married filing jointly/ Qualifying widow(er) If taxable income 1s: over - S0 $19,050 $77,400 $165,000 $315,000 $400,000 $600,000 But not over - $19,050 $77,400 $165,000 $315,000 $400,000 $600,000 Married filing separate If taxable income 1s: over - S0 $9,525 $38,700 $82,500 $157,500 $200,000 $300,000 amount But not over - $9,525 $38,700 $82,500 $157,500 $200,000 $300,000 amount The Tax is: The Tax is: $1905.00 + 12% $8907.00 + 22% $28179.00 24% $64179.00 + 32% $91379.00 + 35% $161379.00 37% $19,050 $77,400 $165,000 $315,000 $400,000 $600,000 $952.50 12% $4453.50 22% $14089.50+24% $32089.50 + 32% $45689.50+35% $80689.50+37% $9,525 $38,700 $82,500 $157,500 $200,000 $300,000 024 (Return of Human Capital). Proble In #53 payments are ta Lo5 Bill was severely injured when he was hit by a car while jogging. He one month in the hospital and missed three months of work because of the in Total medical costs were $60,000. Bill received the following payments as a re spent 53. of the accident: .His employer-provided accident insurance reimburscd him for $48,000 of the medical costs and provided him with S3,800 in sick pay while he was o work . A private medical insurance policy purchased by Bill paid him $12,000 for medical costs. . His employer gave Bill $6,000 to help him get through his rehabilitation period. . A scparate disability policy that Bill had purchased paid him S4,000. How much gross income does Bill have as a result of the payments received for the accident? 025 (Return of Human Capital). Problem #51 51. LO5 Determine the taxability of the damages received in each of the following situations: a. Helio Corporation sues Wrongo Corporation, charging that Wrongo ma false statements about one of Helio's products. Helio claims that the state- ments injured its business reputation with its customers. The court award nd Helio $2,000,000 in damages b. Lien is injured when a chair on a ski lift she is riding on comes loos shes to the ground. Lien sues the ski resort and receives $12,000 in full ayment of her medical expenses, $4,000 for pain and suffering, and $6,500 lost while she recovers from the accident. The company that manu- cra for income tured the ski lift also pays Lien $50,000 in punitive damages. in Medicare fraud. The court rules that the report was made with reckless disregard for the tru $200,000 for loss of his casting company reports that Dr. Henry Mueller was engaged doctor is incensed and sues the company for libel. The c. A major broad th and awards Mueller $20,000 for the humiliation he suffered because of the allegation ion, and S150,000 in punitive dama

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started