Answered step by step

Verified Expert Solution

Question

1 Approved Answer

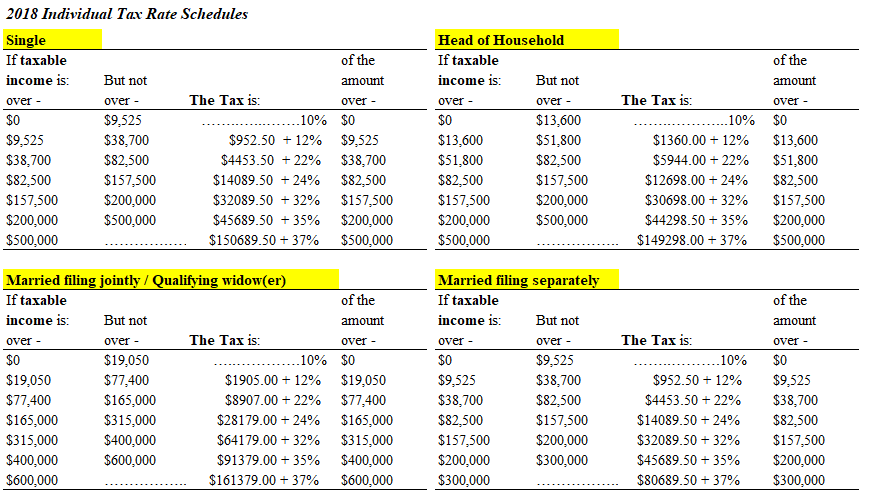

2018 Individual Tax Rate Schedules If taxable income 1s: over - S0 $9,525 $38,700 $82,500 $157,500 $200,000 $500,000 But not over - $9,525 $38,700 $82,500

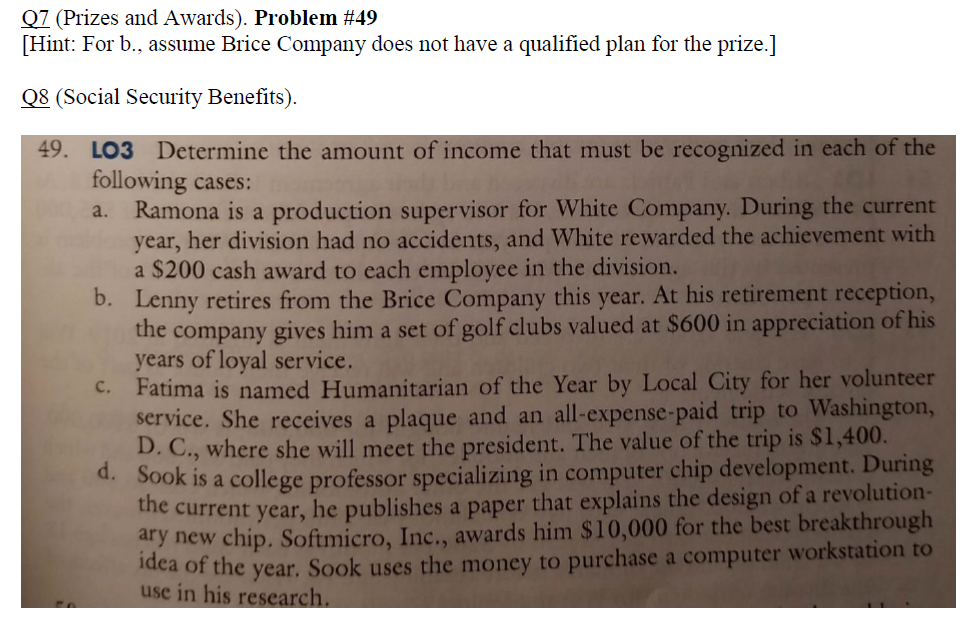

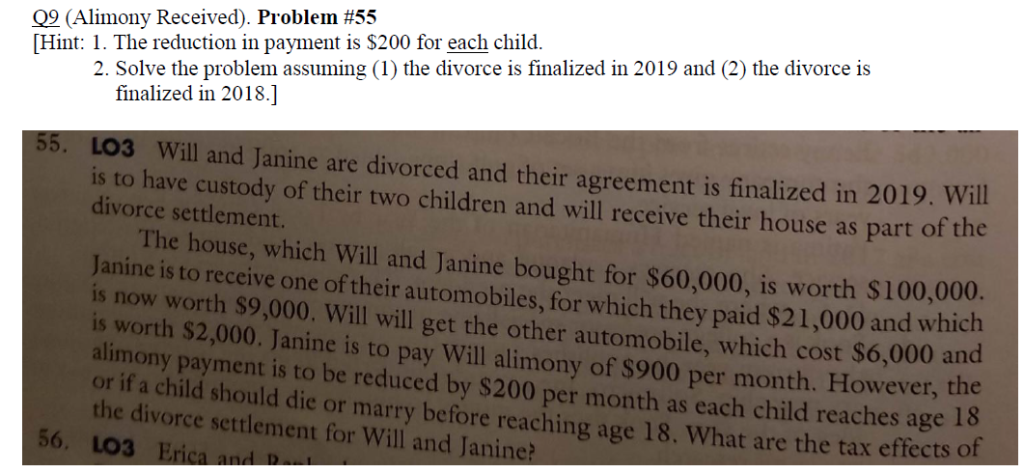

2018 Individual Tax Rate Schedules If taxable income 1s: over - S0 $9,525 $38,700 $82,500 $157,500 $200,000 $500,000 But not over - $9,525 $38,700 $82,500 $157,500 $200,000 $500,000 Head of Household If taxable income 1s: over - S0 $13,600 $51,800 $82,500 $157,500 $200,000 $500,000 amount But not over - $13,600 $51,800 $82,500 $157,500 $200,000 $500,000 amount The Tax is: The Tax is: $952.50+12% $4453.50+22% $14089.50+24% $32089.50+32% $45689.50+35% $150689.50+37% $9,525 $38,700 $82,500 $157,500 $200,000 $500,000 $1360.00 + 12% $5944.00 + 22% $12698.00 24% $30698.00 + 32% $44298.50+35% $149298.00 37% $13,600 $51.800 $82,500 $157,500 $200,000 $500,000 Married filing jointly/ Qualifying widow(er) If taxable income 1s: over - S0 $19,050 $77,400 $165,000 $315,000 $400,000 $600,000 But not over - $19,050 $77,400 $165,000 $315,000 $400,000 $600,000 Married filing separate If taxable income 1s: over - S0 $9,525 $38,700 $82,500 $157,500 $200,000 $300,000 amount But not over - $9,525 $38,700 $82,500 $157,500 $200,000 $300,000 amount The Tax is: The Tax is: $1905.00 + 12% $8907.00 + 22% $28179.00 24% $64179.00 + 32% $91379.00 + 35% $161379.00 37% $19,050 $77,400 $165,000 $315,000 $400,000 $600,000 $952.50 12% $4453.50 22% $14089.50+24% $32089.50 + 32% $45689.50+35% $80689.50+37% $9,525 $38,700 $82,500 $157,500 $200,000 $300,000 07 Prizes and Awards). Problem #49 Hint: For b., assume Brice Company does not have a qualified plan for the prize.] Q8 (Social Security Benefits). 49. LO3 Determine the amount of income that must be recognized in each of the following cases: Ramona is a production supervisor for White Company. During the current year, her division had no accidents, and White rewarded the achievement with a $200 cash award to each employee in the division. Lenny retires from the Brice Company this year. At his retirement reception, the company gives him a set of golf clubs valued at $600 in appreciation of his years of loyal service. a. b. c. Fatima is named Humanitarian of the Year by Local City for her volunteer service. She receives a plaque and an all-expense-paid trip to Washington, D. C. , where she will meet the president. The value of the trip is $1,400. k is a college professor specializing in computer chip development. During current year, he publishes a paper that explains the design of a revolution ary new chip. Sofimicro, Inc., awards him $10,000 for the best breakthrough of the year. Sook uses the money to purchase a computer workstation to d. oo the ea use in his research 09 (Alimony Received). Problem #55 Hint: 1. The reduction in payment is S200 for each child. 2. Solve the problem assuming (1) the divorce is finalized in 2019 and (2) the divorce is finalized in 2018.] 55. LO3 will and Janine are divorced and their agreement is finalized in 2019. Wil to have custody of their two children and will receive their house as part of the divorce settlement is The house, which Will and Janine bought for $60,000, is worth $100,000. Janine is to receive one of their automobiles, for which they paid $21,000 and whic is now worth $9,000. Will will get the other automobile, which cost $6,000 and is worth S2,000. Janine is to pay Will alimony of $900 per month. However, the alimony payment is to be reduced by $200 per month as each child reaches age 18 or if a child should die or marry before reaching age 18. What are the tax effects o the divorce settlement for Will and Janin 6. LO3 Erica a

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started