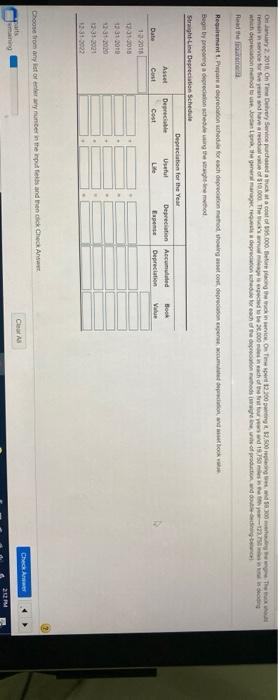

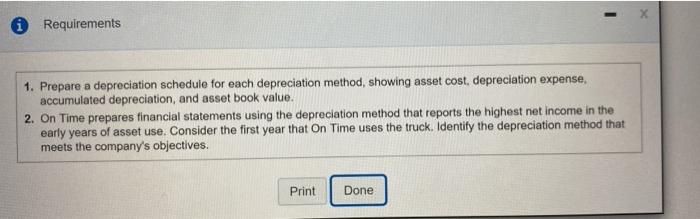

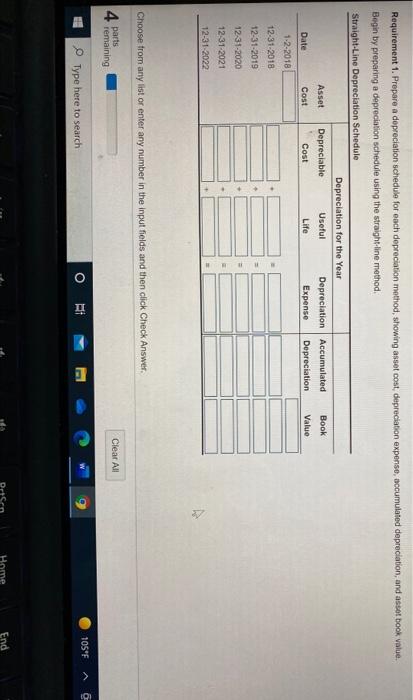

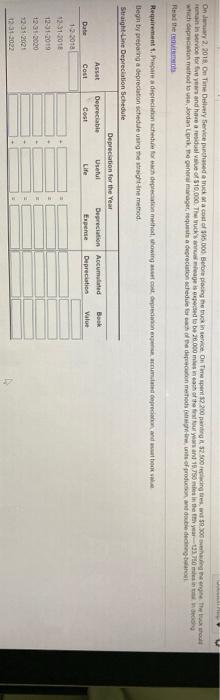

2018 On The Divery Service purchased at a cost of .000 orang wow 2.300 2.500 5300 en service for eyes and heard of 10.000 Theed.00 hod 19.750 which conto the proche con theoretische weito o Regimantt. Prepareren schedule for each den med. thing we could hook Begim by preparation scheduled Straight Line Depreciation Schedule Derection for the Year Asset Depreciate Us Depreciation Accumulated Book Date Cost Cost Lil Expense Depreciation Value 13 2011 100 31 31.2010 312021 2002 --- Choose from any listener unter in the inputs and then click Check Waits Check Claats 2 1 Requirements 1. Prepare a depreciation schedule for each depreciation method, showing asset cost, depreciation expense, accumulated depreciation, and asset book value. 2. On Time prepares financial statements using the depreciation method that reports the highest net income in the early years of asset use. Consider the first year that On Time uses the truck. Identify the depreciation method that meets the company's objectives. Print Done Requirement 1. Prepare a depreciation schedule for each depreciation method, showing asset cost, depreciation expense, accumulated depreciation, and asset book value. Begin by preparing a depreciation schedule using the straight-line method Straight-Line Depreciation Schedule Depreciation for the Year Asset Depreciable Useful Depreciation Accumulated Book Date Cost Cost Life Expense Depreciation Value 1-2-2018 12-31-2018 12-31-2019 12-31-2020 1231-2021 12-31-2022 Choose from any list or enter any number in the input fields and then click Check Answer 4 parts remaining Clear All IRI 7 O Type here to search 105F RI Home Home End On 2.2018 On The Divery Service puched a cost of $95.000 Beforeplacing the truck in onespent 2.200 2.500 gr. hg. The main service for years and have a residual value of 510,000. Thru's to be 20.000 mash of the found 10.750 in the year -070 which derecho , Jordan Lonker manager is depreciation schedule forholdet med fint of traditionale decor Read the Requirement Prana diccionached to a depreciation method towing customed and compete and can ho he Begin by preparing a depreciation schedule using the right in med Straight-Line Depreciation Schedule Depreciation for the Year Asset Depreciable Useful Depreciation Accumulated Book Date Cost Cost Life Expense Depreciation Valor 19 2018 12-01-2018 12-31-2010 12312020 19012 12313022 He for each depreciation method, showing asset cost, depreciation expense, accumulated depreciation, and asset book value. ng Requirements -red 1. Prepare a depreciation schedule for each depreciation method, showing asset cost, depreciation expense, accumulated depreciation, and asset book value. 2. On Time prepares financial statements using the depreciation method that reports the highest net income in the early years of asset use. Consider the first year that On Time uses the truck. Identify the depreciation method that meets the company's objectives. Print Done