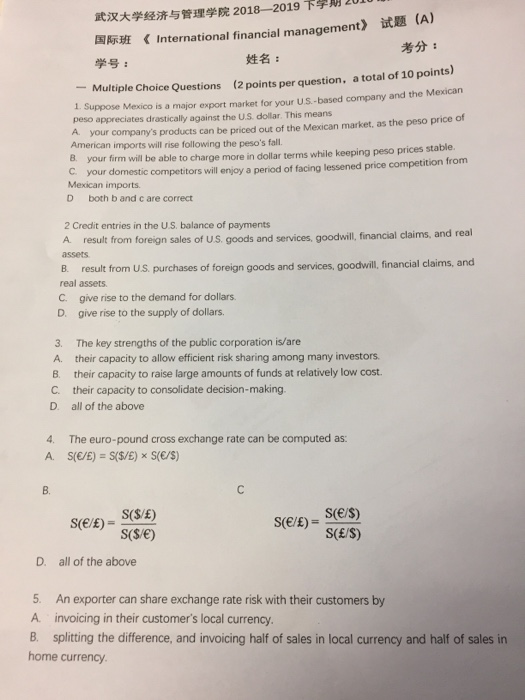

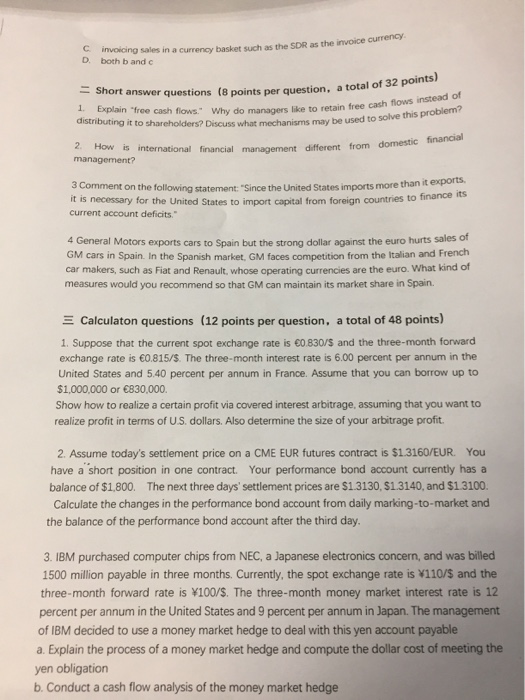

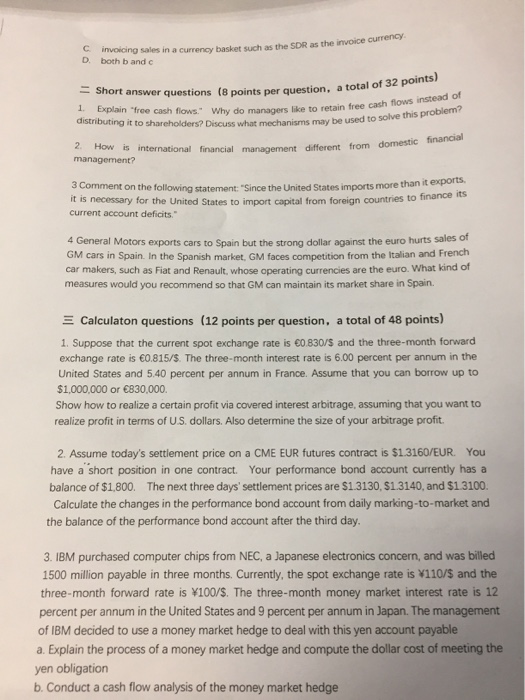

2018-2019 (A) International financial management Ag : : Multiple Choice Questions (2 points per question, a total of 10 points) 1 Suppose Mexico is a major export market for vour U.S.-based company and the Mexican peso appreciates drastically against the US. dollar. This means your company's products can be priced out of the Mexican market, as the peso price of A American imports will rise following the peso's fall. 8 your firm will be able to charge more in dollar terms while keeping peso prices stable. C. your domestic competitors will enjoy a period of facing lessened price competition from Mexican imports D both b and c are correct 2 Credit entries in the U.S. balance of payments A. result from foreign sales of US. goods and services, goodwill, financial claims, and real assets B. result from U.S. purchases of foreign goods and services, goodwill, financial claims, and real assets give rise to the demand for dollars. give rise to the supply of dollars. C. D. The key strengths of the public corporation is/are their capacity to allow efficient risk sharing among many investors their capacity to raise large amounts of funds at relatively low cost their capacity to consolidate decision-making 3. A. B. C. all of the above D. The euro-pound cross exchange rate can be computed as: 4. A. S(E/E) S($/E) x S(E/S) B S(E/S) S(S/E) S(E/E) S(E/E) S(S/E) S(/S) all of the above D. An exporter can share exchange rate risk with their customers by A invoicing in their customer's local currency B. splitting the difference, and invoicing half of sales in local currency and half of sales in home currency 5 invoicing sales in a currency basket such as the SDR as the imvoice currency D both b and c Short answer questions (8 points per question, a total of 32 points) Explain "frce cash flows. Why do managers like to retain free cash flows instead of distributing it to shareholders? Discuss what mechanisms may be used to solve this problem? 1. How is international financial management different from domestic financial management? 2. 3 Comment on the folllowing statement "Since the United States imports more than it exports it is necessary for the United States to import capital from foreign countries to finance its current account deficits." 4 General Motors exports cars to Spain but the strong dollar against the euro hurts sales of GM cars in Spain. In the Spanish market, GM faces competition from the Italian and French car makers, such as Fiat and Renault, whose operating currencies are the euro. What kind of measures would you recommend so that GM can maintain its market share in Spain. E Calculaton questions (12 points per question, a total of 48 points) 1. Suppose that the current spot exchange rate is 60.830/s and the three-month forward exchange rate is 0.815/S. The three-month interest rate is 6.00 percent per annum in the United States and 5.40 percent per annum in France. Assume that you can borrow up to $1,000,000 or 6830,000. Show how to realize a certain profit via covered interest arbitrage, assuming that you want to realize profit in terms of U.S. dollars. Also determine the size of your arbitrage profit 2. Assume today's settlement price on a CME EUR futures contract is $1.3160/EUR You have a short position in one contract. Your performance bond account currently has a balance of $1,800. The next three days' settlement prices are $1.3130, $1.3140, and $1.3100. Calculate the changes in the performance bond account from daily marking-to-market and the balance of the performance bond account after the third day 3. IBM purchased computer chips from NEC, a Japanese electronics concern, and was billed 1500 million payable in three months. Currently, the spot exchange rate is v110/S and the three-month forward rate is 100/S. The three-month money market interest rate is 12 percent per annum in the United States and 9 percent per annum in Japan. The management of IBM decided to use a money market hedge to deal with this yen account payable Explain the process of a money market hedge and compute the dollar cost of meeting the yen obligation b. Conduct a cash flow analysis of the money market hedge a