Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2019 2020 Current Assets = 280000+436000+500000 360500+369500+445500 Current Liabilities = 364000+340000+128800 464000+244000+138500 Current Assets = 1216000 1175500 Current Liabilities = 832800 846500 Current Ratio =

| 2019 | 2020 | |

| Current Assets = | 280000+436000+500000 | 360500+369500+445500 |

| Current Liabilities = | 364000+340000+128800 | 464000+244000+138500 |

| Current Assets = | 1216000 | 1175500 |

| Current Liabilities = | 832800 | 846500 |

| Current Ratio = | 1.46 | 1.39 |

| Gross Profit = Revenue - Cost of Goods Sold. | ||

| 2019 | 2020 | |

| Gross Profit | 612800 | 3187500 |

| Sales | 2400000 | 4625000 |

| Gross Profit Margin = | 25.53% | 68.92% |

Based on the ratios analysis above, explain the overall financial performance of Imtiaz Corporation from 2019 to 2020.

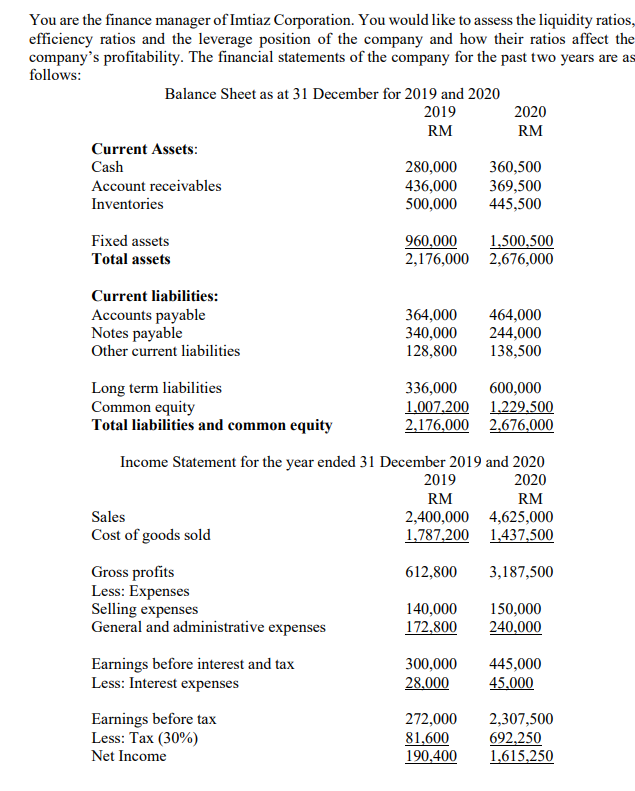

You are the finance manager of Imtiaz Corporation. You would like to assess the liquidity ratios, efficiency ratios and the leverage position of the company and how their ratios affect the company's profitability. The financial statements of the company for the past two years are as follows: Balance Sheet as at 31 December for 2019 and 2020 2019 2020 RM RM Current Assets: Cash 280,000 360,500 Account receivables 436,000 369,500 Inventories 500,000 445,500 Fixed assets Total assets 960,000 1,500,500 2,176,000 2,676,000 Current liabilities: Accounts payable Notes payable Other current liabilities 364,000 340,000 128,800 464,000 244,000 138,500 Long term liabilities Common equity Total liabilities and common equity 336,000 600,000 1,007,200 1,229,500 2,176,000 2,676,000 Income Statement for the year ended 31 December 2019 and 2020 2019 2020 RM RM Sales 2,400,000 4,625,000 Cost of goods sold 1,787,200 1,437,500 Gross profits 612,800 3,187,500 Less: Expenses Selling expenses 140,000 150,000 General and administrative expenses 172,800 240,000 Earnings before interest and tax 300,000 445,000 Less: Interest expenses 28,000 45,000 Earnings before tax 272,000 2,307,500 Less: Tax (30%) 81,600 692,250 Net Income 190,400 1,615,250Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started