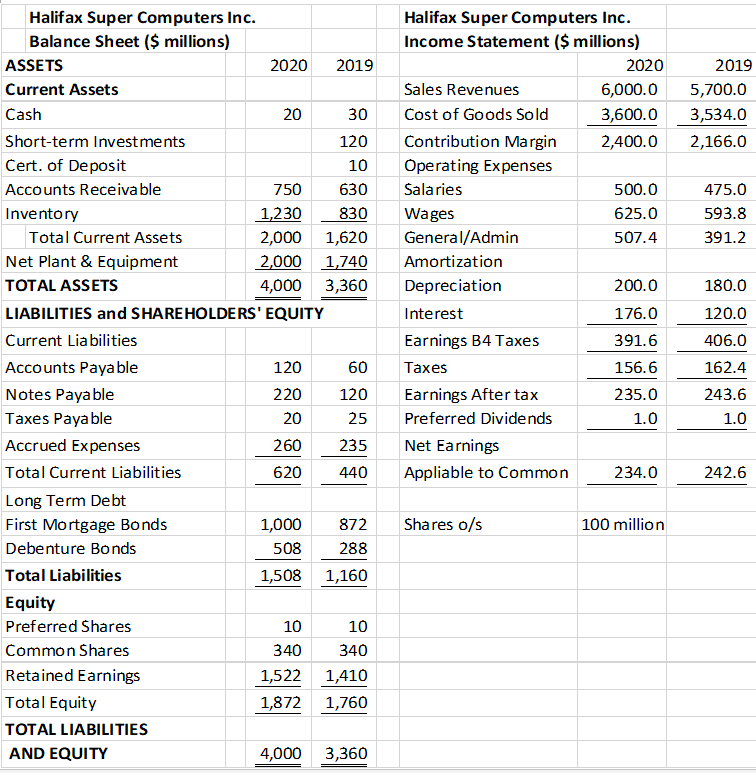

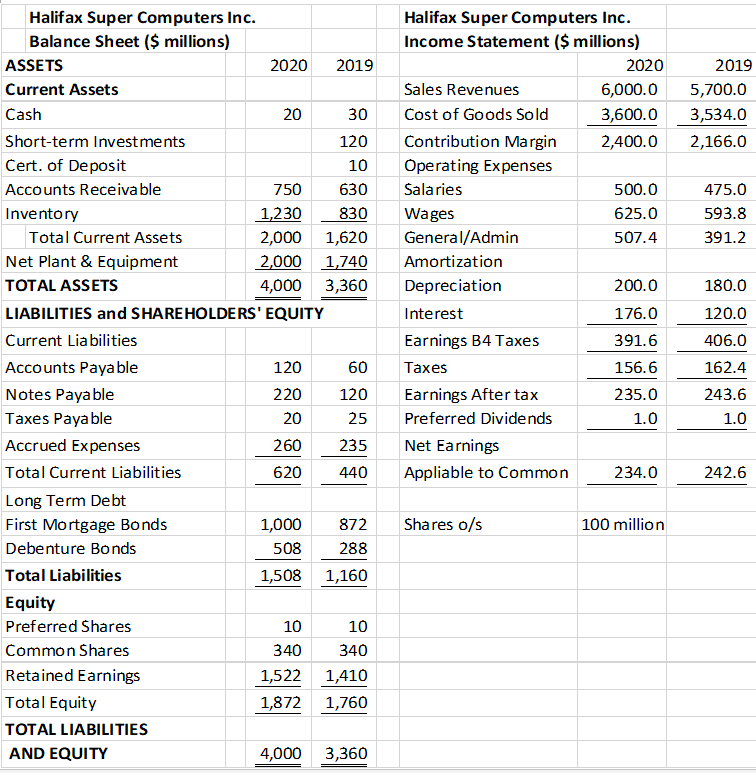

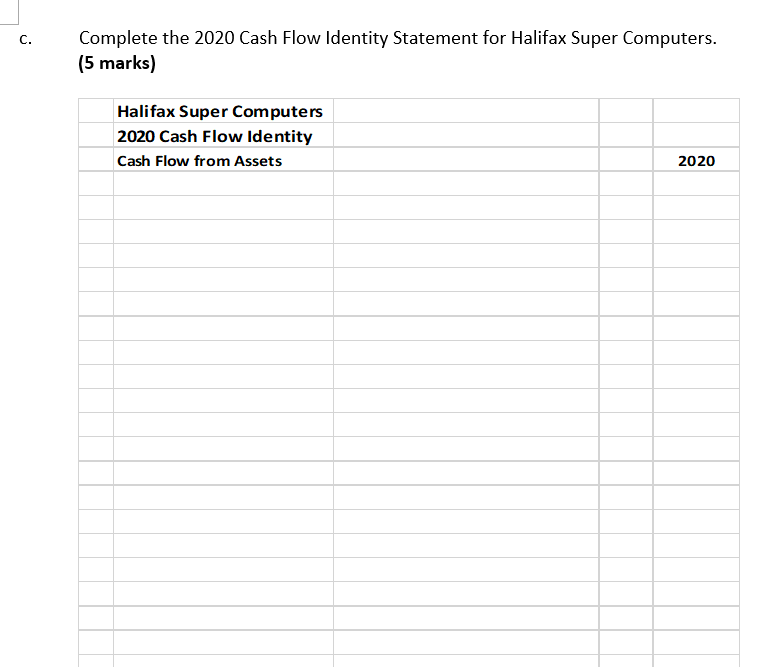

2019 5,700.0 3,534.0 2,166.0 475.0 593.8 391.2 Halifax Super Computers Inc. Income Statement ($ millions) 2020 Sales Revenues 6,000.0 Cost of Goods Sold 3,600.0 Contribution Margin 2,400.0 Operating Expenses Salaries 500.0 Wages 625.0 General/Admin 507.4 Amortization Depreciation 200.0 Interest 176.0 Earnings B4 Taxes 391.6 Taxes 156.6 Earnings After tax 235.0 Preferred Dividends 1.0 Net Earnings Appliable to Common 234.0 180.0 120.0 Halifax Super Computers Inc. Balance Sheet ($ millions) ASSETS 2020 2019 Current Assets Cash 20 30 Short-term Investments 120 Cert. of Deposit 10 Accounts Receivable 750 630 Inventory 1,230 830 Total Current Assets 2,000 1,620 Net Plant & Equipment 2,000 1,740 TOTAL ASSETS 4,000 3,360 LIABILITIES and SHAREHOLDERS' EQUITY Current Liabilities Accounts Payable 120 60 Notes Payable 220 120 Taxes Payable 20 25 Accrued Expenses 260 235 Total Current Liabilities 620 440 Long Term Debt First Mortgage Bonds 1,000 872 Debenture Bonds 508 288 Total Liabilities 1,508 1,160 Equity Preferred Shares 10 10 Common Shares 340 340 Retained Earnings 1,522 1,410 Total Equity 1,872 1,760 TOTAL LIABILITIES AND EQUITY 4,000 3,360 406.0 162.4 243.6 1.0 242.6 Shares o/s 100 million C. Complete the 2020 Cash Flow Identity Statement for Halifax Super Computers. (5 marks) Halifax Super Computers 2020 Cash Flow Identity Cash Flow from Assets 2020 2019 5,700.0 3,534.0 2,166.0 475.0 593.8 391.2 Halifax Super Computers Inc. Income Statement ($ millions) 2020 Sales Revenues 6,000.0 Cost of Goods Sold 3,600.0 Contribution Margin 2,400.0 Operating Expenses Salaries 500.0 Wages 625.0 General/Admin 507.4 Amortization Depreciation 200.0 Interest 176.0 Earnings B4 Taxes 391.6 Taxes 156.6 Earnings After tax 235.0 Preferred Dividends 1.0 Net Earnings Appliable to Common 234.0 180.0 120.0 Halifax Super Computers Inc. Balance Sheet ($ millions) ASSETS 2020 2019 Current Assets Cash 20 30 Short-term Investments 120 Cert. of Deposit 10 Accounts Receivable 750 630 Inventory 1,230 830 Total Current Assets 2,000 1,620 Net Plant & Equipment 2,000 1,740 TOTAL ASSETS 4,000 3,360 LIABILITIES and SHAREHOLDERS' EQUITY Current Liabilities Accounts Payable 120 60 Notes Payable 220 120 Taxes Payable 20 25 Accrued Expenses 260 235 Total Current Liabilities 620 440 Long Term Debt First Mortgage Bonds 1,000 872 Debenture Bonds 508 288 Total Liabilities 1,508 1,160 Equity Preferred Shares 10 10 Common Shares 340 340 Retained Earnings 1,522 1,410 Total Equity 1,872 1,760 TOTAL LIABILITIES AND EQUITY 4,000 3,360 406.0 162.4 243.6 1.0 242.6 Shares o/s 100 million C. Complete the 2020 Cash Flow Identity Statement for Halifax Super Computers. (5 marks) Halifax Super Computers 2020 Cash Flow Identity Cash Flow from Assets 2020