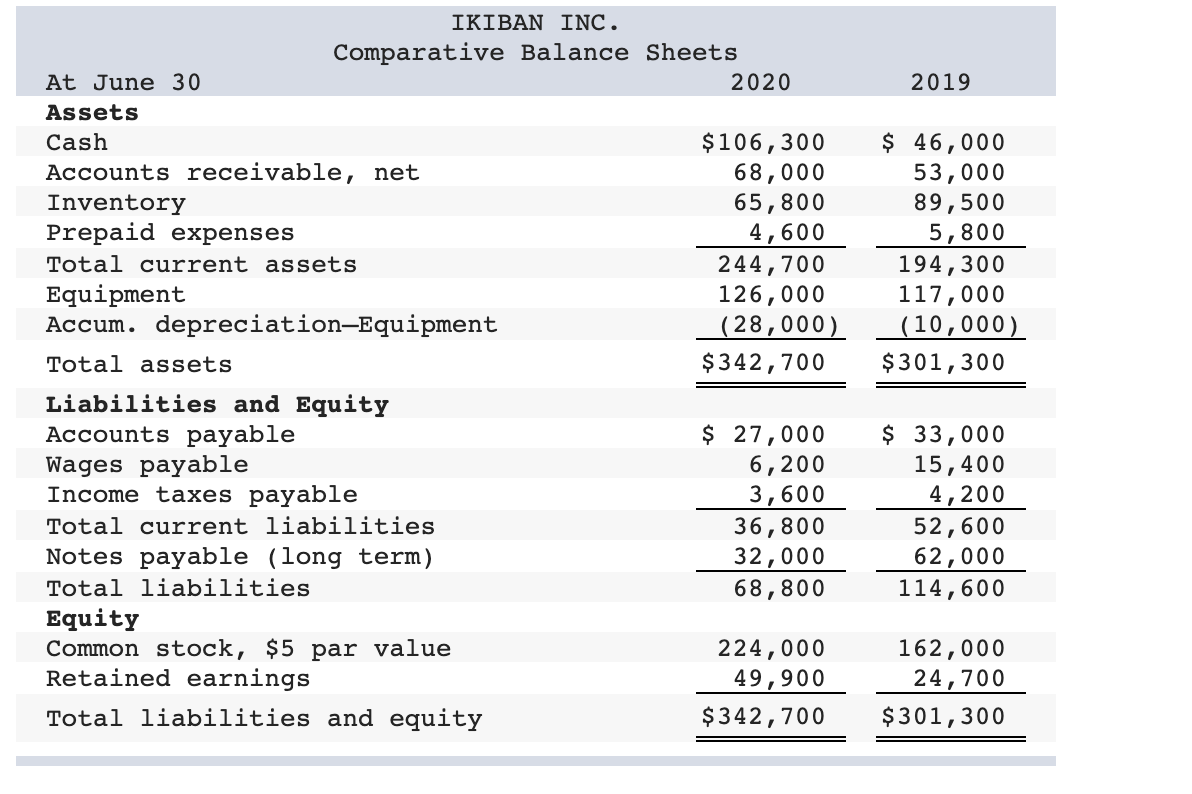

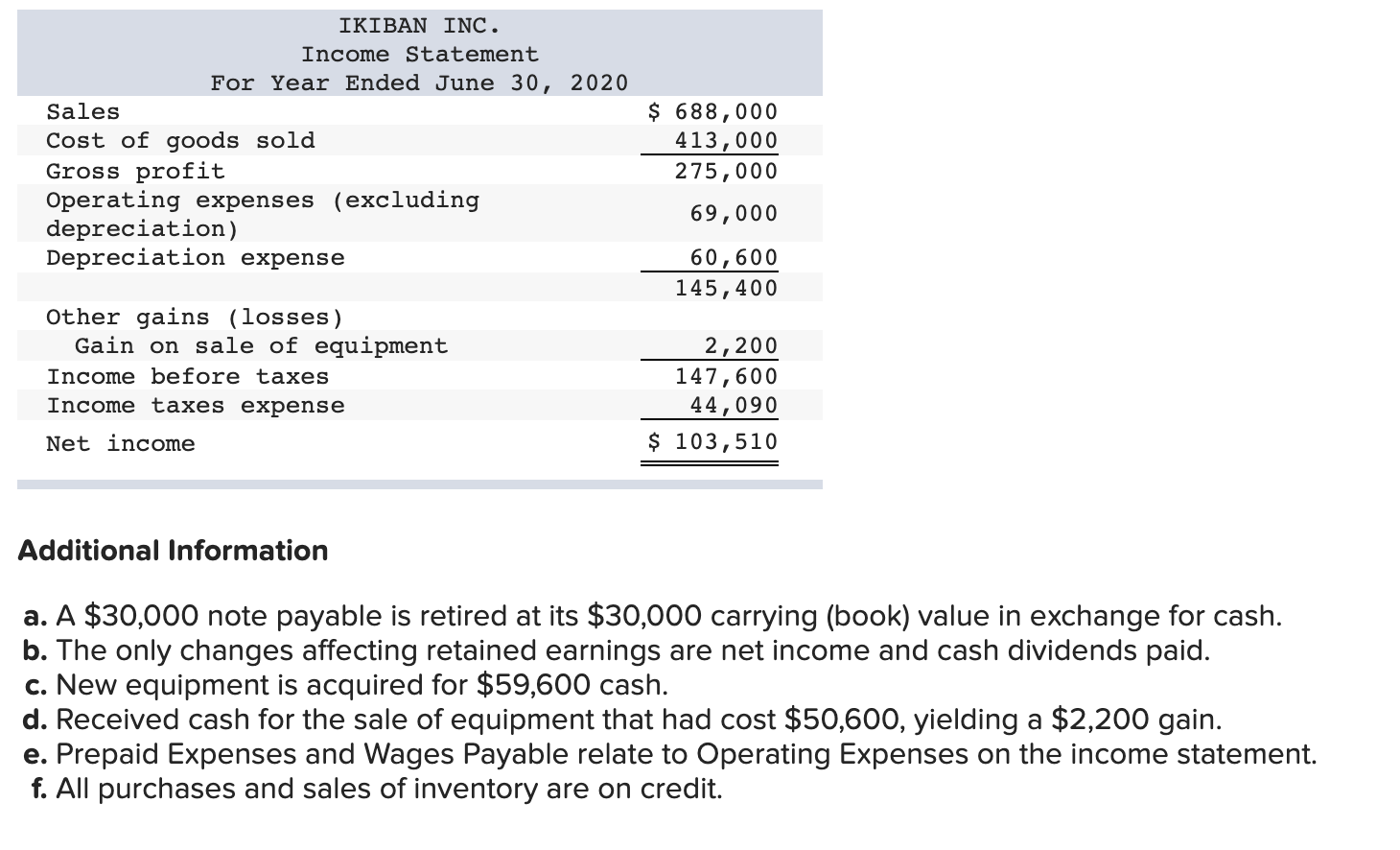

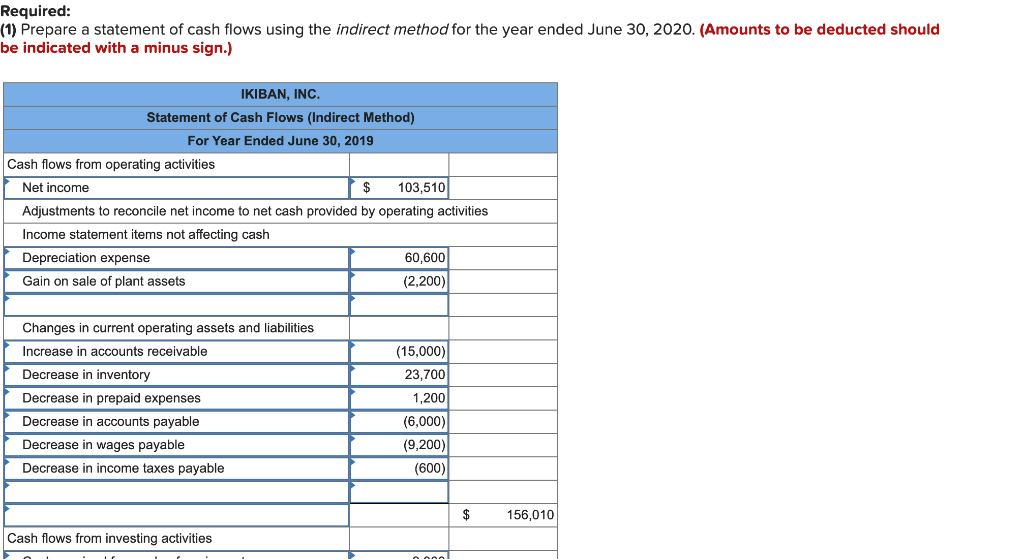

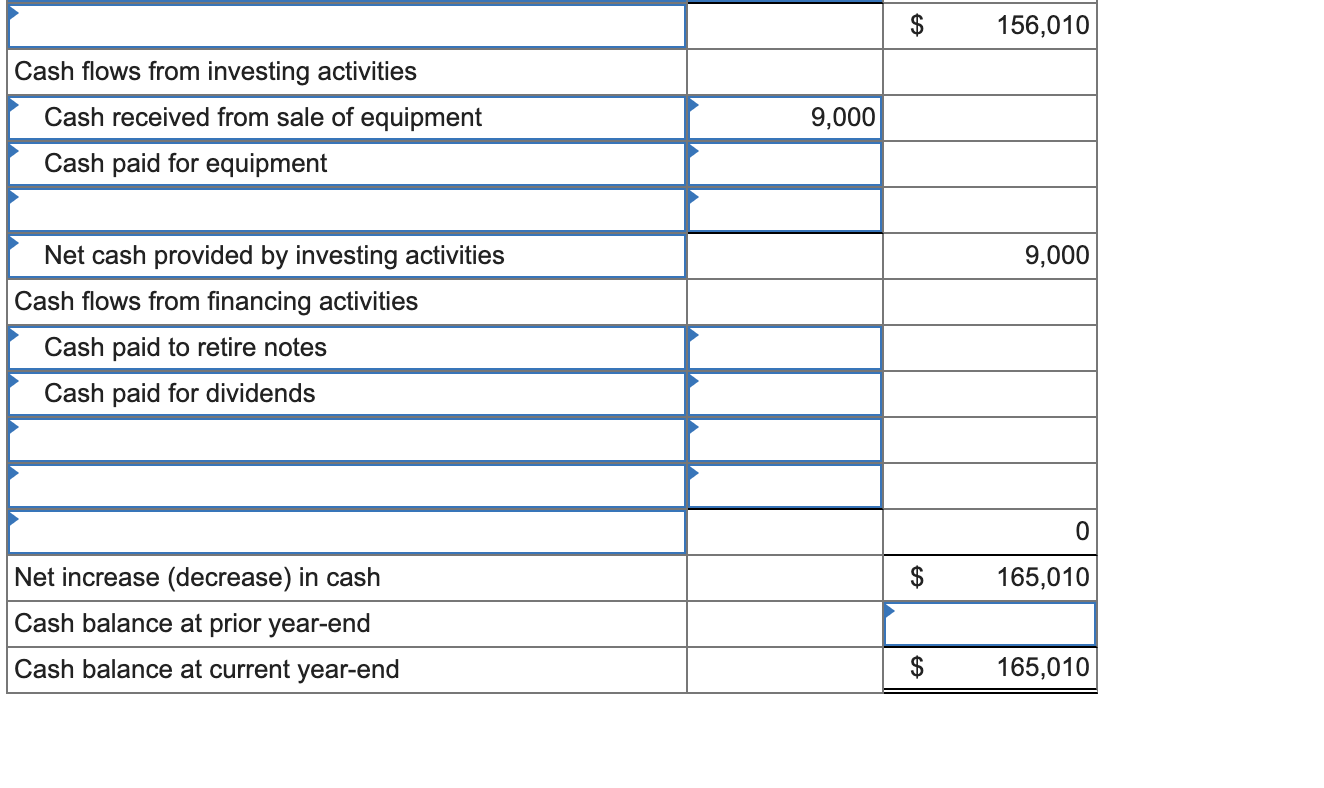

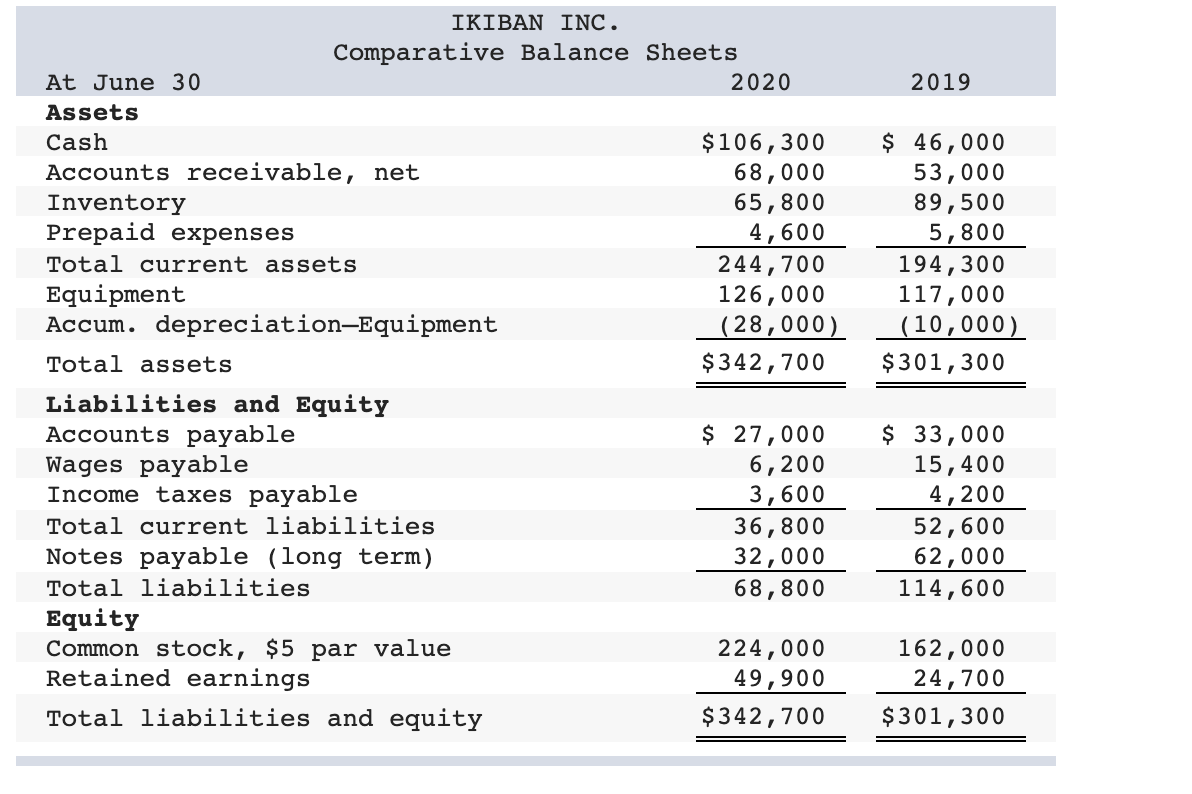

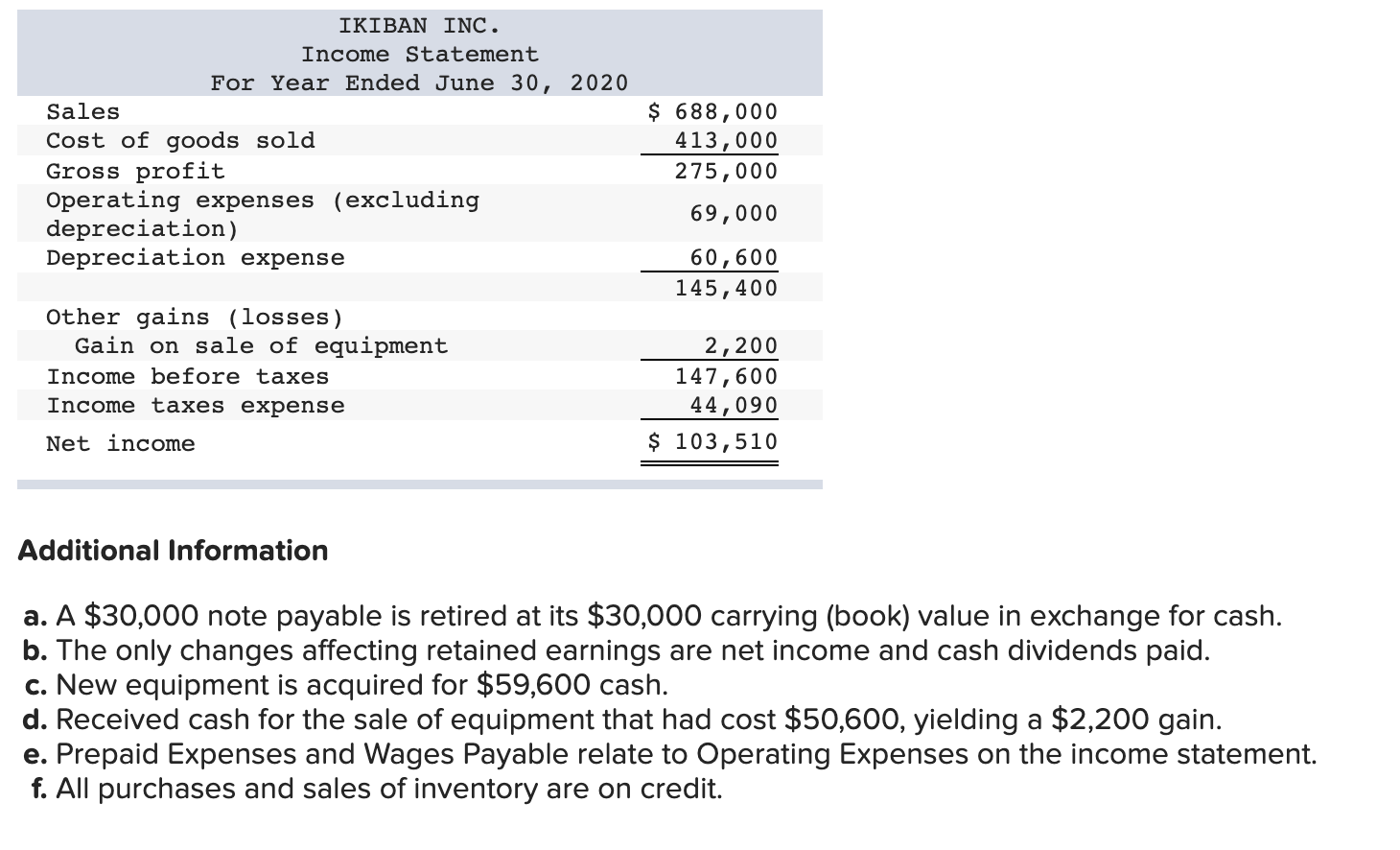

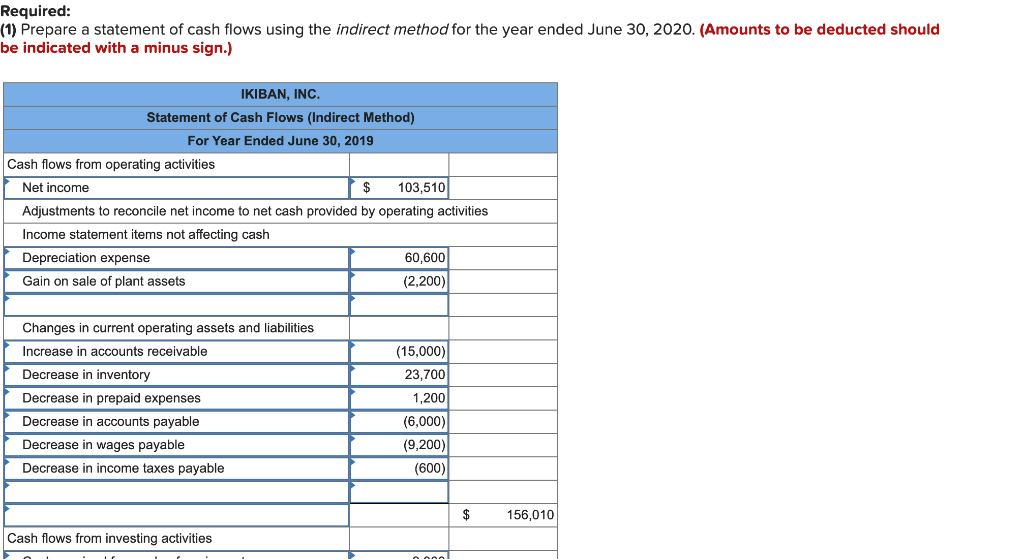

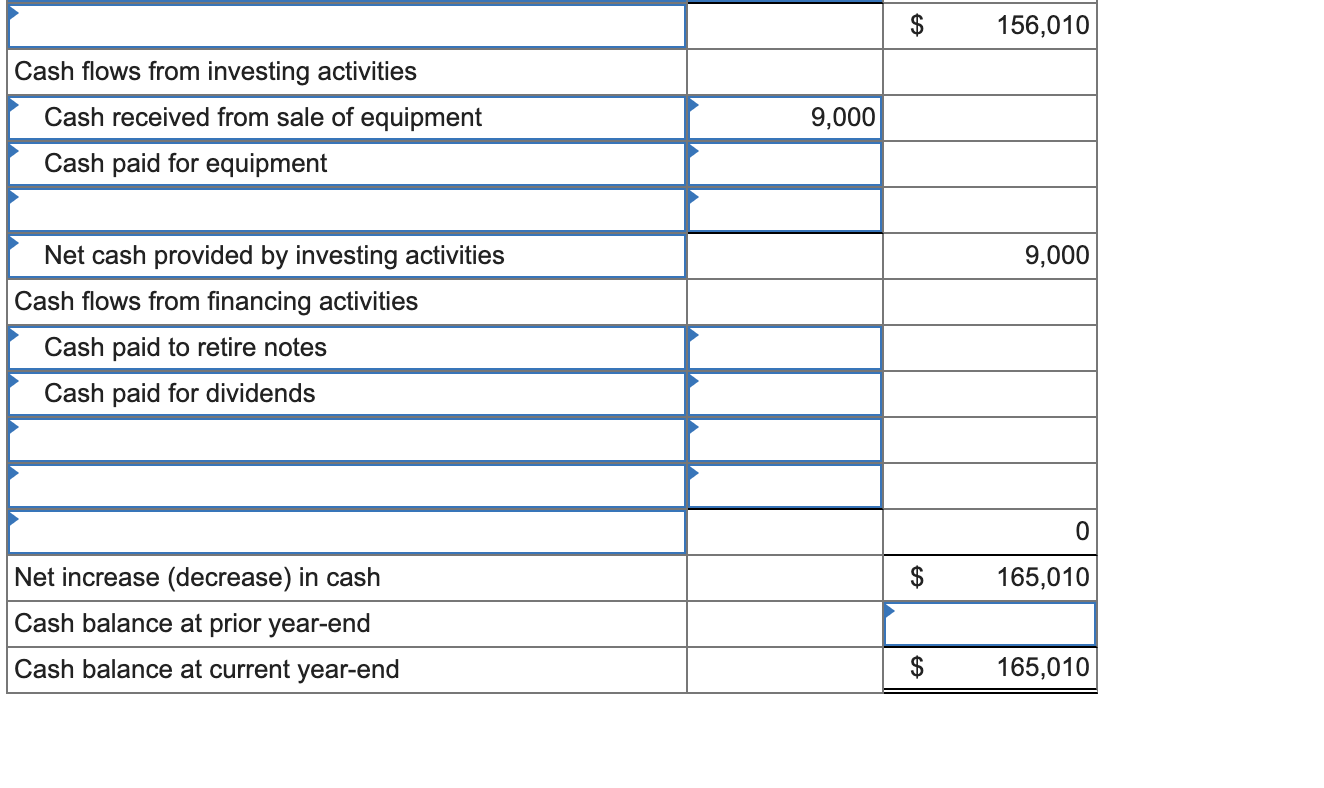

2019 IKIBAN INC. Comparative Balance Sheets At June 30 2020 Assets Cash $106,300 Accounts receivable, net 68,000 Inventory 65,800 Prepaid expenses 4,600 Total current assets 244,700 Equipment 126,000 Accum. depreciation-Equipment (28,000) Total assets $342,700 Liabilities and Equity Accounts payable $ 27,000 Wages payable 6,200 Income taxes payable 3,600 Total current liabilities 36,800 Notes payable (long term) 32,000 Total liabilities 68,800 Equity Common stock, $5 par value 224,000 Retained earnings 49,900 Total liabilities and equity $342,700 $ 46,000 53,000 89,500 5,800 194,300 117,000 (10,000) $301,300 $ 33,000 15,400 4,200 52,600 62,000 114,600 162,000 24,700 $301,300 IKIBAN INC. Income Statement For Year Ended June 30, 2020 Sales Cost of goods sold Gross profit Operating expenses (excluding depreciation) Depreciation expense $ 688,000 413,000 275,000 69,000 60,600 145,400 Other gains (losses) Gain on sale of equipment Income before taxes Income taxes expense 2,200 147,600 44,090 $ 103,510 Net income Additional Information a. A $30,000 note payable is retired at its $30,000 carrying (book) value in exchange for cash. b. The only changes affecting retained earnings are net income and cash dividends paid. c. New equipment is acquired for $59,600 cash. d. Received cash for the sale of equipment that had cost $50,600, yielding a $2,200 gain. e. Prepaid Expenses and Wages Payable relate to Operating Expenses on the income statement. f. All purchases and sales of inventory are on credit. Required: (1) Prepare a statement of cash flows using the indirect method for the year ended June 30, 2020. (Amounts to be deducted should be indicated with a minus sign.) IKIBAN, INC. Statement of Cash Flows (Indirect Method) For Year Ended June 30, 2019 Cash flows from operating activities Net income $ 103,510 Adjustments to reconcile net income to net cash provided by operating activities Income statement items not affecting cash Depreciation expense 60,600 Gain on sale of plant assets (2,200) (15,000) 23,700 Changes in current operating assets and liabilities Increase in accounts receivable Decrease in inventory Decrease in prepaid expenses Decrease in accounts payable Decrease in wages payable Decrease in income taxes payable 1,200 (6,000) (9,200) (600) $ 156,010 Cash flows from investing activities $ 156,010 Cash flows from investing activities Cash received from sale of equipment Cash paid for equipment 9,000 9,000 Net cash provided by investing activities Cash flows from financing activities Cash paid to retire notes Cash paid for dividends 0 $ 165,010 Net increase (decrease) in cash Cash balance at prior year-end Cash balance at current year-end $ 165,010