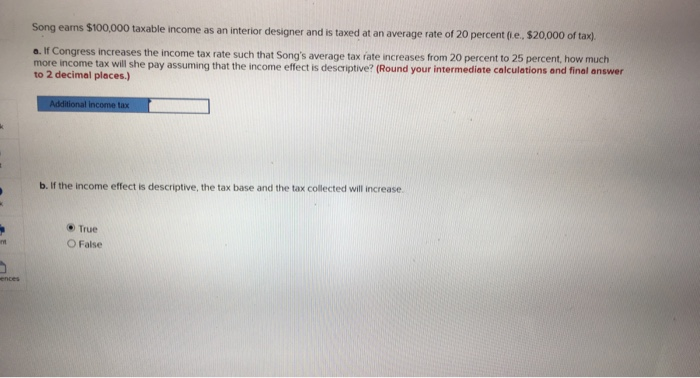

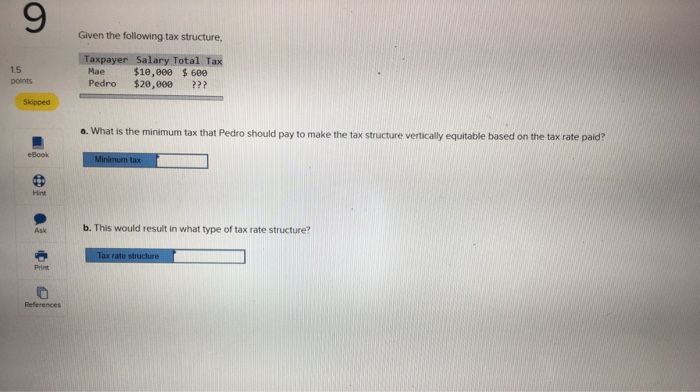

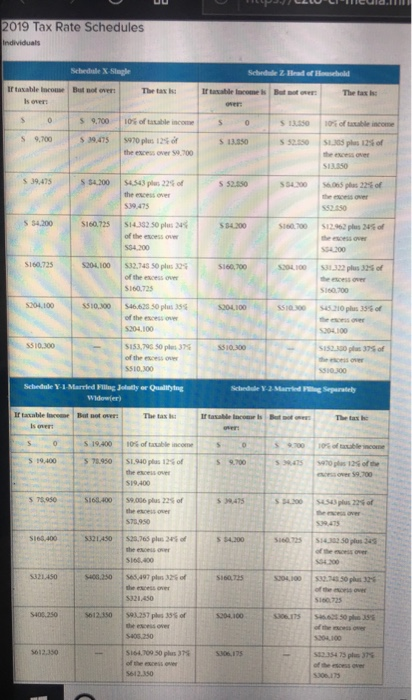

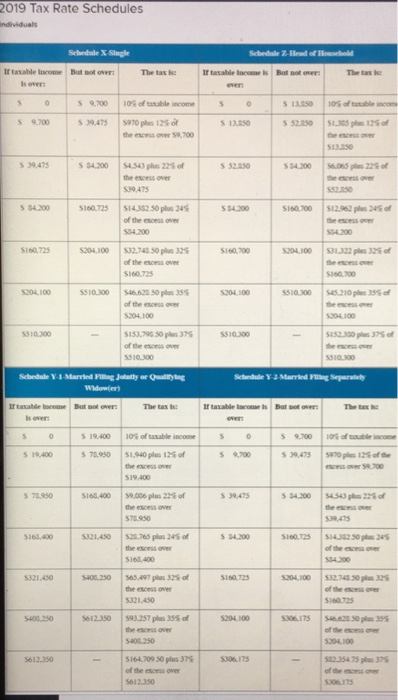

$100,000 taxable income as an interior designer and is taxed at an average rate of 20 percent (Le., $20,000 of tax). Song earns a. If Congress increases the income tax rate such that Song's average tax rate increases from 20 percent to 25 percent, how much more income tax will she pay assuming that the income effect is descriptive? (Round your intermediate calculations and final answer to 2 decimal places.) Additional income tax b. If the income effect is descriptive, the tax base and the tax collected will increase. True O False ences Given the following tax structure, Taxpayer Salary Total Tax $10,000 $6ee $20,e00 15 Mae points Pedro ??? Skipped a. What is the minimum tax that Pedro should pay to make the tax structure vertically equitable based on the tax rate paid? eBook Minimum tax Hint b. This would result in what type of tax rate structure? Ask Tax rate structure Print References 2019 Tax Rate Schedules Individuals Sehedule X Slagle Scbrdule Z Hrad of Housebold If taxable incomse But not over The tax I If tasable lncome is Bt ot over The tax Is over: over s 9,700 10% of tasable income S 13.350 10% of taable income S S 9,700 s 39,475 s970 plus 12% of S 13.850 S1305 plas 12% of s 5250 the excess over 59,700 the excess over S13350 S 39,475 s $4.200 s 52550 $4.543 pls 22% of S6.065 plas 22% of s4200 the escess over the ecess over S39,475 552450 s S4,200 S160.725 S14.332 50 plus 24% of the escess over s S4.200 $12.962 plus 24% of S160 700 the escess over S54.200 S54200 $32.745 50 plus 32 S160725 $204.100 S204 100 $31.322 plus 32% of S160,700 of the escess over the etcess oven S160.725 Sis0 700 S204.100 $510.300 $46.628 50 plus 35% $204.100 S510300 S45.210 phus 35% of the esces over of the escess ove S204.100 s204,100 5510.300 S153,790 50 pes 37 S510,300 S152300 plas 37% of of the ecess ove the esces oer 5510.300 s510300 Schedule Y1 Married Fillng Jolatly or Qualifytng Schedle Y-2 Married g Separately Widowfer) If taxable ner Bat not over The tax If tasable lncour Is The tax hs Is over over S 19,400 10% of taxable income S 9700 10% of taable incomer S 19,400 S 78.950 S1.940 plas 12% of the escess over S 9700 san0 plas 12% of the acsover $9.700 S19,400 s9,006 plus 22% of S 7950 S168.400 s 4200 S 3R475 SA543 plus 22% of he eces over the escess over $78,950 S39475 $2,765 pls 24s of s $4.200 s168.400 5321450 S14302 50 plus 24 of the oes over Sie0 725 the escess oer S166.400 s4200 S65,497 plas 32% of 5321,450 s400,250 532.243 30 phs 32% of he cess over Si60,725 S304,100 the escess over 5321.450 s1s0 725 591.257 ples 35% of S405.250 So12.350 $204.100 s306.175 si662 50 pl J5 of the sce the escess over S406.250 3304 100 Si64 709 50 plus 37% 5612,350 S306.175 s12.354 75 pls 37% of the ecess oner of he escess over 5300175 S612.350 2019 Tax Rate Schedules individuals Schedale X-Slngle Schedule Z-Hed of Housebold The tax If tasable Income The tas But not over If taxable Incecme is But not over Is over ever 10% of taxable income S 13.850 s9,700 10% of taable income s 9700 S 13.850 S 39,475 s970 pls 12% of S 52.850 $1.305 plas 12% of the excess over 59,700 the escess oner S13.350 s 39,475 s34 300 S6065 pls 22% of S 4200 $4.543 pls 22% of S 5250 the escess over the escess oer $39,475 552.350 $12.962 pls 24 of S 4200 S160,725 S14352 50 plus 245 of the escess over s $4.200 S160,300 the escess oer S54.200 S34.200 $31322 ples 325 of the escess ever Sis0700 S160,725 $204.100 $32.745 50 plus 32 S160700 $204.100 of the escess over S160.725 s46.628 50 pls 35 S204.100 $510.300 S204100 s510.300 A5.210 ples 35% of of the escess over the escess ever s204 100 s204.100 s153,796 50 pls 37 SI52.300 pls 37% of 5510.300 S510.300 of the escess over the escess over s510.300 S510.300 Schedule Y-1-Marvied Filng Jolntly or Quality ng Schedule Y-2 Maried Flg Separately Widow(er If tasable tocome If tasable lacome is The tax But not over The tax is But not over Is over over S 19400 10% of tasable income s9700 10% of ble icome S 19,400 S 70.950 s 9700 S 39,475 s070 ples 12% of the $1.940 plus 12% of the ecess over escess over 59,700 S19.400 S 78,950 S 39475 59.006 plus 22% of S168400 s 4200 S4543 p 22% of the escess over the escess over 575.950 S39475 s 4.200 $14.302 50 pls 24 of the escess over s25,765 plas 24 of S168,400 $321.450 Si60,725 the excess over S54.300 S168400 $32 745 50 pls 32 of the escess er s65,497 plas 32% of S160 725 S204100 $321,450 S400250 the escess over S321.450 $160725 s6.28 50 pls 35% S612.350 593.257 plus 35% of $204.100 $306.175 S400.250 the escess over of the escess S204J00 s408.250 S164.709 50 plus 37% s12.354 75 pls 37 of the escess oer 5306175 S612.350 of the escess over 5306.175 S612.350