Answered step by step

Verified Expert Solution

Question

1 Approved Answer

***2019 Tax Rate Schedules*** Sylvester files as a single taxpayer during 2019. He itemizes deductions for regular tax purposes. He paid charitable contributions of $14,300,

***2019 Tax Rate Schedules***

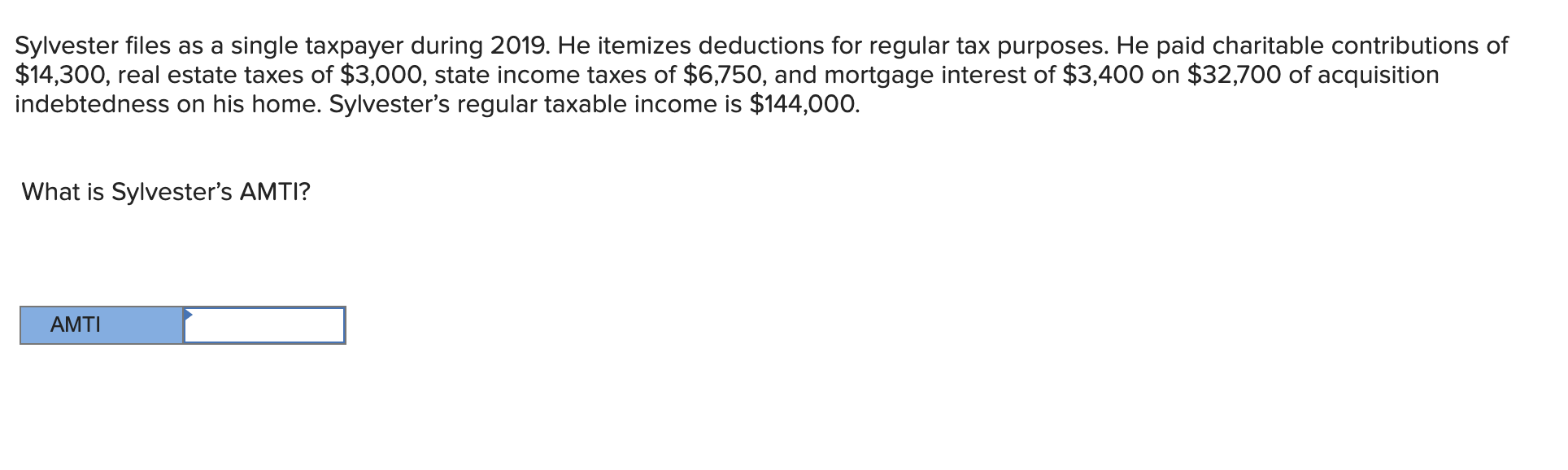

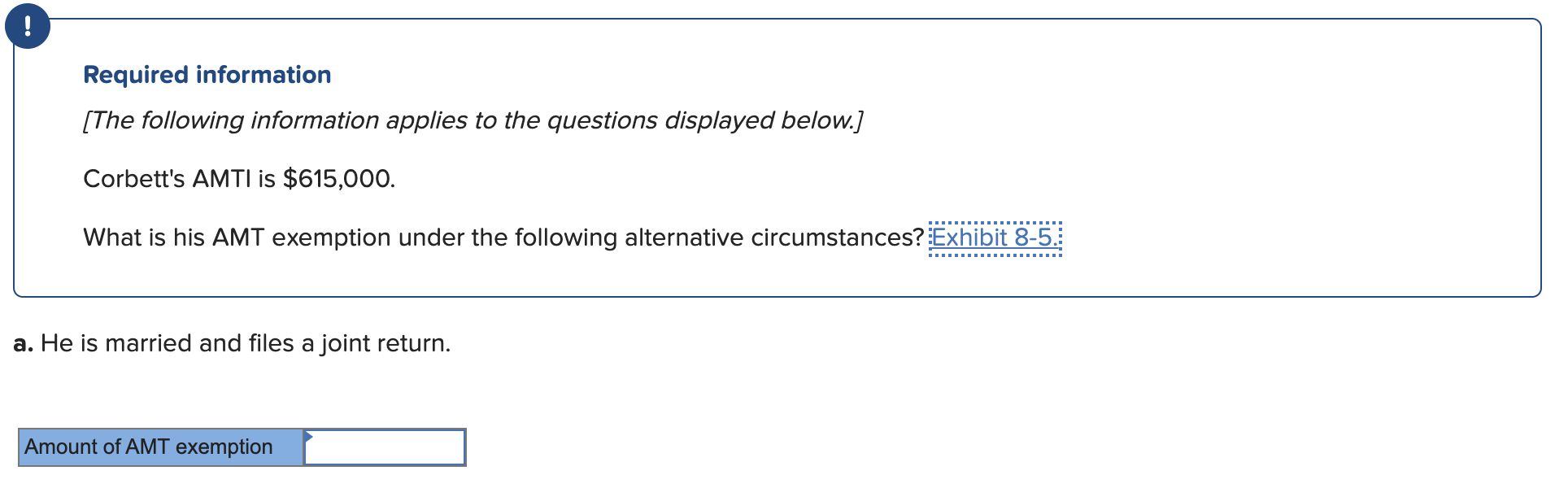

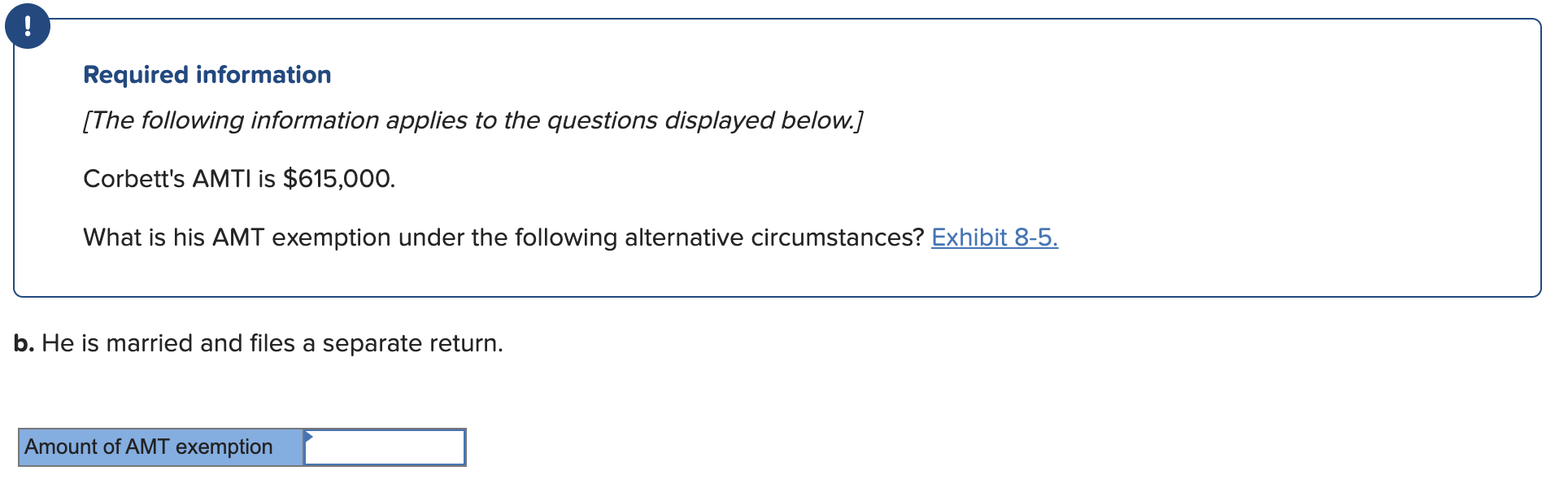

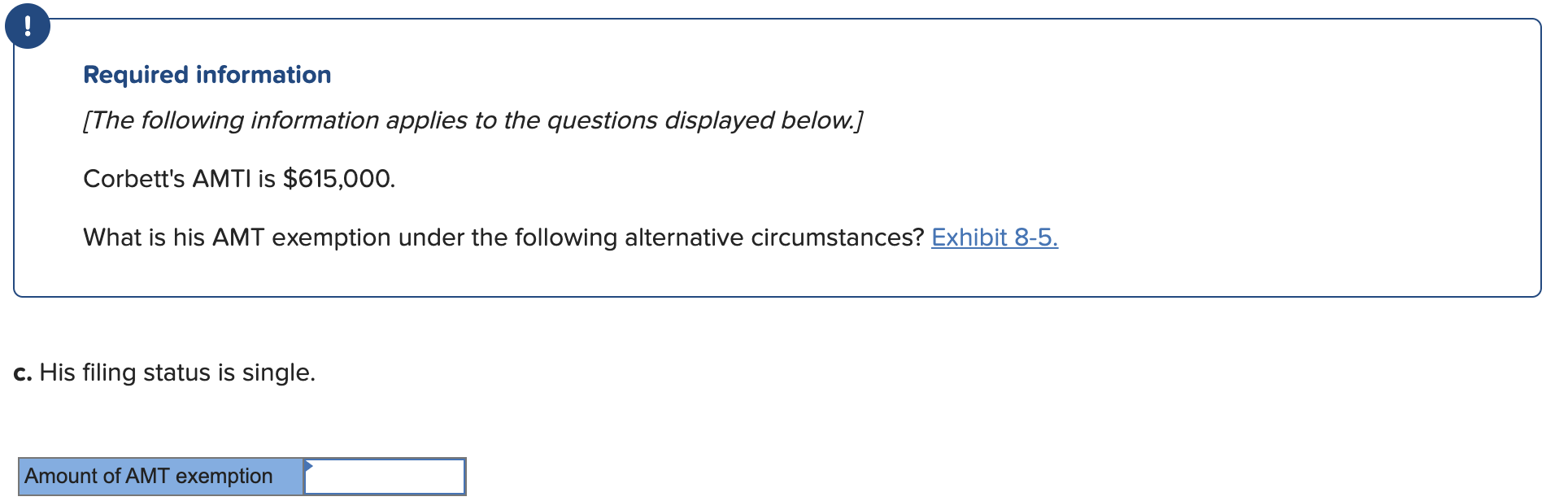

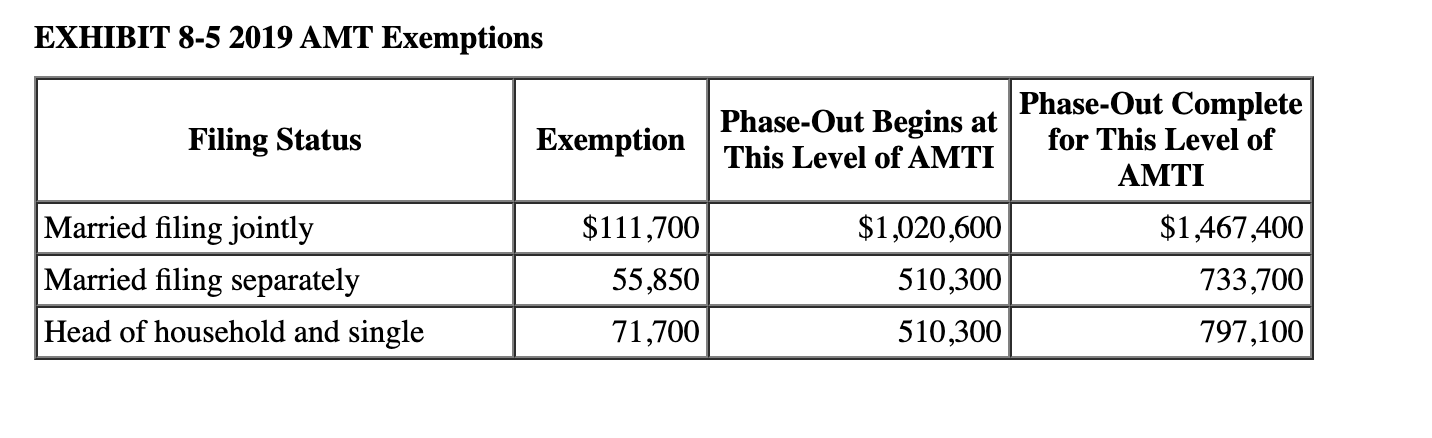

Sylvester files as a single taxpayer during 2019. He itemizes deductions for regular tax purposes. He paid charitable contributions of $14,300, real estate taxes of $3,000, state income taxes of $6,750, and mortgage interest of $3,400 on $32,700 of acquisition indebtedness on his home. Sylvesters regular taxable income is $144,000. What is Sylvesters AMTI? AMTI. Required information [The following information applies to the questions displayed below.] Corbett's AMTI is $615,000. What is his AMT exemption under the following alternative circumstances? Exhibit 8-5. a. He is married and files a joint return. Amount of AMT exemption Required information [The following information applies to the questions displayed below.] Corbett's AMTI is $615,000. What is his AMT exemption under the following alternative circumstances? Exhibit 8-5. b. He is married and files a separate return. Amount of AMT exemption Required information [The following information applies to the questions displayed below.] Corbett's AMTI is $615,000. What is his AMT exemption under the following alternative circumstances? Exhibit 8-5. c. His filing status is single. Amount of AMT exemption EXHIBIT 8-5 2019 AMT Exemptions Filing Status Married filing jointly Married filing separately Head of household and single Phase-Out Begins at Phase-Out Complete Exemption for This Level of This Level of AMTI AMTI $111,700| $1,020,600 $1,467,400 55,850 510,300 733,700 71,700 510,300 797,100 Sylvester files as a single taxpayer during 2019. He itemizes deductions for regular tax purposes. He paid charitable contributions of $14,300, real estate taxes of $3,000, state income taxes of $6,750, and mortgage interest of $3,400 on $32,700 of acquisition indebtedness on his home. Sylvesters regular taxable income is $144,000. What is Sylvesters AMTI? AMTI. Required information [The following information applies to the questions displayed below.] Corbett's AMTI is $615,000. What is his AMT exemption under the following alternative circumstances? Exhibit 8-5. a. He is married and files a joint return. Amount of AMT exemption Required information [The following information applies to the questions displayed below.] Corbett's AMTI is $615,000. What is his AMT exemption under the following alternative circumstances? Exhibit 8-5. b. He is married and files a separate return. Amount of AMT exemption Required information [The following information applies to the questions displayed below.] Corbett's AMTI is $615,000. What is his AMT exemption under the following alternative circumstances? Exhibit 8-5. c. His filing status is single. Amount of AMT exemption EXHIBIT 8-5 2019 AMT Exemptions Filing Status Married filing jointly Married filing separately Head of household and single Phase-Out Begins at Phase-Out Complete Exemption for This Level of This Level of AMTI AMTI $111,700| $1,020,600 $1,467,400 55,850 510,300 733,700 71,700 510,300 797,100Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started