Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2019/2020 Annual Exam QUESTION 1 - 50 MARKS Using the information provided in the Trial Balance and notes / additional information, you are required to

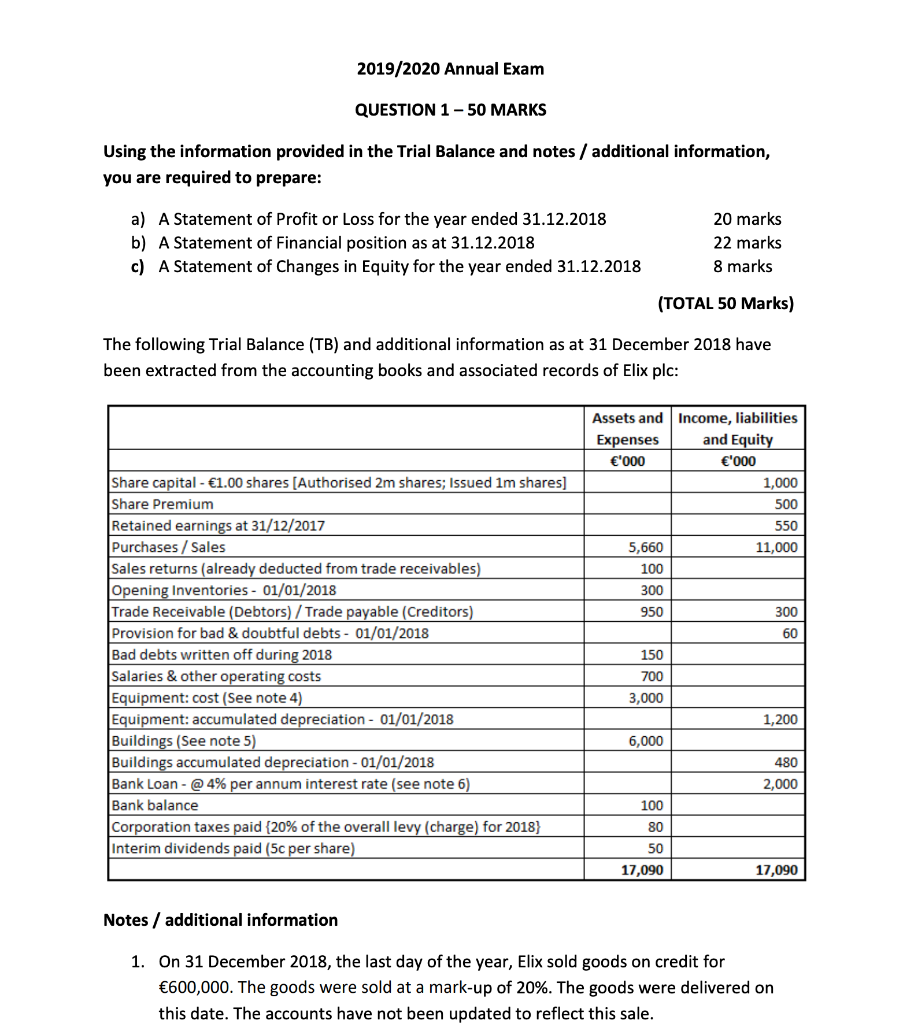

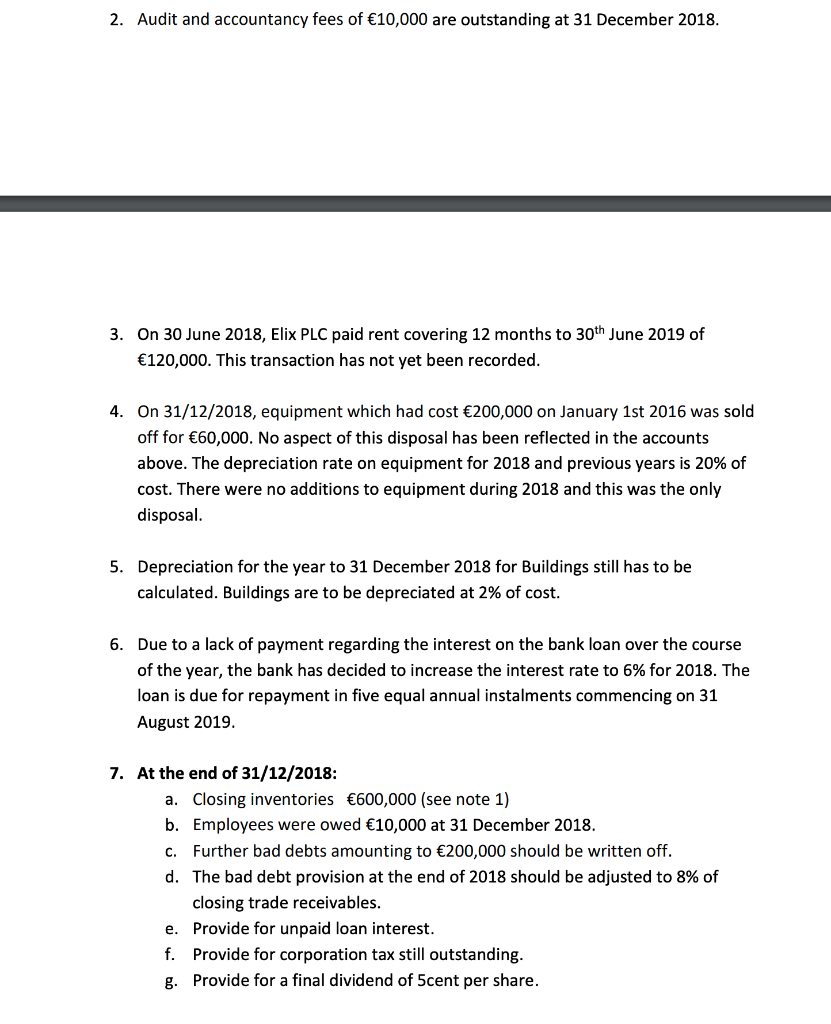

2019/2020 Annual Exam QUESTION 1 - 50 MARKS Using the information provided in the Trial Balance and notes / additional information, you are required to prepare: a) A Statement of Profit or Loss for the year ended 31.12.2018 b) A Statement of Financial position as at 31.12.2018 c) A Statement of Changes in Equity for the year ended 31.12.2018 20 marks 22 marks 8 marks (TOTAL 50 Marks) The following Trial Balance (TB) and additional information as at 31 December 2018 have been extracted from the accounting books and associated records of Elix plc: Assets and Expenses '000 Income, liabilities and Equity '000 Share capital - 1.00 shares [Authorised 2m shares; Issued 1m shares] Share Premium 1,000 500 Retained earnings at 31/12/2017 550 Purchases/Sales 5,660 11,000 Sales returns (already deducted from trade receivables) 100 Opening Inventories- 01/01/2018 300 Trade Receivable (Debtors)/Trade payable (Creditors) 950 300 Provision for bad & doubtful debts - 01/01/2018 60 Bad debts written off during 2018 Salaries & other operating costs Equipment: cost (See note 4) Equipment: accumulated depreciation- 01/01/2018 Buildings (See note 5) 150 700 3,000 1,200 6,000 Buildings accumulated depreciation - 01/01/2018 480 Bank Loan - @4% per annum interest rate (see note 6) Bank balance 2,000 100 Corporation taxes paid {20% of the overall levy (charge) for 2018} 80 Interim dividends paid (5c per share) 50 17,090 17,090 Notes / additional information 1. On 31 December 2018, the last day of the year, Elix sold goods on credit for 600,000. The goods were sold at a mark-up of 20%. The goods were delivered on this date. The accounts have not been updated to reflect this sale. 2. Audit and accountancy fees of 10,000 are outstanding at 31 December 2018. 3. On 30 June 2018, Elix PLC paid rent covering 12 months to 30th June 2019 of 120,000. This transaction has not yet been recorded. 4. On 31/12/2018, equipment which had cost 200,000 on January 1st 2016 was sold off for 60,000. No aspect of this disposal has been reflected in the accounts above. The depreciation rate on equipment for 2018 and previous years is 20% of cost. There were no additions to equipment during 2018 and this was the only disposal. 5. Depreciation for the year to 31 December 2018 for Buildings still has to be calculated. Buildings are to be depreciated at 2% of cost. 6. Due to a lack of payment regarding the interest on the bank loan over the course of the year, the bank has decided to increase the interest rate to 6% for 2018. The loan is due for repayment in five equal annual instalments commencing on 31 August 2019. 7. At the end of 31/12/2018: a. Closing inventories 600,000 (see note 1) b. Employees were owed 10,000 at 31 December 2018. c. Further bad debts amounting to 200,000 should be written off. d. The bad debt provision at the end of 2018 should be adjusted to 8% of closing trade receivables. e. Provide for unpaid loan interest. f. Provide for corporation tax still outstanding. g. Provide for a final dividend of 5cent per share

2019/2020 Annual Exam QUESTION 1 - 50 MARKS Using the information provided in the Trial Balance and notes / additional information, you are required to prepare: a) A Statement of Profit or Loss for the year ended 31.12.2018 b) A Statement of Financial position as at 31.12.2018 c) A Statement of Changes in Equity for the year ended 31.12.2018 20 marks 22 marks 8 marks (TOTAL 50 Marks) The following Trial Balance (TB) and additional information as at 31 December 2018 have been extracted from the accounting books and associated records of Elix plc: Assets and Expenses '000 Income, liabilities and Equity '000 Share capital - 1.00 shares [Authorised 2m shares; Issued 1m shares] Share Premium 1,000 500 Retained earnings at 31/12/2017 550 Purchases/Sales 5,660 11,000 Sales returns (already deducted from trade receivables) 100 Opening Inventories- 01/01/2018 300 Trade Receivable (Debtors)/Trade payable (Creditors) 950 300 Provision for bad & doubtful debts - 01/01/2018 60 Bad debts written off during 2018 Salaries & other operating costs Equipment: cost (See note 4) Equipment: accumulated depreciation- 01/01/2018 Buildings (See note 5) 150 700 3,000 1,200 6,000 Buildings accumulated depreciation - 01/01/2018 480 Bank Loan - @4% per annum interest rate (see note 6) Bank balance 2,000 100 Corporation taxes paid {20% of the overall levy (charge) for 2018} 80 Interim dividends paid (5c per share) 50 17,090 17,090 Notes / additional information 1. On 31 December 2018, the last day of the year, Elix sold goods on credit for 600,000. The goods were sold at a mark-up of 20%. The goods were delivered on this date. The accounts have not been updated to reflect this sale. 2. Audit and accountancy fees of 10,000 are outstanding at 31 December 2018. 3. On 30 June 2018, Elix PLC paid rent covering 12 months to 30th June 2019 of 120,000. This transaction has not yet been recorded. 4. On 31/12/2018, equipment which had cost 200,000 on January 1st 2016 was sold off for 60,000. No aspect of this disposal has been reflected in the accounts above. The depreciation rate on equipment for 2018 and previous years is 20% of cost. There were no additions to equipment during 2018 and this was the only disposal. 5. Depreciation for the year to 31 December 2018 for Buildings still has to be calculated. Buildings are to be depreciated at 2% of cost. 6. Due to a lack of payment regarding the interest on the bank loan over the course of the year, the bank has decided to increase the interest rate to 6% for 2018. The loan is due for repayment in five equal annual instalments commencing on 31 August 2019. 7. At the end of 31/12/2018: a. Closing inventories 600,000 (see note 1) b. Employees were owed 10,000 at 31 December 2018. c. Further bad debts amounting to 200,000 should be written off. d. The bad debt provision at the end of 2018 should be adjusted to 8% of closing trade receivables. e. Provide for unpaid loan interest. f. Provide for corporation tax still outstanding. g. Provide for a final dividend of 5cent per share Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started