Answered step by step

Verified Expert Solution

Question

1 Approved Answer

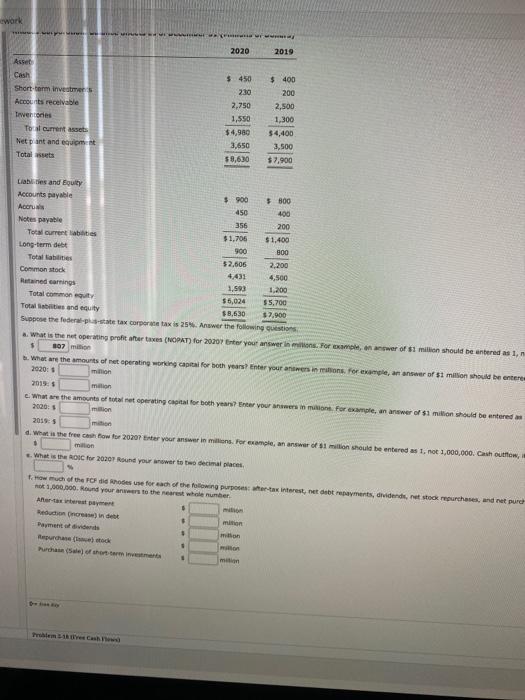

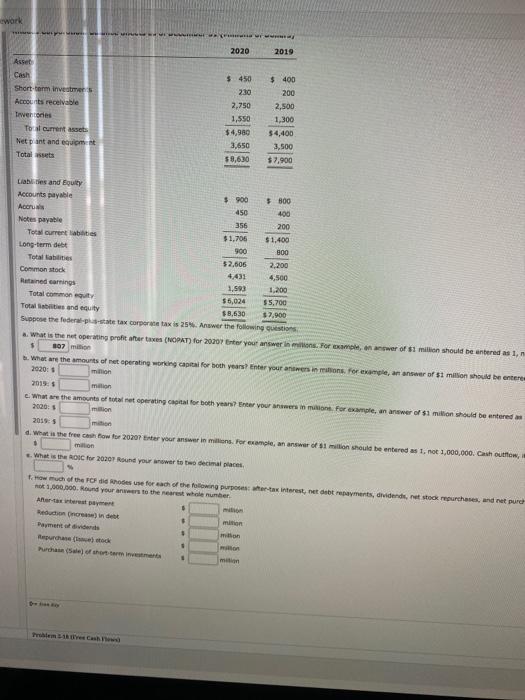

2020 -2019 Asset Cash Short-term investments Accounts receivable Twentos To al current assets Netpant and equipment Total $ 450 230 2,750 1.550 $4,900 3,650 59,630

2020 -2019 Asset Cash Short-term investments Accounts receivable Twentos To al current assets Netpant and equipment Total $ 450 230 2,750 1.550 $4,900 3,650 59,630 $ 400 200 2,500 1,300 54,400 3,500 $7,900 Liables and Equity Accounts payable $ 900 5 800 Accu 450 400 Notes payable 356 200 Tot current abilities $1,706 $ 1.400 Long-term debet 900 800 Total abilities 52.606 2,200 Common stock 4.431 4,500 Rated carings 1,593 1.200 Totalcommon equity $5,024 $5,700 Total ties and equity $8,630 $7.900 Sopose the federal state tax corporate taxis 25. Answer the following ustions What is the net operating profit after taxes (NOPAT) for 20307 Enter your answer. For more of million should be entered as 1, 107 min . What are the amounts of net operating word capital for both easter your ansios fore, an answer of 51 million should be entere min 2019: 5 milion c. What are the amounts of total net operating cialfor both years?tar vous forme en answer of $1 million should be entered as milion 2016: 5 d. What is there show for 20207 tr your answer is. For example, anaf 1 million should be entered as 1. not 1,000,000. Chutton, million What is the ROIC for 2020T Round your answer to the decimal places 1. How much of the Foods for each of the ring purposestedet, der stock repurchases, and not purch 1.000.000Round your answers to the nearest whole number Arrestent Reducine min Payment viders $

2020 -2019 Asset Cash Short-term investments Accounts receivable Twentos To al current assets Netpant and equipment Total $ 450 230 2,750 1.550 $4,900 3,650 59,630 $ 400 200 2,500 1,300 54,400 3,500 $7,900 Liables and Equity Accounts payable $ 900 5 800 Accu 450 400 Notes payable 356 200 Tot current abilities $1,706 $ 1.400 Long-term debet 900 800 Total abilities 52.606 2,200 Common stock 4.431 4,500 Rated carings 1,593 1.200 Totalcommon equity $5,024 $5,700 Total ties and equity $8,630 $7.900 Sopose the federal state tax corporate taxis 25. Answer the following ustions What is the net operating profit after taxes (NOPAT) for 20307 Enter your answer. For more of million should be entered as 1, 107 min . What are the amounts of net operating word capital for both easter your ansios fore, an answer of 51 million should be entere min 2019: 5 milion c. What are the amounts of total net operating cialfor both years?tar vous forme en answer of $1 million should be entered as milion 2016: 5 d. What is there show for 20207 tr your answer is. For example, anaf 1 million should be entered as 1. not 1,000,000. Chutton, million What is the ROIC for 2020T Round your answer to the decimal places 1. How much of the Foods for each of the ring purposestedet, der stock repurchases, and not purch 1.000.000Round your answers to the nearest whole number Arrestent Reducine min Payment viders $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started