Answered step by step

Verified Expert Solution

Question

1 Approved Answer

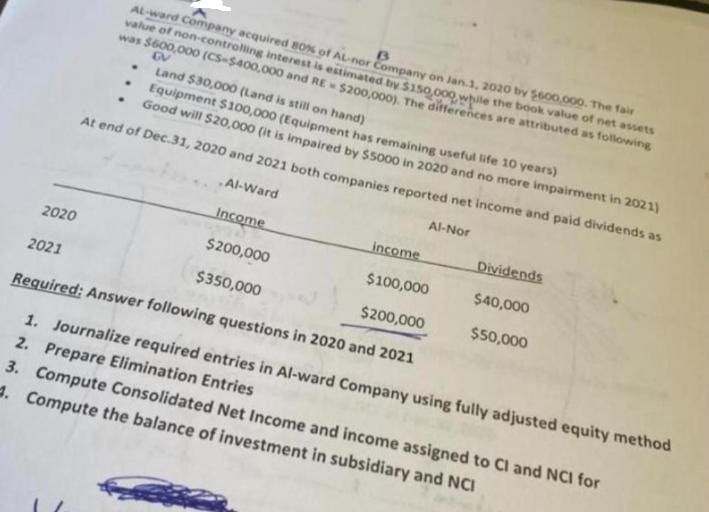

2020 Al-ward Company acquired 80% of AL-nor Company on Jan 1, 2020 by $600,000. The fair value of non-controlling interest is estimated by $150,000

2020 Al-ward Company acquired 80% of AL-nor Company on Jan 1, 2020 by $600,000. The fair value of non-controlling interest is estimated by $150,000 while the book value of net assets was $600,000 (CS-$400,000 and RE- $200,000). The differences are attributed as following 2021 Land $30,000 (Land is still on hand) Equipment $100,000 (Equipment has remaining useful life 10 years) Good will $20,000 (it is impaired by $5000 in 2020 and no more impairment in 2021) At end of Dec.31, 2020 and 2021 both companies reported net income and paid dividends as Al-Ward Al-Nor Income $200,000 $350,000 income $100,000 $200,000 Required: Answer following questions in 2020 and 2021 1. Journalize required entries in Al-ward Company using fully adjusted equity method 2. Prepare Elimination Entries 3. Compute Consolidated Net Income and income assigned to Cl and NCI for 1. Compute the balance of investment in subsidiary and NCI . Dividends $40,000 $50,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the given information the answers to the questions are as follows AlNors Income and Dividen...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started