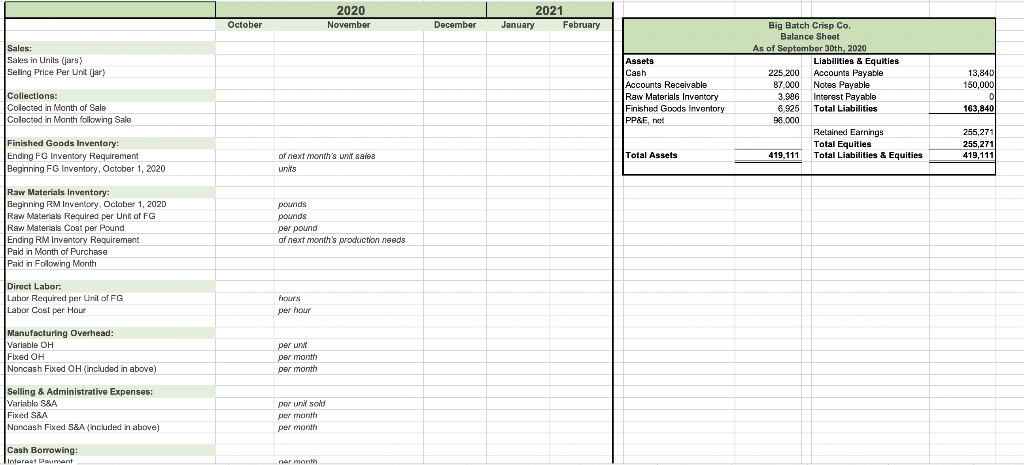

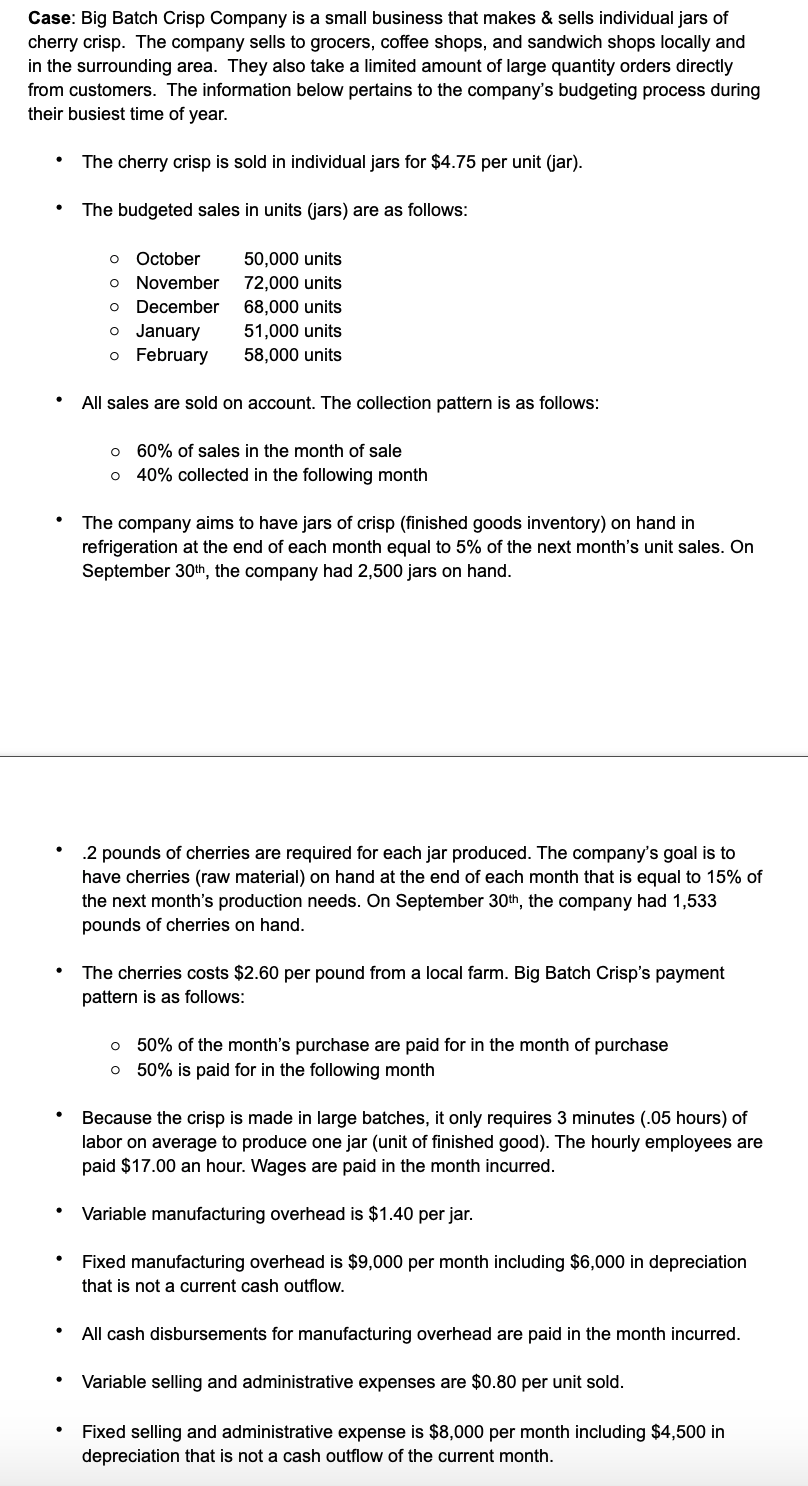

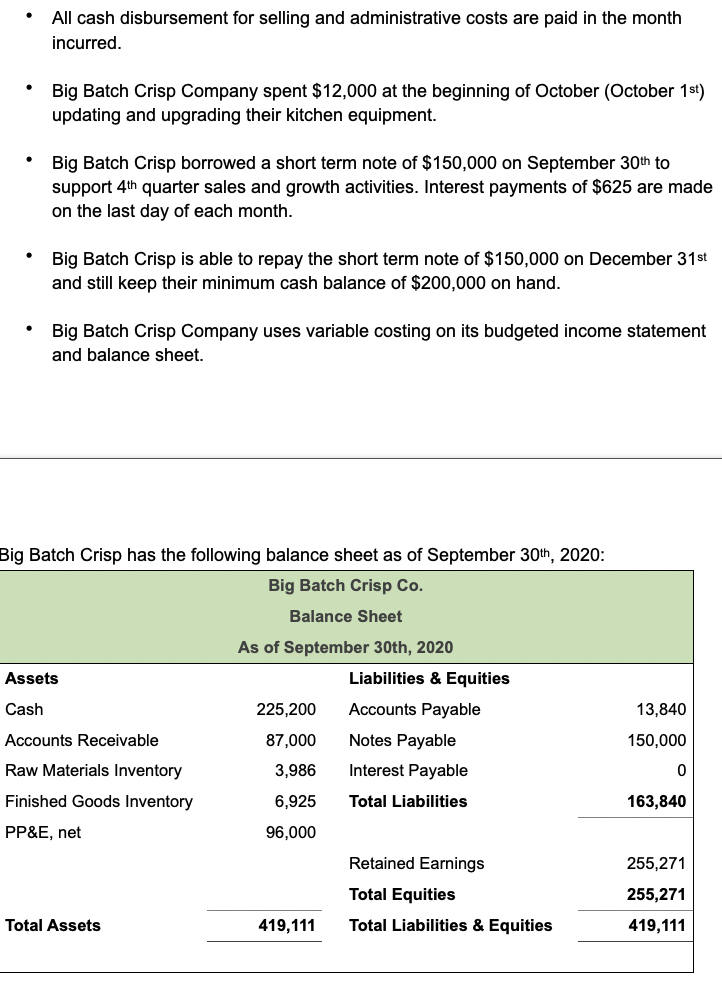

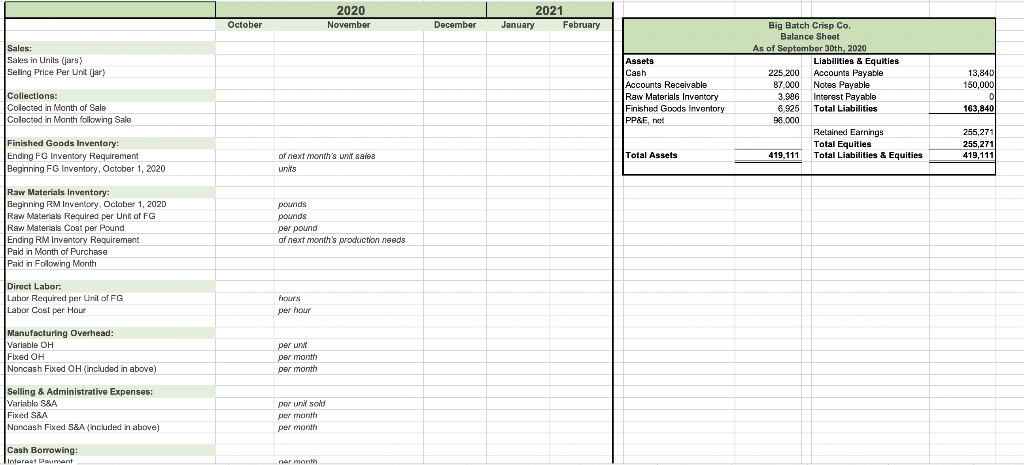

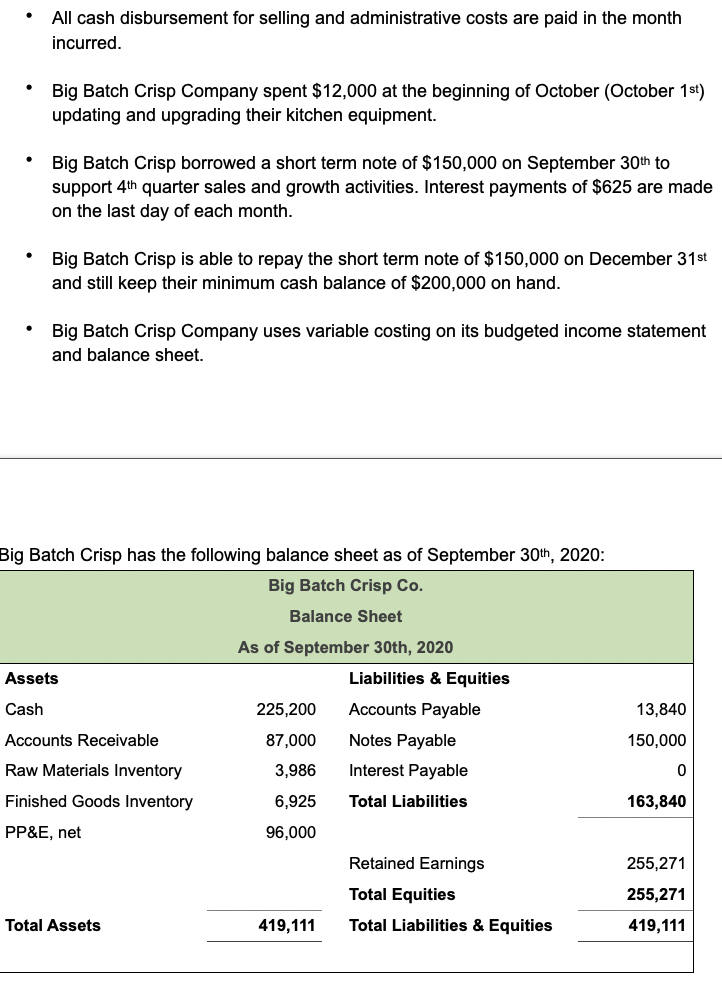

2020 November 2021 January February October December Sales: Sales in Unils (jars) Seling Price Per Unit (jar) Assets Cash Accounts Receivable Raw Materials Inventory Finished Goods Inventory PP&E.net Collections: Colected in Month of Sale Colected in Month following Sale Big Batch Crisp Co. Balance Sheet As of September 30th, 2020 Liabilities & Equities 225 200 Accounts Payable 87.000 Notes Payable 3.996 Interest Payable 6.925 Total Liabilities 98 000 Retained Earnings Total Equities 419,111 Total Liabilities & Equities 13,8401 150,000 163,840 Finished Goods Inventory: Ending FG Inventory Requirement Beginning FG Inventory, October 1, 2020 255,271 255,2711 419,111 Total Assets of next month's w sales units Raw Materials Inventory Beginning RM Inventory, October 1, 2020 Raw Materials Required per Unit of FG Raw Materials Cost per Pound Ending RM Inventory Requirement Paid in Month of Purchase Paid in Following Month pounds pounds per pound of next month's production needs Direct Labor Labor Required per Unit of FG Labor Cost per Hour Prours per hour Manufacturing Overhead: Variable OH Fixed OH Noncash Fixed OH (included in above) per un per month per month Selling & Administrative Expenses: Variable S&A Fixed S&A Noncash Fixed S&A (included in above) por un sold per month per month Cash Borrowing: Interest Piment ner month Cash Borrowing: Interest Payment Note per month repayment made Dec. 31, 2020 Other: Equipment Purchase purchased Oct. 1, 2020 Case: Big Batch Crisp Company is a small business that makes & sells individual jars of cherry crisp. The company sells to grocers, coffee shops, and sandwich shops locally and in the surrounding area. They also take a limited amount of large quantity orders directly from customers. The information below pertains to the company's budgeting process during their busiest time of year. The cherry crisp is sold in individual jars for $4.75 per unit (jar). The budgeted sales in units (jars) are as follows: o o o October November December January February 50,000 units 72,000 units 68,000 units 51,000 units 58,000 units o o All sales are sold on account. The collection pattern is as follows: o 60% of sales in the month of sale 40% collected in the following month The company aims to have jars of crisp (finished goods inventory) on hand in refrigeration at the end of each month equal to 5% of the next month's unit sales. On September 30th, the company had 2,500 jars on hand. .2 pounds of cherries are required for each jar produced. The company's goal is to have cherries (raw material) on hand at the end of each month that is equal to 15% of the next month's production needs. On September 30th, the company had 1,533 pounds of cherries on hand. . The cherries costs $2.60 per pound from a local farm. Big Batch Crisp's payment pattern is as follows: o 50% of the month's purchase are paid for in the month of purchase 50% is paid for in the following month o Because the crisp is made in large batches, it only requires 3 minutes (.05 hours) of labor on average to produce one jar (unit of finished good). The hourly employees are paid $17.00 an hour. Wages are paid in the month incurred. Variable manufacturing overhead is $1.40 per jar. Fixed manufacturing overhead is $9,000 per month including $6,000 in depreciation that is not a current cash outflow. All cash disbursements for manufacturing overhead are paid in the month incurred. Variable selling and administrative expenses are $0.80 per unit sold. Fixed selling and administrative expense is $8,000 per month including $4,500 in depreciation that is not a cash outflow of the current month. All cash disbursement for selling and administrative costs are paid in the month incurred. Big Batch Crisp Company spent $12,000 at the beginning of October (October 1st) updating and upgrading their kitchen equipment. Big Batch Crisp borrowed a short term note of $150,000 on September 30th to support 4th quarter sales and growth activities. Interest payments of $625 are made on the last day of each month. . Big Batch Crisp is able to repay the short term note of $150,000 on December 31st and still keep their minimum cash balance of $200,000 on hand. Big Batch Crisp Company uses variable costing on its budgeted income statement and balance sheet. Big Batch Crisp has the following balance sheet as of September 30th, 2020: Big Batch Crisp Co. Balance Sheet Assets Cash As of September 30th, 2020 Liabilities & Equities 225,200 Accounts Payable 87,000 Notes Payable 3,986 Interest Payable 13,840 Accounts Receivable 150,000 0 Raw Materials Inventory Finished Goods Inventory 6,925 Total Liabilities 163,840 PP&E, net 96,000 255,271 Retained Earnings Total Equities Total Liabilities & Equities 255,271 419,111 Total Assets 419,111