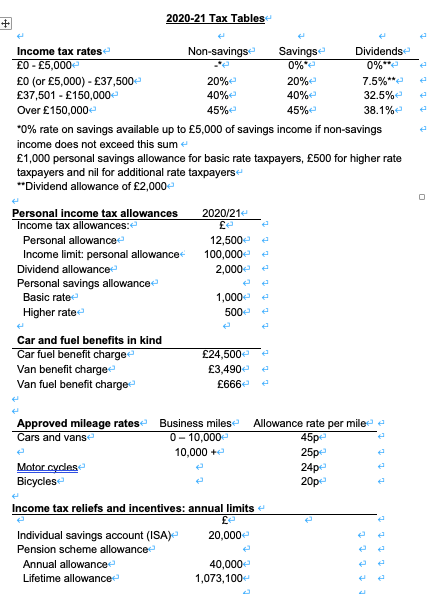

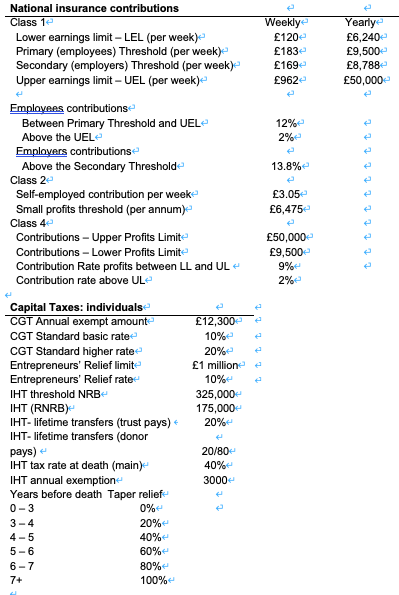

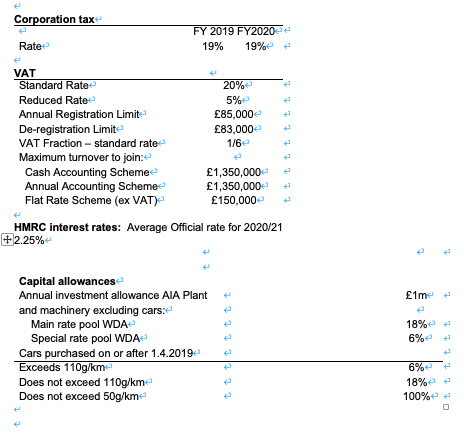

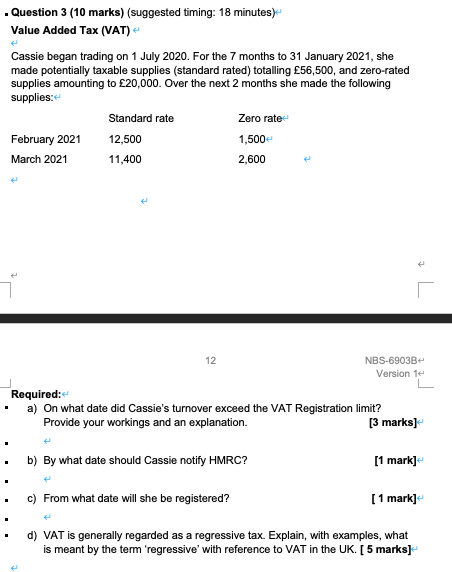

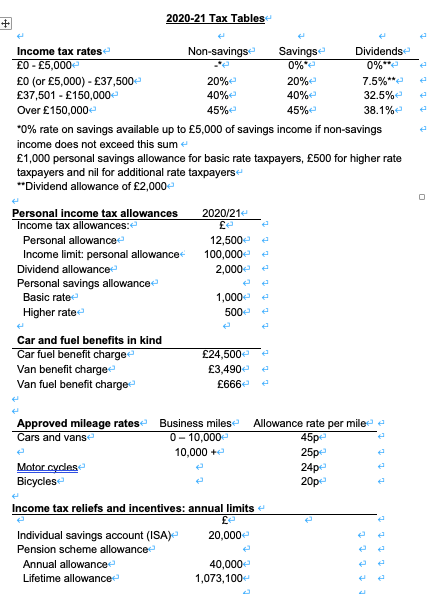

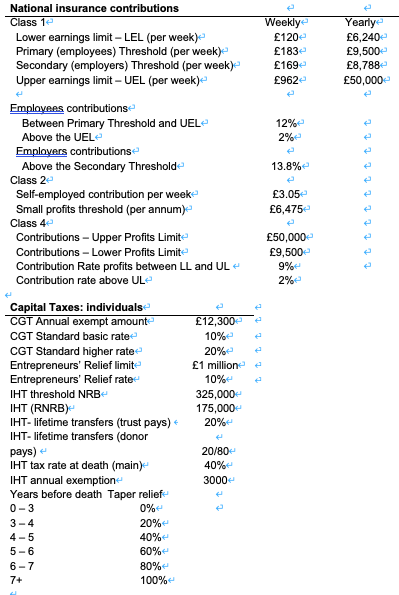

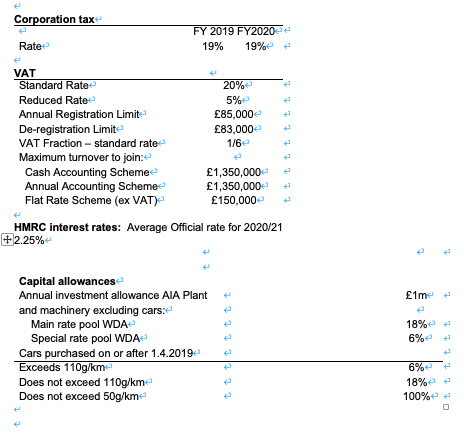

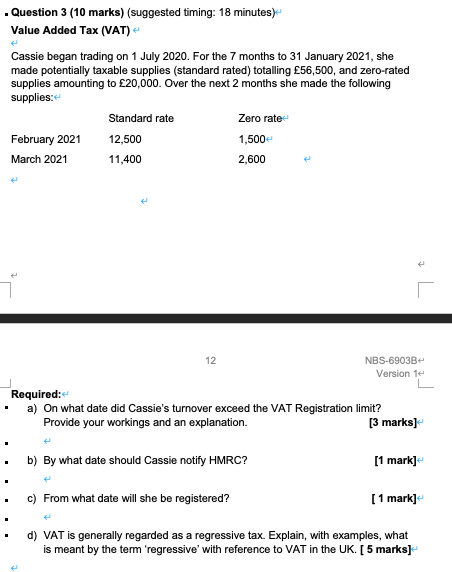

+ 2020-21 Tax Tables Income tax rates Non-savings Savingse Dividends O - 5,000 0% 0%" (or 5,000) - 37,500 20% 20% 7.5%** 37,501 - 150,000 40% 40% 32.5% Over 150,000 45% 45% 38.1% *0% rate on savings available up to 5,000 of savings income if non-savings income does not exceed this sum 1,000 personal savings allowance for basic rate taxpayers, 500 for higher rate taxpayers and nil for additional rate taxpayers **Dividend allowance of 2,000 Personal income tax allowances 2020/21 Income tax allowances: Personal allowance 12,500 Income limit: personal allowance 100,000 Dividend allowance 2,000 Personal savings allowance Basic rate 1,000 e Higher rate 500 e Car and fuel benefits in kind Car fuel benefit charge Van benefit charge Van fuel benefit charge 24,500 3,490 666 Approved mileage rates- Cars and vans Business miles 0 - 10,000 10,000+ Allowance rate per mile 45p 25p 24p 20p Motorcycles Bicycles Income tax reliefs and incentives: annual limits Individual savings account (ISA) 20,000 Pension scheme allowance Annual allowance 40,000 Lifetime allowance 1,073,100 Yearly 6,240 9,500 8,788 50,000 ttttt National insurance contributions Class 1e Weekly Lower earnings limit -LEL (per week) 120 Primary employees) Threshold (per week) 183 Secondary employers) Threshold (per week) 169 Upper earnings limit - UEL (per week) 962 Employees contributions Between Primary Threshold and UEL 12% Above the UEL 2% Employers contributions Above the Secondary Threshold 13.8% Class 2 Self-employed contribution per week 3.05 Small profits threshold (per annum) 6,475 Class 4 Contributions - Upper Profits Limit- 50,000 Contributions - Lower Profits Limite 9,500 Contribution Rate profits between LL and UL 4 9% Contribution rate above UL 2% Capital Taxes: individuals CGT Annual exempt amount 12,300 CGT Standard basic rate- 10% CGT Standard higher rate- 20% Entrepreneurs' Relief limite 1 millione Entrepreneurs' Relief rate 10% IHT threshold NRB 325,000 IHT (RNRB) 175,000 IHT-lifetime transfers (trust pays) 20% IHT-lifetime transfers (donor pays) 20/80- IHT tax rate at death (main) 40% IHT annual exemption 3000 Years before death Taper relief- 0-3 3-4 20% 4-5 40% 5-6 60% 6-7 80% 7+ 100% 0% Corporation tax FY 2019 FY2020 19% 19% e Rate VAT Standard Rate Reduced Rate Annual Registration Limite De-registration Limite VAT Fraction - standard rate- Maximum turnover to join: Cash Accounting Scheme Annual Accounting Scheme Flat Rate Scheme (ex VAT) 20% 5% 85,000 83,000 1/6 2. 1,350,000 1,350,000 150,000 HMRC interest rates: Average Official rate for 2020/21 +2.25% 1me e Capital allowances Annual investment allowance AIA Plant and machinery excluding cars: Main rate pool WDA Special rate pool WDA Cars purchased on or after 1.4.2019 Exceeds 110g/km Does not exceed 110g/km Does not exceed 50g/km 18%ee e % %6 tttt 6%e 18% % %100 . Question 3 (10 marks) (suggested timing: 18 minutes) Value Added Tax (VAT) Cassie began trading on 1 July 2020. For the 7 months to 31 January 2021, she made potentially taxable supplies (standard rated) totalling 56,500, and zero-rated supplies amounting to 20,000. Over the next 2 months she made the following supplies: Standard rate Zero rate- February 2021 12,500 1,500 March 2021 11,400 2,600 T 12 NBS-6903B Version le Required:- a) On what date did Cassie's turnover exceed the VAT Registration limit? Provide your workings and an explanation. [3 marks) b) By what date should Cassie notify HMRC? [1 mark] - c) From what date will she be registered? [1 mark] d) VAT is generally regarded as a regressive tax. Explain, with examples, what is meant by the term 'regressive' with reference to VAT in the UK. [ 5 marks) + 2020-21 Tax Tables Income tax rates Non-savings Savingse Dividends O - 5,000 0% 0%" (or 5,000) - 37,500 20% 20% 7.5%** 37,501 - 150,000 40% 40% 32.5% Over 150,000 45% 45% 38.1% *0% rate on savings available up to 5,000 of savings income if non-savings income does not exceed this sum 1,000 personal savings allowance for basic rate taxpayers, 500 for higher rate taxpayers and nil for additional rate taxpayers **Dividend allowance of 2,000 Personal income tax allowances 2020/21 Income tax allowances: Personal allowance 12,500 Income limit: personal allowance 100,000 Dividend allowance 2,000 Personal savings allowance Basic rate 1,000 e Higher rate 500 e Car and fuel benefits in kind Car fuel benefit charge Van benefit charge Van fuel benefit charge 24,500 3,490 666 Approved mileage rates- Cars and vans Business miles 0 - 10,000 10,000+ Allowance rate per mile 45p 25p 24p 20p Motorcycles Bicycles Income tax reliefs and incentives: annual limits Individual savings account (ISA) 20,000 Pension scheme allowance Annual allowance 40,000 Lifetime allowance 1,073,100 Yearly 6,240 9,500 8,788 50,000 ttttt National insurance contributions Class 1e Weekly Lower earnings limit -LEL (per week) 120 Primary employees) Threshold (per week) 183 Secondary employers) Threshold (per week) 169 Upper earnings limit - UEL (per week) 962 Employees contributions Between Primary Threshold and UEL 12% Above the UEL 2% Employers contributions Above the Secondary Threshold 13.8% Class 2 Self-employed contribution per week 3.05 Small profits threshold (per annum) 6,475 Class 4 Contributions - Upper Profits Limit- 50,000 Contributions - Lower Profits Limite 9,500 Contribution Rate profits between LL and UL 4 9% Contribution rate above UL 2% Capital Taxes: individuals CGT Annual exempt amount 12,300 CGT Standard basic rate- 10% CGT Standard higher rate- 20% Entrepreneurs' Relief limite 1 millione Entrepreneurs' Relief rate 10% IHT threshold NRB 325,000 IHT (RNRB) 175,000 IHT-lifetime transfers (trust pays) 20% IHT-lifetime transfers (donor pays) 20/80- IHT tax rate at death (main) 40% IHT annual exemption 3000 Years before death Taper relief- 0-3 3-4 20% 4-5 40% 5-6 60% 6-7 80% 7+ 100% 0% Corporation tax FY 2019 FY2020 19% 19% e Rate VAT Standard Rate Reduced Rate Annual Registration Limite De-registration Limite VAT Fraction - standard rate- Maximum turnover to join: Cash Accounting Scheme Annual Accounting Scheme Flat Rate Scheme (ex VAT) 20% 5% 85,000 83,000 1/6 2. 1,350,000 1,350,000 150,000 HMRC interest rates: Average Official rate for 2020/21 +2.25% 1me e Capital allowances Annual investment allowance AIA Plant and machinery excluding cars: Main rate pool WDA Special rate pool WDA Cars purchased on or after 1.4.2019 Exceeds 110g/km Does not exceed 110g/km Does not exceed 50g/km 18%ee e % %6 tttt 6%e 18% % %100 . Question 3 (10 marks) (suggested timing: 18 minutes) Value Added Tax (VAT) Cassie began trading on 1 July 2020. For the 7 months to 31 January 2021, she made potentially taxable supplies (standard rated) totalling 56,500, and zero-rated supplies amounting to 20,000. Over the next 2 months she made the following supplies: Standard rate Zero rate- February 2021 12,500 1,500 March 2021 11,400 2,600 T 12 NBS-6903B Version le Required:- a) On what date did Cassie's turnover exceed the VAT Registration limit? Provide your workings and an explanation. [3 marks) b) By what date should Cassie notify HMRC? [1 mark] - c) From what date will she be registered? [1 mark] d) VAT is generally regarded as a regressive tax. Explain, with examples, what is meant by the term 'regressive' with reference to VAT in the UK. [ 5 marks)