Answered step by step

Verified Expert Solution

Question

1 Approved Answer

20-21 17. Cleo's Market has sales of $36,600, costs of $28,400, depreciation expense of $3,100, and interest expense of $1,500. If the tax rate is

20-21

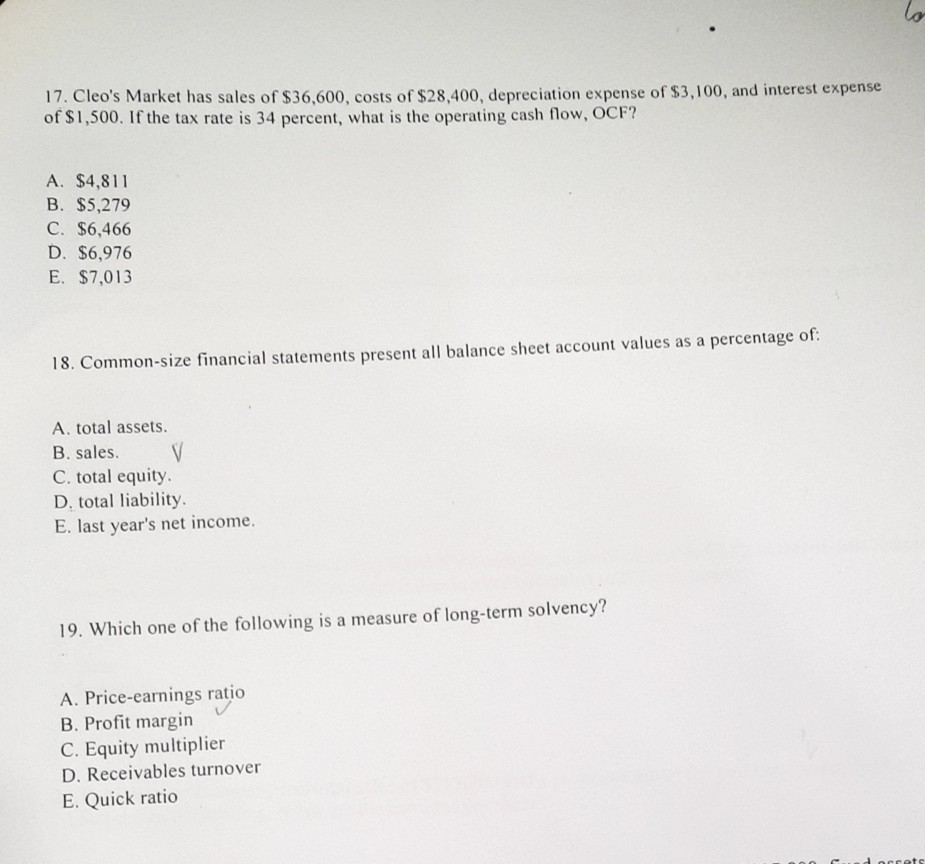

17. Cleo's Market has sales of $36,600, costs of $28,400, depreciation expense of $3,100, and interest expense of $1,500. If the tax rate is 34 percent, what is the operating cash flow, OCF? A. $4,811 B. $5,279 C. $6,466 D. $6,976 E. $7,013 18. Common-size financial statements present all balance sheet account values as a percentage of A. total assets. B. sales C. total equity. D, total liability E. last year's net income. 19. Which one of the following is a measure of long-term solvency? A. Price-earnings ratio B. Profit margin C. Equity multiplier D. Receivables turnover E Quick ratioStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started