Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2021 tax year Paul made the following charitable donations during the year: He gave $12,000 of cash to the Huntsville United Methodist Church He gave

2021 tax year

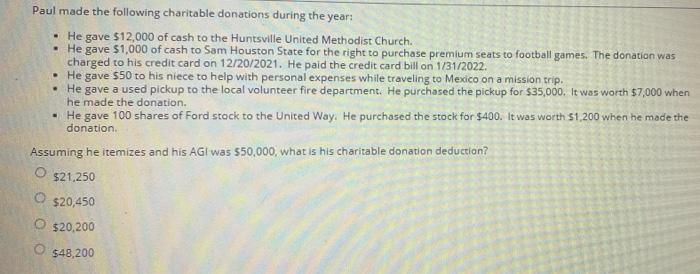

Paul made the following charitable donations during the year: He gave $12,000 of cash to the Huntsville United Methodist Church He gave $1,000 of cash to Sam Houston State for the right to purchase premium seats to football games. The donation was charged to his credit card on 12/20/2021. He paid the credit card bill on 1/31/2022. He gave 550 to his niece to help with personal expenses while traveling to Mexico on a mission trip. gave a used pickup to the local volunteer fire department. He purchased the pickup for $35,000. It was worth $7,000 when he made the donation. He gave 100 shares of Ford stock to the United Way. He purchased the stock for $400. It was worth $1,200 when he made the donation Assuming he itemizes and his AG was 550,000, what is his charitable donation deduction? $21,250 O $20,450 O $20,200 $48,200

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started