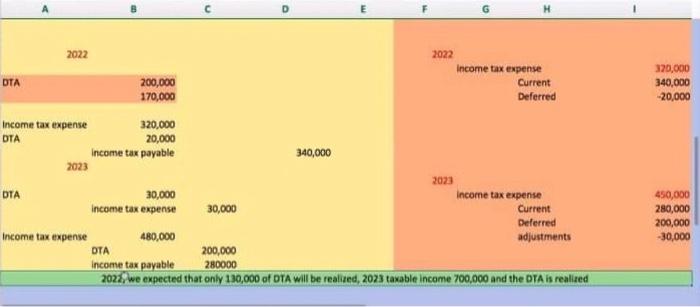

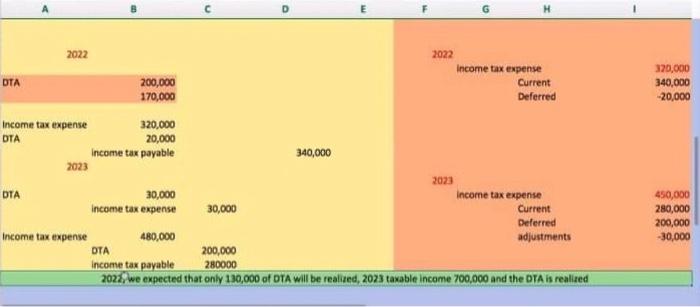

2022 we expected that only 130,000 of DTA will be realized , 2023 taxable income 700,000 and the DTA is realized .

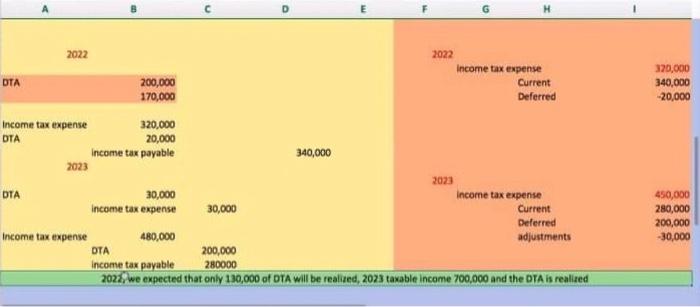

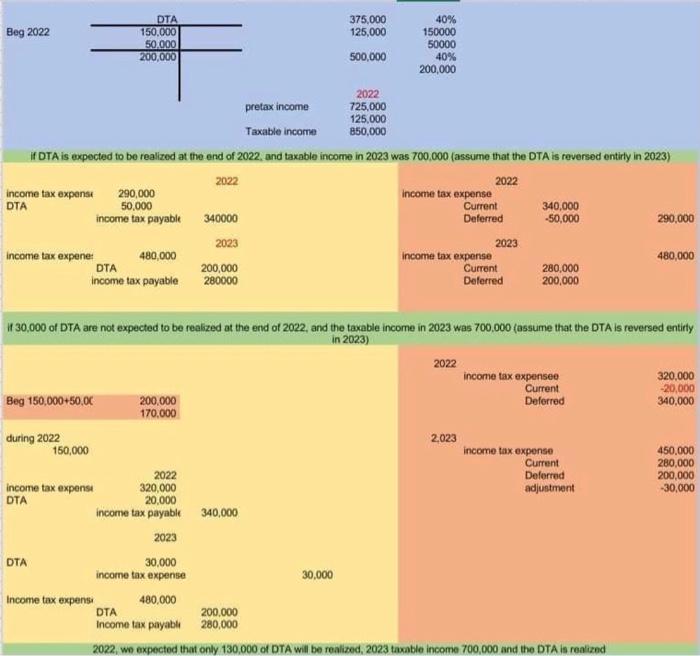

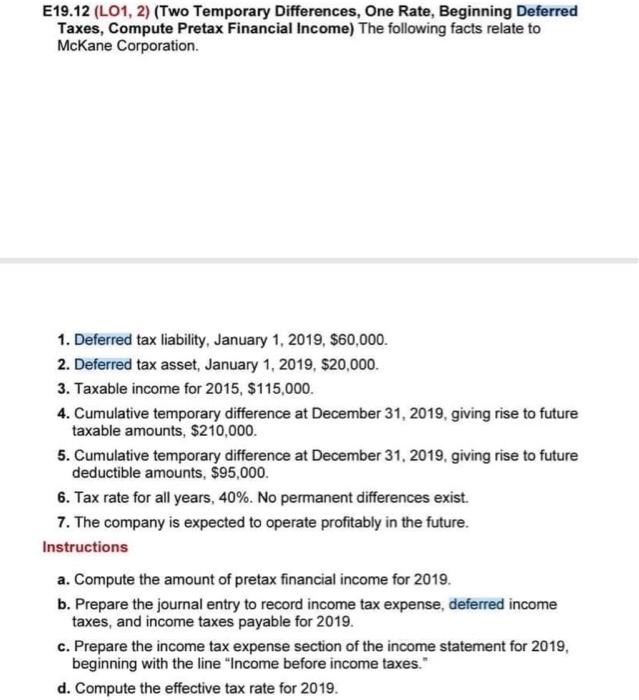

320,000 340,000 -20,000 2022 2022 Income tax expense DTA 200,000 Current 170,000 Deferred Income tax expense 320,000 OTA 20,000 Income tax payable 340,000 2023 2023 DTA 30,000 Income tax expense income tax expense 30,000 Current Deferred Income tax expense 480,000 adjustments OTA 200,000 Income tax payable 280000 2023, we expected that only 130,000 of OTA will be realized, 2023 taxable income 700,000 and the DTA is realized 450,000 280,000 200,000 -30,000 E19.12 (L01, 2) (Two Temporary Differences, One Rate, Beginning Deferred Taxes, Compute Pretax Financial Income) The following facts relate to McKane Corporation. 1. Deferred tax liability, January 1, 2019, $60,000. 2. Deferred tax asset, January 1, 2019, $20,000. 3. Taxable income for 2015, $115,000. 4. Cumulative temporary difference at December 31, 2019, giving rise to future taxable amounts, $210,000. 5. Cumulative temporary difference at December 31, 2019, giving rise to future deductible amounts, $95,000. 6. Tax rate for all years, 40%. No permanent differences exist. 7. The company is expected to operate profitably in the future. Instructions a. Compute the amount of pretax financial income for 2019. b. Prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2019. c. Prepare the income tax expense section of the income statement for 2019, beginning with the line "Income before income taxes." d. Compute the effective tax rate for 2019. DTA 375,000 40% Beg 2022 150.000 125,000 150000 50,000 50000 200,000 500,000 40% 200,000 2022 pretax income 725,000 125.000 Taxable income 850,000 DTA is expected to be realized at the end of 2022, and taxable income in 2023 was 700,000 (assume that the DTA is reversed entirly in 2023) 2022 2022 income tax expense 290,000 income tax expense DTA 50.000 Current 340,000 income tax payable 340000 Deferred -50,000 290,000 2023 2023 Income tax expene: 480,000 Income tax expense 480,000 DTA 200,000 Current 280,000 income tax payable 280000 Deferred 200,000 30,000 of DTA are not expected to be realized at the end of 2022, and the taxable income in 2023 was 700,000 (assume that the DTA is reversed entity in 2023) 2022 320,000 -20,000 340,000 450.000 280,000 200,000 -30,000 income tax expenseo Current Beg 150,000+50,00 200,000 Deferred 170,000 during 2022 2,023 150,000 income tax expense Current 2022 Deferred Income tax expense 320,000 adjustment DTA 20,000 income tax payable 340,000 2023 DTA 30.000 income tax expense 30,000 Income tax expens 480,000 DTA 200.000 Income tax payable 280,000 2022, we expected that only 130,000 of OTA will be realized, 2023 taxable income 700,000 and the DTA in realized