Answered step by step

Verified Expert Solution

Question

1 Approved Answer

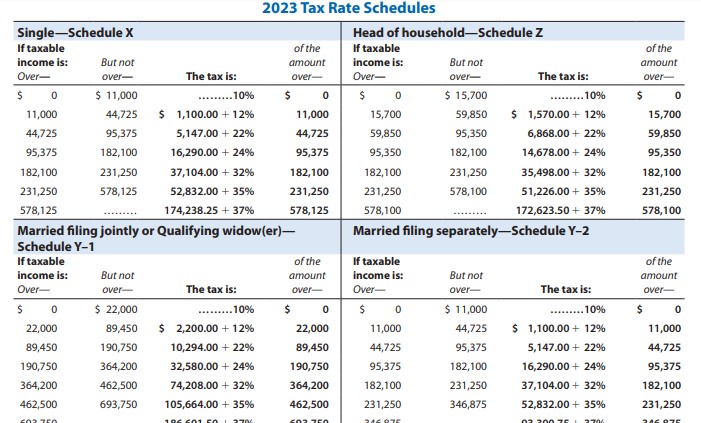

2023 Tax Rate Schedules begin{tabular}{|c|c|c|c|c|c|c|c|} hline multicolumn{4}{|c|}{ Single-Schedule X} & multicolumn{4}{|c|}{ Head of household-Schedule Z } hline Iftaxableincomeis:Over- & multirow{2}{*}{Butnotover-$11,000} & multirow{2}{*}{Thetaxis:..10%} & oftheamountover-

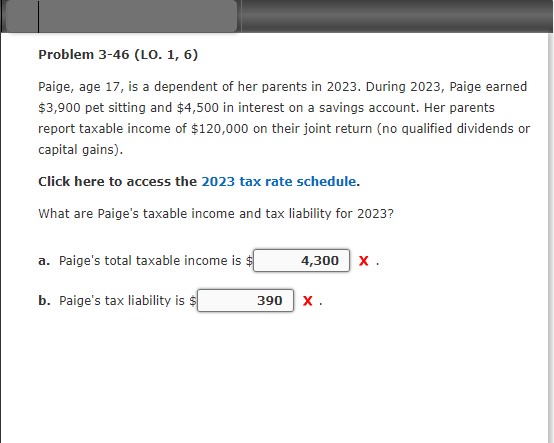

2023 Tax Rate Schedules \begin{tabular}{|c|c|c|c|c|c|c|c|} \hline \multicolumn{4}{|c|}{ Single-Schedule X} & \multicolumn{4}{|c|}{ Head of household-Schedule Z } \\ \hline Iftaxableincomeis:Over- & \multirow{2}{*}{Butnotover-$11,000} & \multirow{2}{*}{Thetaxis:..10%} & oftheamountover- & Iftaxableincomeis:Over- & \multirow{2}{*}{Butnotover-$15,700} & \multirow{2}{*}{Thetaxis:...10%} & oftheamountover- \\ \hline 0 & & & $ & 0 & & & $ \\ \hline 11,000 & 44,725 & $1,100.00+12% & 11,000 & 15,700 & 59,850 & $1,570.00+12% & 15,700 \\ \hline 44,725 & 95,375 & 5,147.00+22% & 44,725 & 59,850 & 95,350 & 6,868.00+22% & 59,850 \\ \hline 95,375 & 182,100 & 16,290.00+24% & 95,375 & 95,350 & 182,100 & 14,678.00+24% & 95,350 \\ \hline 182,100 & 231,250 & 37,104.00+32% & 182,100 & 182,100 & 231,250 & 35,498.00+32% & 182,100 \\ \hline 231,250 & 578,125 & 52,832.00+35% & 231,250 & 231,250 & 578,100 & 51,226.00+35% & 231,250 \\ \hline 578,125 & .......... & 174,238.25+37% & 578,125 & 578,100 & .......... & 172,623.50+37% & 578,100 \\ \hline \multicolumn{4}{|c|}{MarriedfilingjointlyorQualifyingwidow(er)-ScheduleY-1} & \multicolumn{4}{|c|}{ Married filing separately-Schedule Y-2 } \\ \hline Iftaxableincomeis:Over- & Butnotover- & The tax is: & oftheamountover- & Iftaxableincomeis:Over- & Butnotover- & The tax is: & oftheamountover- \\ \hline 0 & $22,000 & .........10\% & $ & 0 & $11,000 & ..........10\% & $ \\ \hline 22,000 & 89,450 & $2,200.00+12% & 22,000 & 11,000 & 44,725 & $1,100.00+12% & 11,000 \\ \hline 89,450 & 190,750 & 10,294.00+22% & 89,450 & 44,725 & 95,375 & 5,147.00+22% & 44,725 \\ \hline 190,750 & 364,200 & 32,580.00+24% & 190,750 & 95,375 & 182,100 & 16,290.00+24% & 95,375 \\ \hline 364,200 & 462,500 & 74,208.00+32% & 364,200 & 182,100 & 231,250 & 37,104.00+32% & 182,100 \\ \hline 462,500 & 693,750 & 105,664.00+35% & 462,500 & 231,250 & 346,875 & 52,832.00+35% & 231,250 \\ \hline \end{tabular} Paige, age 17 , is a dependent of her parents in 2023. During 2023, Paige earned $3,900 pet sitting and $4,500 in interest on a savings account. Her parents report taxable income of $120,000 on their joint return (no qualified dividends or capital gains). Click here to access the 2023 tax rate schedule. What are Paige's taxable income and tax liability for 2023 ? a. Paige's total taxable income is $ x. b. Paige's tax liability is $ x

2023 Tax Rate Schedules \begin{tabular}{|c|c|c|c|c|c|c|c|} \hline \multicolumn{4}{|c|}{ Single-Schedule X} & \multicolumn{4}{|c|}{ Head of household-Schedule Z } \\ \hline Iftaxableincomeis:Over- & \multirow{2}{*}{Butnotover-$11,000} & \multirow{2}{*}{Thetaxis:..10%} & oftheamountover- & Iftaxableincomeis:Over- & \multirow{2}{*}{Butnotover-$15,700} & \multirow{2}{*}{Thetaxis:...10%} & oftheamountover- \\ \hline 0 & & & $ & 0 & & & $ \\ \hline 11,000 & 44,725 & $1,100.00+12% & 11,000 & 15,700 & 59,850 & $1,570.00+12% & 15,700 \\ \hline 44,725 & 95,375 & 5,147.00+22% & 44,725 & 59,850 & 95,350 & 6,868.00+22% & 59,850 \\ \hline 95,375 & 182,100 & 16,290.00+24% & 95,375 & 95,350 & 182,100 & 14,678.00+24% & 95,350 \\ \hline 182,100 & 231,250 & 37,104.00+32% & 182,100 & 182,100 & 231,250 & 35,498.00+32% & 182,100 \\ \hline 231,250 & 578,125 & 52,832.00+35% & 231,250 & 231,250 & 578,100 & 51,226.00+35% & 231,250 \\ \hline 578,125 & .......... & 174,238.25+37% & 578,125 & 578,100 & .......... & 172,623.50+37% & 578,100 \\ \hline \multicolumn{4}{|c|}{MarriedfilingjointlyorQualifyingwidow(er)-ScheduleY-1} & \multicolumn{4}{|c|}{ Married filing separately-Schedule Y-2 } \\ \hline Iftaxableincomeis:Over- & Butnotover- & The tax is: & oftheamountover- & Iftaxableincomeis:Over- & Butnotover- & The tax is: & oftheamountover- \\ \hline 0 & $22,000 & .........10\% & $ & 0 & $11,000 & ..........10\% & $ \\ \hline 22,000 & 89,450 & $2,200.00+12% & 22,000 & 11,000 & 44,725 & $1,100.00+12% & 11,000 \\ \hline 89,450 & 190,750 & 10,294.00+22% & 89,450 & 44,725 & 95,375 & 5,147.00+22% & 44,725 \\ \hline 190,750 & 364,200 & 32,580.00+24% & 190,750 & 95,375 & 182,100 & 16,290.00+24% & 95,375 \\ \hline 364,200 & 462,500 & 74,208.00+32% & 364,200 & 182,100 & 231,250 & 37,104.00+32% & 182,100 \\ \hline 462,500 & 693,750 & 105,664.00+35% & 462,500 & 231,250 & 346,875 & 52,832.00+35% & 231,250 \\ \hline \end{tabular} Paige, age 17 , is a dependent of her parents in 2023. During 2023, Paige earned $3,900 pet sitting and $4,500 in interest on a savings account. Her parents report taxable income of $120,000 on their joint return (no qualified dividends or capital gains). Click here to access the 2023 tax rate schedule. What are Paige's taxable income and tax liability for 2023 ? a. Paige's total taxable income is $ x. b. Paige's tax liability is $ x Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started