Adam has just purchased a new car and has to decide whether to buy insurance to cover his new car in the event of

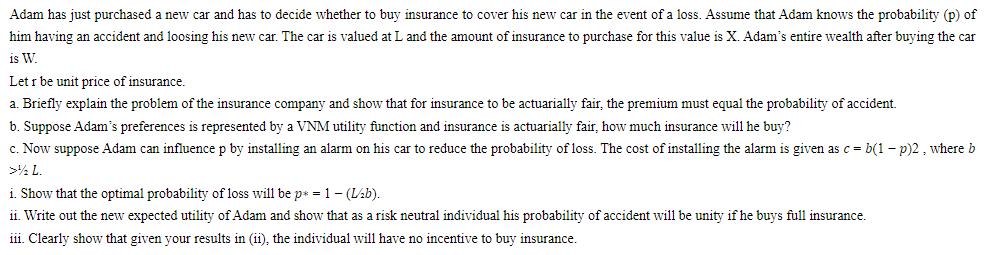

Adam has just purchased a new car and has to decide whether to buy insurance to cover his new car in the event of a loss. Assume that Adam knows the probability (p) of him having an accident and loosing his new car. The car is valued at L and the amount of insurance to purchase for this value is X. Adam's entire wealth after buying the car is W. Letr be unit price of insurance. a. Briefly explain the problem of the insurance company and show that for insurance to be actuarially fair, the premium must equal the probability of accident. b. Suppose Adam's preferences is represented by a VNM utility function and insurance is actuarially fair, how much insurance will he buy? c. Now suppose Adam can influence p by installing an alarm on his car to reduce the probability of loss. The cost of installing the alarm is given as c = b(1 - p)2, where b > L i. Show that the optimal probability of loss will be p*= 1 - (L/b). ii. Write out the new expected utility of Adam and show that as a risk neutral individual his probability of accident will be unity if he buys full insurance. iii. Clearly show that given your results in (ii), the individual will have no incentive to buy insurance.

Step by Step Solution

3.57 Rating (168 Votes )

There are 3 Steps involved in it

Step: 1

a The problem of the insurance company is to set the premium r such that the expected value of the p...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started