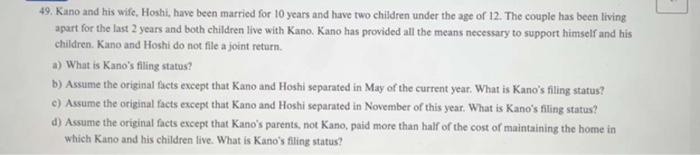

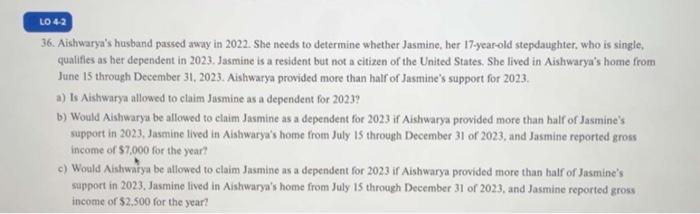

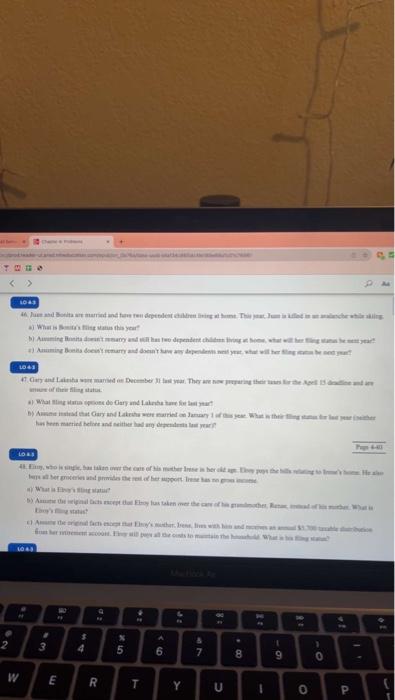

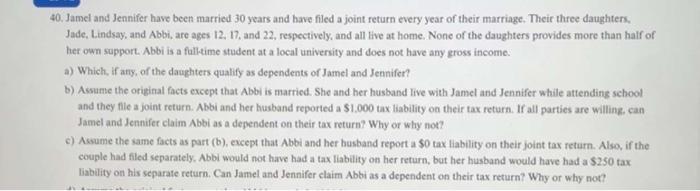

204: targhen statas? 36. Aishwarya's husband passed away in 2022. She needs to determine whether Jasmine, her 17-year-old stepdaughter, who is single, qualifies as her dependent in 2023. Jasmine is a resident but not a citizen of the United States. She lived in Aishwarya's home from June 15 through December 31, 2023. Aishwarya provided more than half of Jasmine's support for 2023. a) Is Aishwarya allowed to claim Jasmine as a dependent for 2023 ? b) Would Aishwarya be allowed to claim Jasmine as a dependent for 2023 if Aishwarya provided more than half of Jasmine's support in 2023, Jasmine lived in Aishwarya's home from July is through December 31 of 2023, and Jasmine reported gross income of $7,000 for the year? c) Would Aishwarya be allowed to claim Jasmine as a dependent for 2023 if Aishwarya provided more than half of Jasmine's support in 2023. Jasmine lived in Aishwarya's home from July 15 through December 31 of 2023, and Jasmine reported gross income of $2.500 for the year? 49. Kano and his wife, Hoshi, have been married for 10 years and have two children under the age of 12 . The couple has been living apurt for the last 2 years and both children live with Kano. Kano has provided all the means necessary to support himself and his children. Kano and Hoshi do not flle a joint return. a) What is Kano's filing status? b) Assume the original facts except that Kano and Hoshi separated in May of the current year. What is Kano's filing status? e) Assume the original facts except that Kano and Hoshi separated in November of this year. What is Kano's flling status? d) Assume the original facts except that Kano's parents, not Kano, paid more than half of the cost of maintaining the home in which Kano and his children live. What is Kano's flling status? 40. Jamel and Jennifer have been married 30 years and have filed a joint feturn every year of their marriage. Their three daughters, Jade, Lindsay, and Abbi, are ages 12, 17, and 22, respectively, and all live at home. None of the daughters provides more than half of her own support. Abbi is a fulltime student at a local university and does not have any gross income. a) Which, if any, of the daughters qualify as dependents of Jamel and Jennifen? b) Assume the original facts except that Abbi is married. She and her husband live with Jamel and Jennifer while attending sehool and they flle a joint return. Abbi and her husband reported a \$1,000 tax liability on their tax return. If all parties are willing, can Jamel and Jennifer claim Abbi as a dependent on their tax return? Why or why not? c) Assume the same facts as part (b), except that Abbi and her husband report a $0 tax liability on their joint tax return. Also, if the couple had filed separately. Abbi would not have had a tax liability on her return, but her husband would have had a $250 tax biability on his separate return. Can Jamel and Jennifer elaim Abbi as a dependent on their tax return? Why or why not