20.4-20.6 answers typed or able to copy/paste please and thank you.

my bad thank you so much

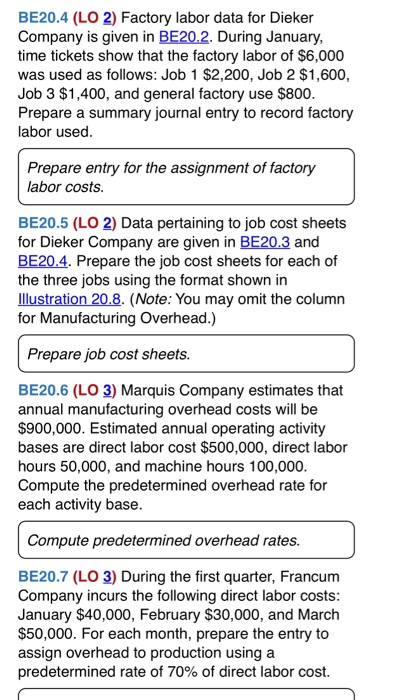

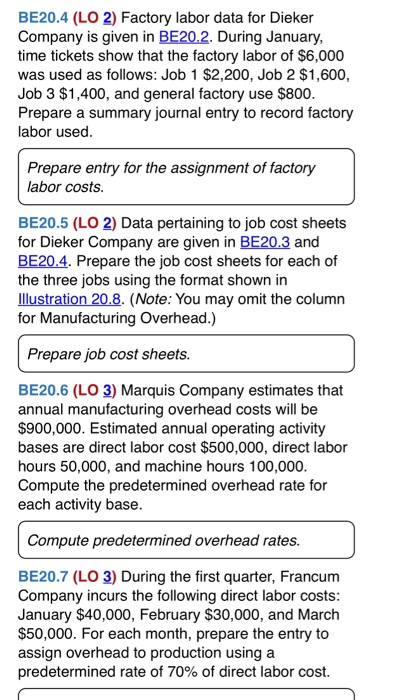

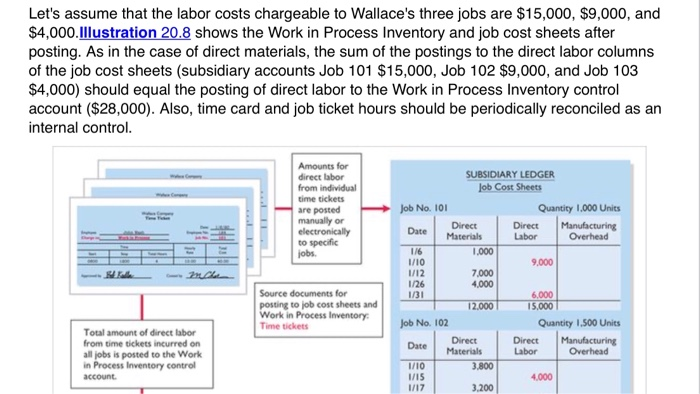

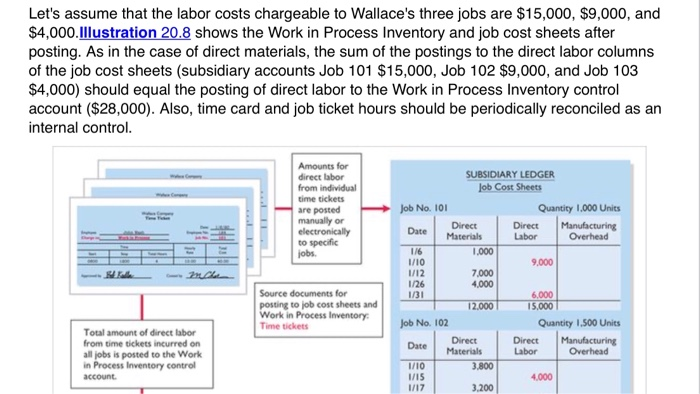

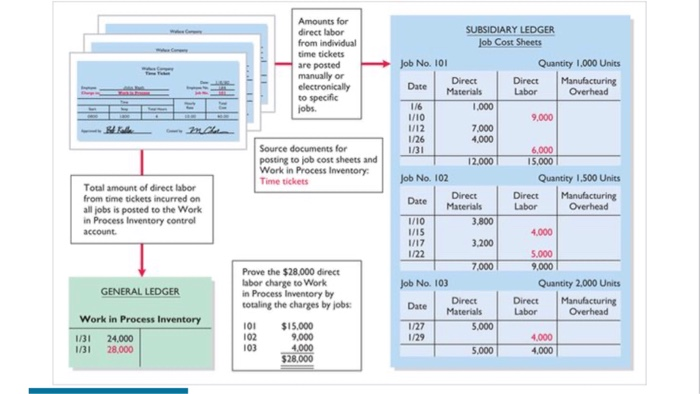

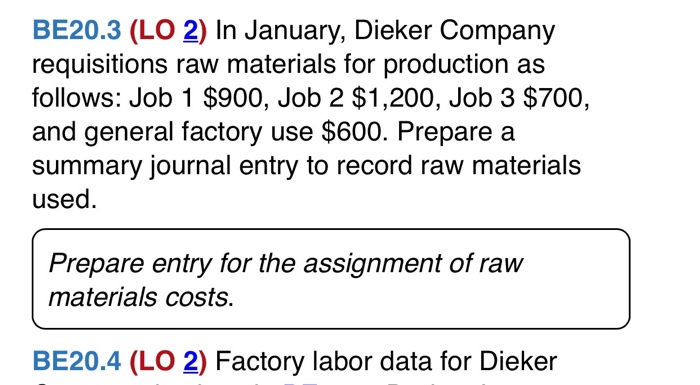

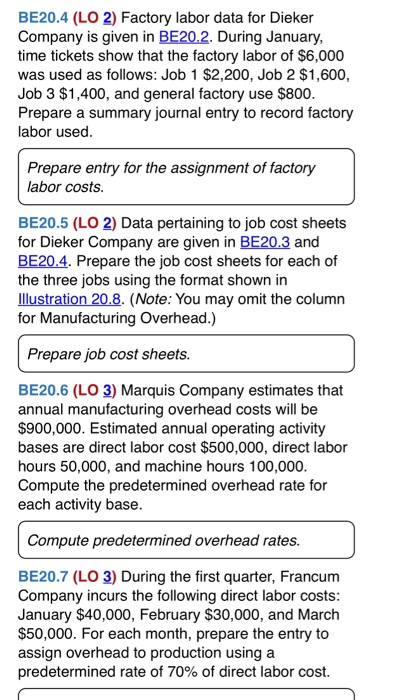

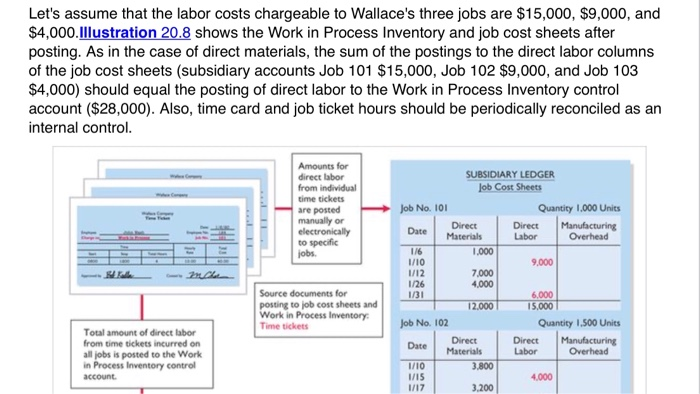

BE20.4 (LO 2) Factory labor data for Dieker Company is given in BE 20.2. During January, time tickets show that the factory labor of $6,000 was used as follows: Job 1 $2,200, Job 2 $1,600, Job 3 $1,400, and general factory use $800. Prepare a summary journal entry to record factory labor used. Prepare entry for the assignment of factory labor costs. BE20.5 (LO 2) Data pertaining to job cost sheets for Dieker Company are given in BE20.3 and BE20.4. Prepare the job cost sheets for each of the three jobs using the format shown in Illustration 20.8. (Note: You may omit the column for Manufacturing Overhead.) Prepare job cost sheets. BE20.6 (LO 3) Marquis Company estimates that annual manufacturing overhead costs will be $900,000. Estimated annual operating activity bases are direct labor cost $500,000, direct labor hours 50,000, and machine hours 100,000. Compute the predetermined overhead rate for each activity base. Compute predetermined overhead rates. BE20.7 (LO 3) During the first quarter, Francum Company incurs the following direct labor costs: January $40,000, February $30,000, and March $50,000. For each month, prepare the entry to assign overhead to production using a predetermined rate of 70% of direct labor cost. Let's assume that the labor costs chargeable to Wallace's three jobs are $15,000, $9,000, and $4,000.Illustration 20.8 shows the Work in Process Inventory and job cost sheets after posting. As in the case of direct materials, the sum of the postings to the direct labor columns of the job cost sheets (subsidiary accounts Job 101 $15,000, Job 102 $9,000, and Job 103 $4,000) should equal the posting of direct labor to the Work in Process Inventory control account ($28,000). Also, time card and job ticket hours should be periodically reconciled as an internal control. SUBSIDIARY LEDGER Job Cost Sheets Amounts for direct labor from individual time tickets are posted manually or electronically to specific jobs. Quantity 1.000 Units Direct Manufacturing Labor Overhead Job No. 101 Direct Date Materials 1.000 1/10 7.000 1/26 4.000 9,000 kolle che 1/12 Source documents for posting to job cost sheets and Work in Process Inventory Time tickets 6,000 15,000 Quantity 1,500 Units Direct Manufacturing Labor Overhead 12.000 Job No. 102 Direct Date Materials 1/10 3.800 1/15 1/17 3.200 Total amount of direct labor from time tickets incurred on all jobs is posted to the Work in Process Inventory control account 4.000 Amounts for direct labor from individual time tickets are posted manually or electronically to specific jobs. Date kolle che Source documents for posting to job cost sheets and Work in Process Inventory Time tickets Total amount of direct labor from time tickets incurred on all jobs is posted to the Work in Process Inventory control account SUBSIDIARY LEDGER Job Cost Sheets Job No. 101 Quantity 1.000 Units Direct Direct Manufacturing Materials Labor Overhead 1.000 1/10 9,000 1/12 7.000 1/26 4,000 1/31 6.000 12.000 15,000 Job No. 102 Quantity 1.500 Units Direct Date Direct Manufacturing Materials Labor Overhead 1/10 3.800 1/15 1/17 3.200 5.000 7.000 9,000 Job No. 103 Quantity 2,000 Units Direct Direct Date Manufacturing Materials Labor Overhead 5.000 1/29 4.000 5,000 4,000 4.000 GENERAL LEDGER Prove the $28.000 direct labor charge to Work in Process Inventory by totaling the charges by jobs 1/27 Work in Process Inventory 1/31 24,000 1/31 28,000 101 102 103 $15.000 9.000 4.000 $28.000 BE20.3 (LO 2) In January, Dieker Company requisitions raw materials for production as follows: Job 1 $900, Job 2 $1,200, Job 3 $700, and general factory use $600. Prepare a summary journal entry to record raw materials used. Prepare entry for the assignment of raw materials costs. BE20.4 (LO 2) Factory labor data for Dieker