20.60 predetermined overhead rate

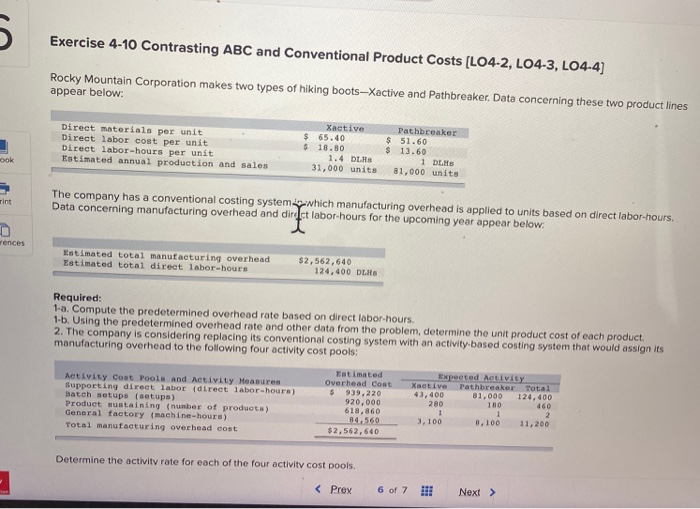

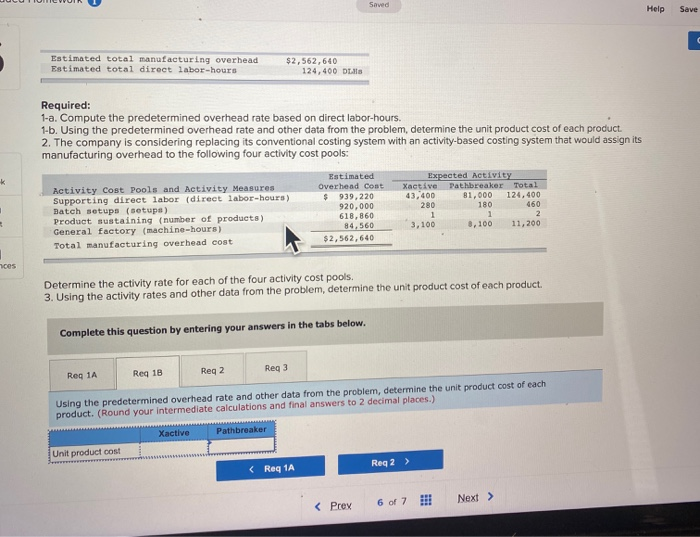

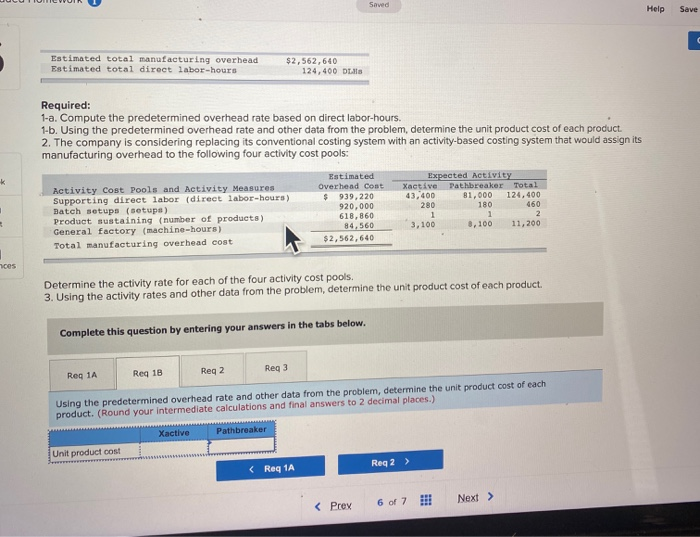

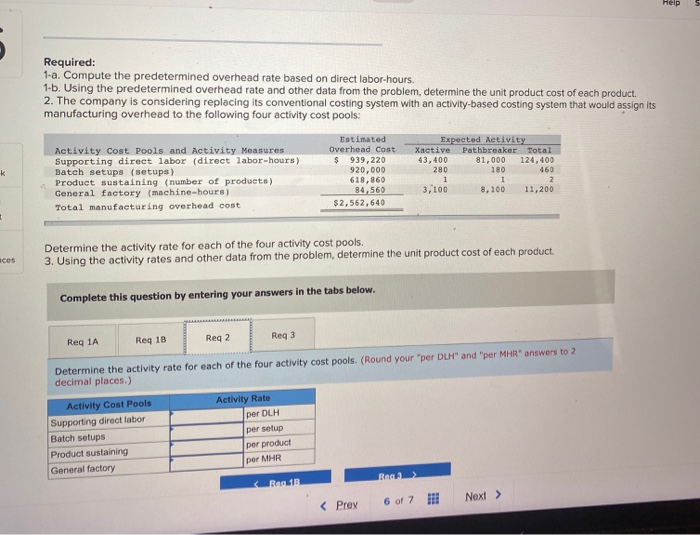

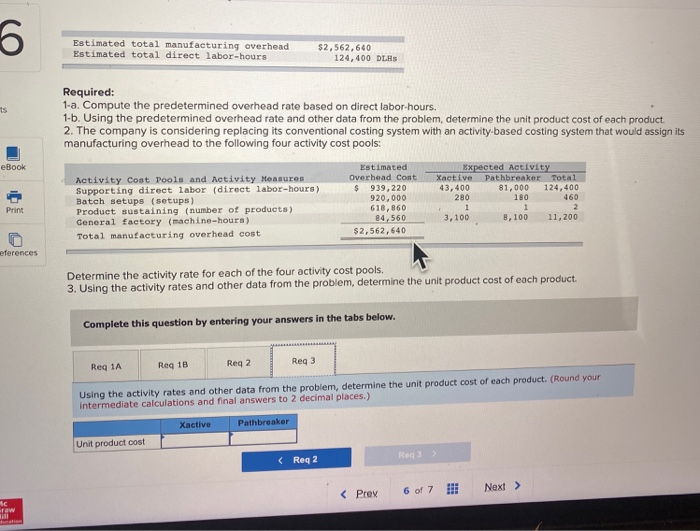

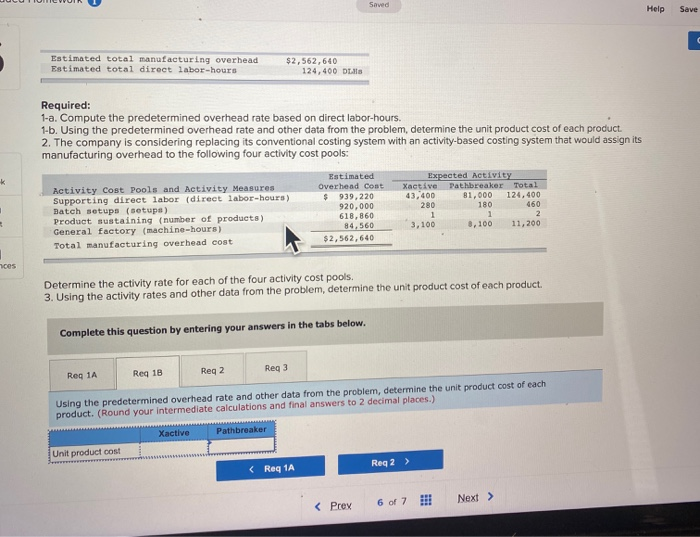

Exercise 4-10 Contrasting ABC and Conventional Product Costs (L04-2, L04-3, L04-4) Rocky Mountain Corporation makes two types of hiking boots-Xactive and Pathbreaker. Data concerning these two product lines appear below: Direct materials per unit Direct labor cost per unit Direct labor-hours per unit Estimated annual production and sales Xactive $ 65.40 $ 18.80 1.4 DLHS 31,000 units Pathbreaker $ 51.60 $ 13.60 1 DLHS 81,000 units rint The company has a conventional costing system which manufacturing overhead is applied to units based on direct labor-hours. Data concerning manufacturing overhead and direct labor hours for the upcoming year appear below: rences Estimated total manufacturing overhead Estimated total direct labor-hours $2,562,640 124,400 Ls Required: 1-a. Compute the predetermined overhead rate based on direct labor hours. 1-b. Using the predetermined overhead rate and other data from the problem, determine the unit product cost of each product 2. The company is considering replacing its conventional costing system with an activity based costing system that would assign its manufacturing overhead to the following four activity cost pools: Activity Cost Pools and Activity Measures Estimated Expected Activity Overhead Coat Xactive rathbreaker Total Supporting direct labor (direct labor-hours) $ 939,220 Batoh setups (setups) 43,400 81,000 124,400 920,000 280 180 Product sustaining number of products) 618,860 1 2 General factory (machine-hours) 84,560 3,100 8,100 11,200 Total manufacturing overhead cost $2,562,640 Determine the activity rate for each of the four activity cost pools. Saved Help Save Estimated total manufacturing overhead Estimated total direct labor-hours $2,562,640 124,400 DLS Required: 1-a. Compute the predetermined overhead rate based on direct labor-hours. 1-b. Using the predetermined overhead rate and other data from the problem, determine the unit product cost of each product 2. The company is considering replacing its conventional costing system with an activity-based costing system that would assign its manufacturing overhead to the following four activity cost pools: Estimated Expected Activity Activity Cost Pools and Activity Measures Overhead cost Xactive Pathbreaker Total Supporting direct labor (direct labor-hours) $ 939,220 43,400 81,000 124,400 Batch setups (setups) 920,000 180 460 Product sustaining number of products) 618,860 General factory (machine-hours) 84,560 3,100 8,100 Total manufacturing overhead cost $2,562,640 k 280 1 1 2 11,200 ces Determine the activity rate for each of the four activity cost pools. 3. Using the activity rates and other data from the problem, determine the unit product cost of each product. Complete this question by entering your answers in the tabs below. Reg 1A Reg 3 Reg 18 Reg 2 Using the predetermined overhead rate and other data from the problem, determine the unit product cost of each product. (Round your intermediate calculations and final answers to 2 decimal places.) Xactive Pathbreaker Unit product cost Reg 2 > Help Required: 1-a. Compute the predetermined overhead rate based on direct labor-hours. 1-b. Using the predetermined overhead rate and other data from the problem, determine the unit product cost of each product. 2. The company is considering replacing its conventional costing system with an activity-based costing system that would assign its manufacturing overhead to the following four activity cost pools: Estimated Expected Activity Activity Cost Pools and Activity Measures Overhead Cost Xactive Pathbreaker Total Supporting direct labor (direct labor-hours) $ 939,220 43,400 81,000 124,400 Batch setups (setups) 920,000 280 180 460 Product sustaining (number of products) 618,860 General factory (machine-hours) 84,560 3,100 8,100 11,200 Total manufacturing overhead cost $2,562,640 k 1 1 2 Determine the activity rate for each of the four activity cost pools. 3. Using the activity rates and other data from the problem, determine the unit product cost of each product Complete this question by entering your answers in the tabs below. Reg 1A Reg 13 Reg 2 Reg 3 Determine the activity rate for each of the four activity cost pools. (Round your "per DLH" and "per MHR" answers to 2 decimal places.) Activity Cost Pools Supporting direct labor Batch setups Product sustaining General factory Activity Rate per DLH per setup per product per MHR Red 6 Estimated total manufacturing overhead Estimated total direct labor-hours $2,562,640 124,400 DLHS Required: 1-a. Compute the predetermined overhead rate based on direct labor hours. 1-b. Using the predetermined overhead rate and other data from the problem, determine the unit product cost of each product 2. The company is considering replacing its conventional costing system with an activity-based costing system that would assign its manufacturing overhead to the following four activity cost pools: eBook Estimated Overhead Cost $ 939,220 920,000 618,860 84,560 $2,562,640 Activity Coat Pools and Activity Measures Supporting direct labor (direct labor-hours) Batch setups (setups) Product sustaining (number of products) General factory (machine-hours) Total manufacturing overhead cost Expected Activity Xactive Pathbreaker Total 43,400 81,000 124,400 280 180 460 1 1 2 3,100 8,100 11,200 Print eferences Determine the activity rate for each of the four activity cost pools. 3. Using the activity rates and other data from the problem, determine the unit product cost of each product. Complete this question by entering your answers in the tabs below. Reg 1A Reg 1B Reg 2 Reg 3 Using the activity rates and other data from the problem, determine the unit product cost of each product. (Round your intermediate calculations and final answers to 2 decimal places.) Xactive Pathbreaker Unit product cost SC raw Exercise 4-10 Contrasting ABC and Conventional Product Costs (L04-2, L04-3, L04-4) Rocky Mountain Corporation makes two types of hiking boots-Xactive and Pathbreaker. Data concerning these two product lines appear below: Direct materials per unit Direct labor cost per unit Direct labor-hours per unit Estimated annual production and sales Xactive $ 65.40 $ 18.80 1.4 DLHS 31,000 units Pathbreaker $ 51.60 $ 13.60 1 DLHS 81,000 units rint The company has a conventional costing system which manufacturing overhead is applied to units based on direct labor-hours. Data concerning manufacturing overhead and direct labor hours for the upcoming year appear below: rences Estimated total manufacturing overhead Estimated total direct labor-hours $2,562,640 124,400 Ls Required: 1-a. Compute the predetermined overhead rate based on direct labor hours. 1-b. Using the predetermined overhead rate and other data from the problem, determine the unit product cost of each product 2. The company is considering replacing its conventional costing system with an activity based costing system that would assign its manufacturing overhead to the following four activity cost pools: Activity Cost Pools and Activity Measures Estimated Expected Activity Overhead Coat Xactive rathbreaker Total Supporting direct labor (direct labor-hours) $ 939,220 Batoh setups (setups) 43,400 81,000 124,400 920,000 280 180 Product sustaining number of products) 618,860 1 2 General factory (machine-hours) 84,560 3,100 8,100 11,200 Total manufacturing overhead cost $2,562,640 Determine the activity rate for each of the four activity cost pools. Saved Help Save Estimated total manufacturing overhead Estimated total direct labor-hours $2,562,640 124,400 DLS Required: 1-a. Compute the predetermined overhead rate based on direct labor-hours. 1-b. Using the predetermined overhead rate and other data from the problem, determine the unit product cost of each product 2. The company is considering replacing its conventional costing system with an activity-based costing system that would assign its manufacturing overhead to the following four activity cost pools: Estimated Expected Activity Activity Cost Pools and Activity Measures Overhead cost Xactive Pathbreaker Total Supporting direct labor (direct labor-hours) $ 939,220 43,400 81,000 124,400 Batch setups (setups) 920,000 180 460 Product sustaining number of products) 618,860 General factory (machine-hours) 84,560 3,100 8,100 Total manufacturing overhead cost $2,562,640 k 280 1 1 2 11,200 ces Determine the activity rate for each of the four activity cost pools. 3. Using the activity rates and other data from the problem, determine the unit product cost of each product. Complete this question by entering your answers in the tabs below. Reg 1A Reg 3 Reg 18 Reg 2 Using the predetermined overhead rate and other data from the problem, determine the unit product cost of each product. (Round your intermediate calculations and final answers to 2 decimal places.) Xactive Pathbreaker Unit product cost Reg 2 > Help Required: 1-a. Compute the predetermined overhead rate based on direct labor-hours. 1-b. Using the predetermined overhead rate and other data from the problem, determine the unit product cost of each product. 2. The company is considering replacing its conventional costing system with an activity-based costing system that would assign its manufacturing overhead to the following four activity cost pools: Estimated Expected Activity Activity Cost Pools and Activity Measures Overhead Cost Xactive Pathbreaker Total Supporting direct labor (direct labor-hours) $ 939,220 43,400 81,000 124,400 Batch setups (setups) 920,000 280 180 460 Product sustaining (number of products) 618,860 General factory (machine-hours) 84,560 3,100 8,100 11,200 Total manufacturing overhead cost $2,562,640 k 1 1 2 Determine the activity rate for each of the four activity cost pools. 3. Using the activity rates and other data from the problem, determine the unit product cost of each product Complete this question by entering your answers in the tabs below. Reg 1A Reg 13 Reg 2 Reg 3 Determine the activity rate for each of the four activity cost pools. (Round your "per DLH" and "per MHR" answers to 2 decimal places.) Activity Cost Pools Supporting direct labor Batch setups Product sustaining General factory Activity Rate per DLH per setup per product per MHR Red 6 Estimated total manufacturing overhead Estimated total direct labor-hours $2,562,640 124,400 DLHS Required: 1-a. Compute the predetermined overhead rate based on direct labor hours. 1-b. Using the predetermined overhead rate and other data from the problem, determine the unit product cost of each product 2. The company is considering replacing its conventional costing system with an activity-based costing system that would assign its manufacturing overhead to the following four activity cost pools: eBook Estimated Overhead Cost $ 939,220 920,000 618,860 84,560 $2,562,640 Activity Coat Pools and Activity Measures Supporting direct labor (direct labor-hours) Batch setups (setups) Product sustaining (number of products) General factory (machine-hours) Total manufacturing overhead cost Expected Activity Xactive Pathbreaker Total 43,400 81,000 124,400 280 180 460 1 1 2 3,100 8,100 11,200 Print eferences Determine the activity rate for each of the four activity cost pools. 3. Using the activity rates and other data from the problem, determine the unit product cost of each product. Complete this question by entering your answers in the tabs below. Reg 1A Reg 1B Reg 2 Reg 3 Using the activity rates and other data from the problem, determine the unit product cost of each product. (Round your intermediate calculations and final answers to 2 decimal places.) Xactive Pathbreaker Unit product cost SC raw