Answered step by step

Verified Expert Solution

Question

1 Approved Answer

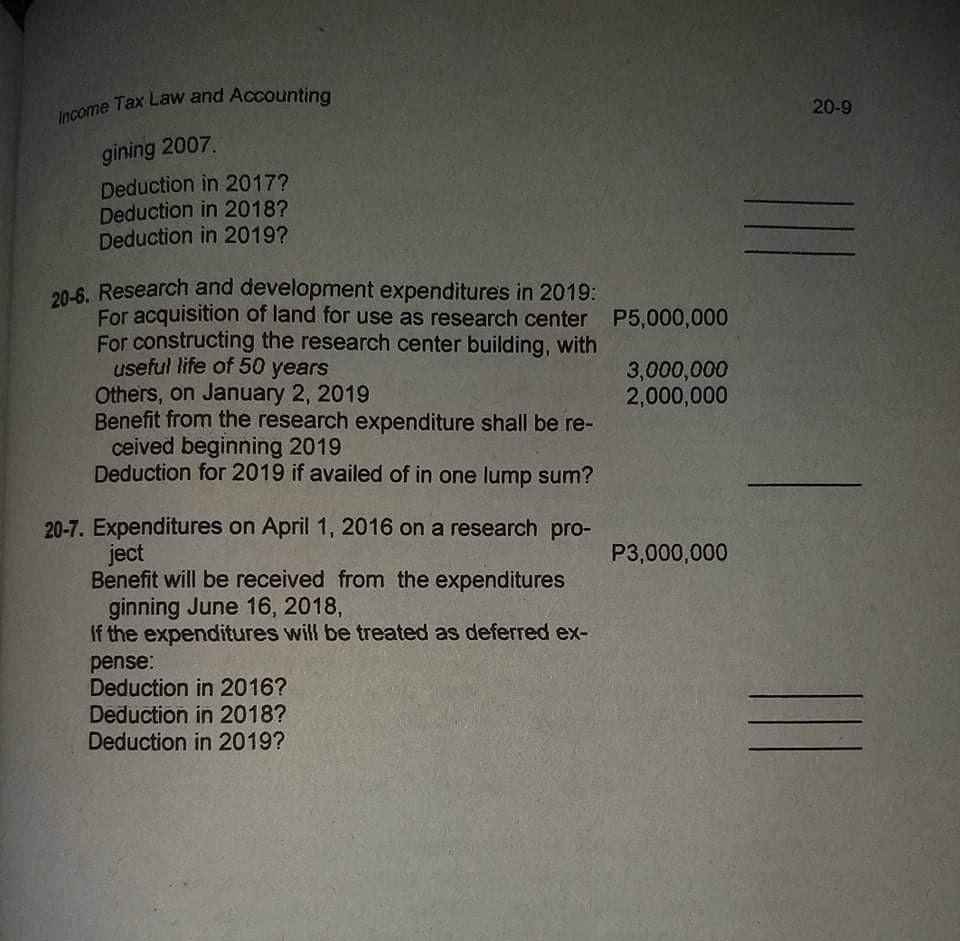

20-9 Income Tax Law and Accounting gining 2007 Deduction in 2017? Deduction in 2018? Deduction in 2019? 20-6. Research and development expenditures in 2019: For

20-9 Income Tax Law and Accounting gining 2007 Deduction in 2017? Deduction in 2018? Deduction in 2019? 20-6. Research and development expenditures in 2019: For acquisition of land for use as research center P5,000,000 For constructing the research center building, with useful life of 50 years 3,000,000 Others, on January 2, 2019 2,000,000 Benefit from the research expenditure shall be re- ceived beginning 2019 Deduction for 2019 if availed of in one lump sum? P3,000,000 20-7. Expenditures on April 1, 2016 on a research pro- ject Benefit will be received from the expenditures ginning June 16, 2018, If the expenditures will be treated as deferred ex- pense: Deduction in 2016? Deduction in 2018? Deduction in 2019

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started