Answered step by step

Verified Expert Solution

Question

1 Approved Answer

20-9 lessor accounting with guaranteed residual value. enters into a leves ots of $100.00 d at the end of the lone 520-8 Lessor Accounting with

20-9 lessor accounting with guaranteed residual value.

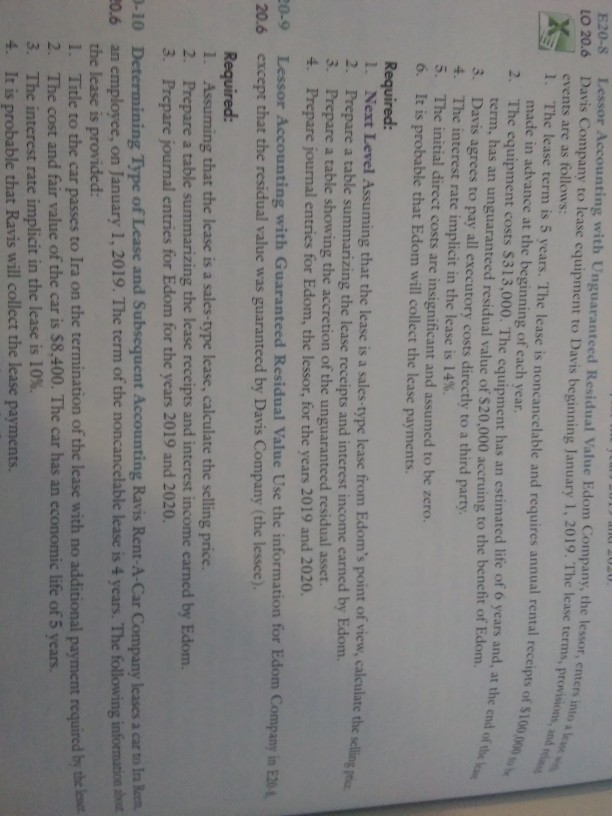

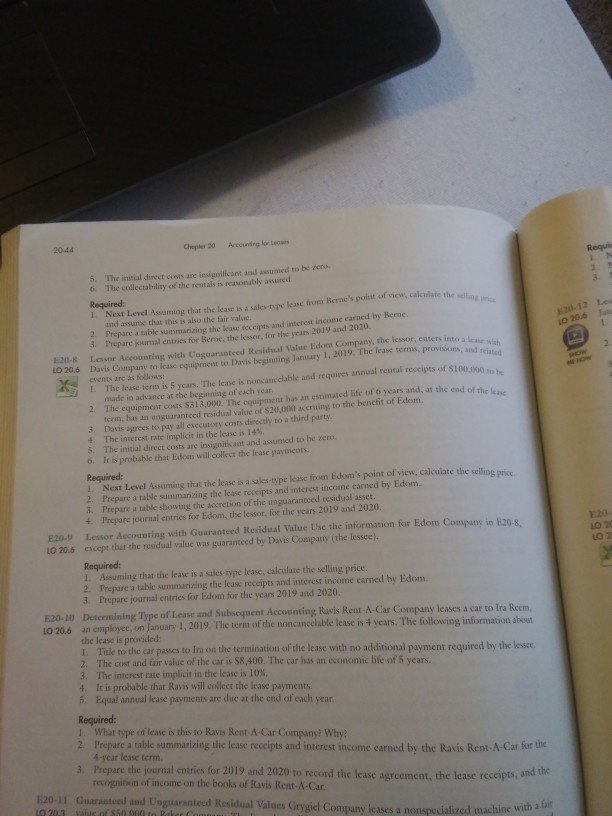

enters into a leves ots of $100.00 d at the end of the lone 520-8 Lessor Accounting with Unguaranteed Residual Value Edom Company, the lessor, enter LO 20.6 Davis Company to lease equipment to Davis beginning January 1, 2019. The lease terms, provisi events are as follows: 1. The lease term is 5 years. The lease is noncancelable and requires annual rental receipts of Sio made in advance at the beginning of each year. 2. The equipment costs $313,000. The equipment has an estimated life of 6 years and, at the end term, has an unguaranteed residual value of $20,000 accruing to the benefit of Edom. 3. Davis agrees to pay all executory costs directly to a third party 4. The interest rate implicit in the lease is 14%. 5. The initial direct costs are insignificant and assumed to be zero. 0. It is probable that Edom will collect the lease payments. Required: 1. Next Level Assuming that the lease is a sales-type lease from Edom's point of view, calculate the selling 2. Prepare a table summarizing the lease receipts and interest income earned by Edom. 3. Prepare a table showing the accretion of the unguaranteed residual asset. 4. Prepare journal entries for Edom, the lessor, for the years 2019 and 2020. 20-9 Lessor Accounting with Guaranteed Residual Value Use the information for Edom Company in E20 20.6 except that the residual value was guaranteed by Davis Company (the lessce). Required: 1. Assuming that the lease is a sales-type lease, calculate the selling price. 2. Prepare a table summarizing the lease receipts and interest income earned by Edom 3. Prepare journal entries for Edom for the years 2019 and 2020. 3-10 Determining Type of Lease and Subsequent Accounting Ravis Rent-A-Car Company cases a cartoln Bom 20.6 an employee, on January 1, 2019. The term of the noncancelable lease is 4 years. The following information the lease is provided: 1. Title to the car passes to Ira on the termination of the lease with no additional payment required by the 2. The cost and fair value of the car is $8.400. The car has an economic life of 5 years. 3. The interest rate implicit in the lease is 10% 4. It is probable that Ravis will collect the lease payments. Chapter 20 Aco 20.44 lo Requi 10- 1 20.6 The initial direct cows are insignificant and assumed to be 6. The collectability of the rentals is reasonably assured Required: 1 Next Level Assuming that the lease is a sales pe lease from Bernes porno calculate the and assume that this is also the fair value repare a table summarizing the base receipts and interest income card by Bere. Prepare uma entries for Berne, the lesson for the years 2019 and 2010 Lessor Accounting with Unguaranteed Residual Value Edom Company, the lesso, caters into Davis Company to lease equipment to Davis binning January 1, 2017 The re p o r t events are as follows: The lease term is 5 years. The lease is non ancelable and requires annual rental receipts of S100.000 made in advance at the betinning of each year 2. The equipment costs S313,000. The cyuipment has an estimated life of years and, at the end of term, has an unguaranteed residual value of $20,00Kr to the bench of dom 3 Davis aurces to pay all executory costs directly to a third party + The interest rate implicit in the lease is 1+%. 5 The initial direct costs are insinicant and assumed to be zero 6. It is probable that Edom will collect the lease payments. LO 20 LOZ Required: 1 Next Level Assuming that the lease is a sales-type lease from Edom's point of view, calculate the selline 2. Prepare a talle summarizing the lease receipts and interest income earned by Edom. 3. Prepare a table showing the accretion of the unguaranteed residual asset. + Prepare journal entries for Edom, the lessor for the years 2019 and 2020. 520.9 Lessor Accounting with Guaranteed Residual Value Use the information for Edom Company in 20-8 LO 20.6 ccept that the residual value was guaranteed by Davis Company (the lessee). Required: 1. Assuming that the lease is a sales type lease, calculate the selling price 2. Prepare a talle summarizing the lease receipts and interest income earned by Edom. 3. Prepare journal entries for Edom for the years 2019 and 2020. 20.10Determining Type of Lease and subsequent Accounting Ravis Rent-A-Car Company leases a car to Ira Reem, LO 20.6 ancmplovec, on January 1, 2019. The term of the mancancelable lease is 4 years. The following information ab the lease is provided: Title to the car passes ton on the termination of the lease with no additional payment required by the lesse 2. The cost and fair value of the car is $8.400. The car has an economic life of 5 years 3. The interest rate implicit in the lease is 10% 4. It is probable that Ravis will collect the lease payments. 5. Equal annual lease payments are due at the end of each year. Required: 1. What type of lease is this to Ravis Rent-A-Car Company? Why? 2Prepare a table summarizing the lease receipts and interest income earned by the Ravis Rent A Car 4-year lease term Prepare the journal entries for 2019 and 2020 to record the lease agreement the lease receipts, an recognition of income on the books of Ravis Rent-A-Car. 120-11 Guaranteed and Unguaranteed Residual Values Grygiel Company leases a nonspecialized machine LO 20 Yale 550 Rabac specialized machine with a fait

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started