Answered step by step

Verified Expert Solution

Question

1 Approved Answer

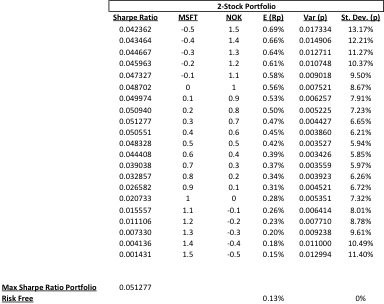

20.If your clients risk aversion factor A = 2, what is the optimal allocation between Optimal Risky Portfolio and Rf security? If you want to

20.If your clients risk aversion factor A = 2, what is the optimal allocation between Optimal Risky Portfolio and Rf security?

If you want to achieve the Rp = 0.30%, how much would you invest into Risky portfolio and how much into Rf security?

Risk Free 0.042362 -0.5 0.043464 -0A 0.044667 -0.3 0.045963 -0.2 0.047327 0.048702 0.049974. 0.1 0.050940 0.2 0.0 1277 0.3 0.05055 0.4 0.048328 (D.S 0.044408 0.6 0.039038 0.7 0.03 28S7 0.8 0.026582 0.9 0.020733 0.015 SS7 0.011106 0.00 330 0.004136 1.4 0.001431 0.0 1277 2-Stock Portfolio 0.69% 0.66% 0.64% 0.61% 0.58% 0.56% 0.53% 0.8 0.50% 0.7 047% 0.6 0 45% 0.42% 0.39% 0.37% 0.34% 0.31% 0.28% 0.25% 0.23% 0.20% 0.18% 0.15% 0.13% 0.017334 0.014906 0.01271 0.010748 0.009018 0.00 S2 0.0062 S7 0.005225 0.004427 0.003860 0.003527 0.003426 0.003 SS9 0.003923 0.00452 0.0053 1 0.006414 0.00710 0.009238 0.011000 0.012994. 13.17% 12.21% 11.27% 10.37% 9.50% 8.67% 7.91% 7.23% 6.21% 5.94% 5.8S% 5.97% 6.26% 6.72% 7.32% 8.01% 8.73% 9.61% 10.49% 11.40%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started