Answered step by step

Verified Expert Solution

Question

1 Approved Answer

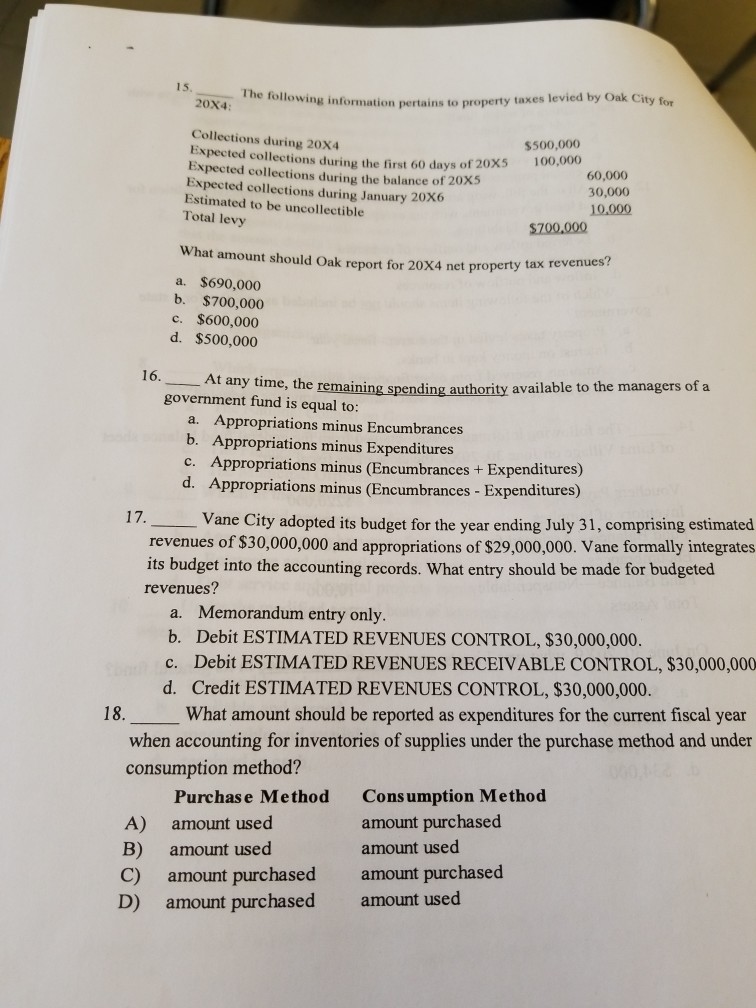

20x4 mation pertains to property taxes levied by Oak City for Collections during 20X4 $500,000 100,000 Expected collections during the first 60 days of 20xs

20x4 mation pertains to property taxes levied by Oak City for Collections during 20X4 $500,000 100,000 Expected collections during the first 60 days of 20xs Expected collections during the balance of 20X5 Expected collections during January 20x6 Estimated to be uncollectible Total levy 60,000 30,000 10.000 $700,000 What amount should Oak report for 20x4 net property tax revenues? a. $690,000 b. $700,000 c. $600,000 d. $500,000 16. At any time, the remaining spending authority available to the managers of a a. Appropriations minus Encumbrances b. Appropriations minus Expenditures c. Appropriations minus (Encumbrances Expenditures) d. Appropriations minus (Encumbrances - government fund is equal to: Expenditures) Vane City adopted its budget for the year ending July 31, comprising estimated revenues of $30,000,000 and appropriations of $29,000,000. Vane formally integrates its budget into the accounting records. What entry should be made for budgeted revenues? a. Memorandum entry only. b. Debit ESTIMATED REVENUES CONTROL, $30,000,000. c. Debit ESTIMATED REVENUES RECEIVABLE CONTROL, $30,000,000 d. Credit ESTIMATED REVENUES CONTROL, S30,000,000. 18. What amount should be reported as expenditures for the current fiscal year when accounting for inventories of supplies under the purchase method and under consumption method? Cons umption Method amount purchased amount used Purchase Method A) amount used B) amount used C) amount purchased amount purchased D) amount purchased amount used

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started