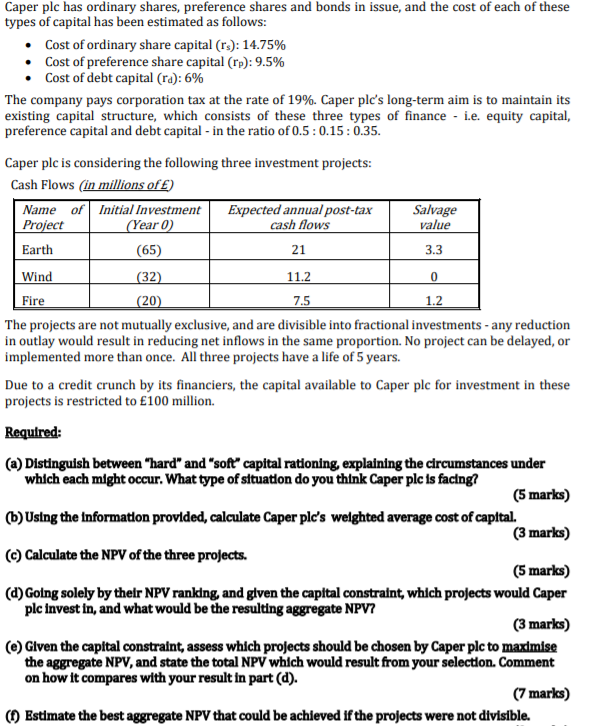

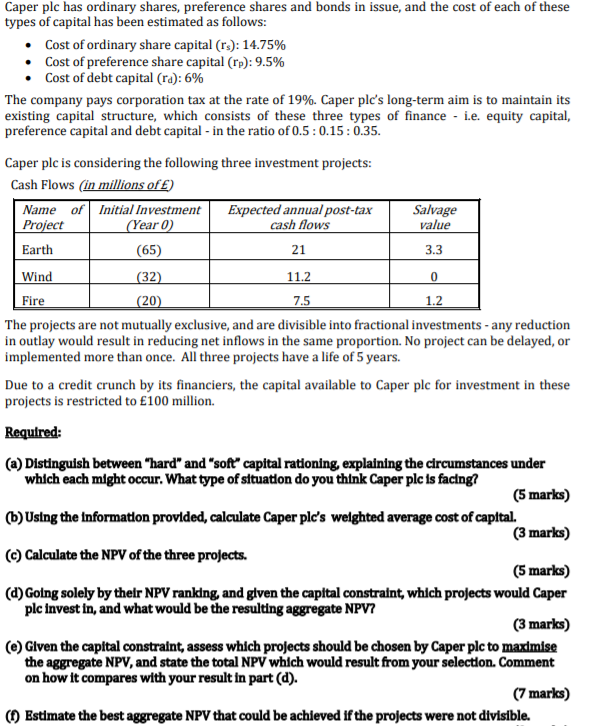

21 11.2 0 7.5 1.2 Caper plc has ordinary shares, preference shares and bonds in issue, and the cost of each of these types of capital has been estimated as follows: Cost of ordinary share capital (rs): 14.75% Cost of preference share capital (rp): 9.5% Cost of debt capital (ra): 6% The company pays corporation tax at the rate of 19%. Caper ple's long-term aim is to maintain its existing capital structure, which consists of these three types of finance - i.e. equity capital, preference capital and debt capital - in the ratio of 0.5:0.15:0.35. Caper plc is considering the following three investment projects: Cash Flows (in millions of ) Name of Initial Investment Expected annual post-tax Salvage Project (Year 0) cash flows value Earth (65) 3.3 Wind (32) Fire (20) The projects are not mutually exclusive, and are divisible into fractional investments - any reduction in outlay would result in reducing net inflows in the same proportion. No project can be delayed, or implemented more than once. All three projects have a life of 5 years. Due to a credit crunch by its financiers, the capital available to Caper plc for investment in these projects is restricted to 100 million. Required: (a) Distinguish between "hard" and "soft" capital rationing, explaining the circumstances under which each might occur. What type of situation do you think Caper plc is facing? (5 marks) (6) Using the Information provided, calculate Caper ple's welghted average cost of capital. (3 marks) (c) Calculate the NPV of the three projects. (5 marks) (d) Going solely by their NPV ranking, and given the capital constraint, which projects would Caper plc invest in, and what would be the resulting aggregate NPV? (3 marks) (e) Given the capital constraint, assess which projects should be chosen by Caper plc to maximise the aggregate NPV, and state the total NPV which would result from your selection. Comment on how it compares with your result in part (d). (7 marks) (1) Estimate the best aggregate NPV that could be achieved if the projects were not divisible