Answered step by step

Verified Expert Solution

Question

1 Approved Answer

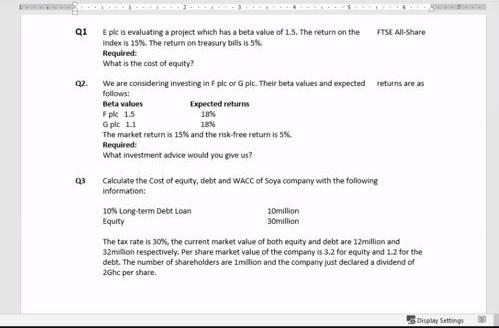

21 2. Eple la evaluating a project which has a beta value of 1.5. The return on the FTSE All-Share index is 15%. The return

21 2. Eple la evaluating a project which has a beta value of 1.5. The return on the FTSE All-Share index is 15%. The return on treasury bills 5%. Required: What is the cost of equity? We are considering investing in plc or Gple. Their beta values and expected returns are as follows: Beta values Expected returns Fpic 1.5 18% Gpl 1.1 18% The market return is 15% and the risk-free return is 5%. Required: What investment advice would you give us? Calculate the cost of equity, debt and WACC of Soya company with the following Information: 10% Long-term Debt Loan 10million Equity 30million The tax rate is 30%, the current market value of both equity and debt are 12 million and 32milion respectively. Per share market value of the company is 3.2 for equity and 1.2 for the debt. The number of shareholders are million and the company Just declared a dividend of 2Ghc per share. Q3 De Setting

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started