Answered step by step

Verified Expert Solution

Question

1 Approved Answer

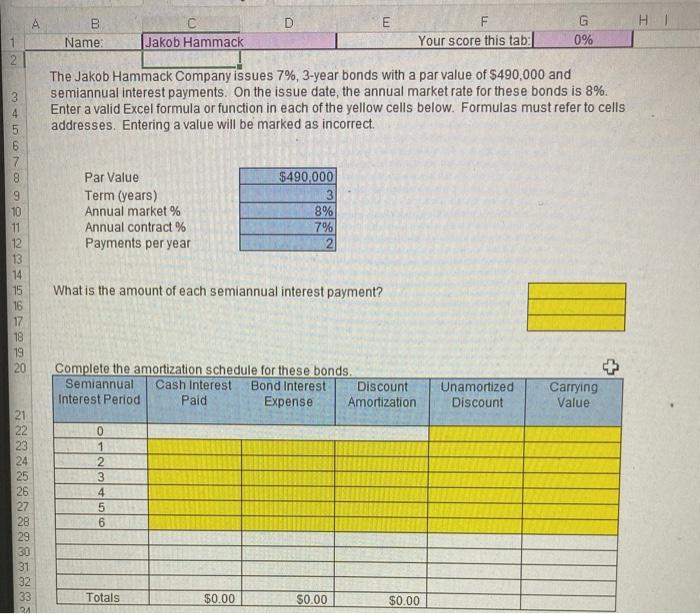

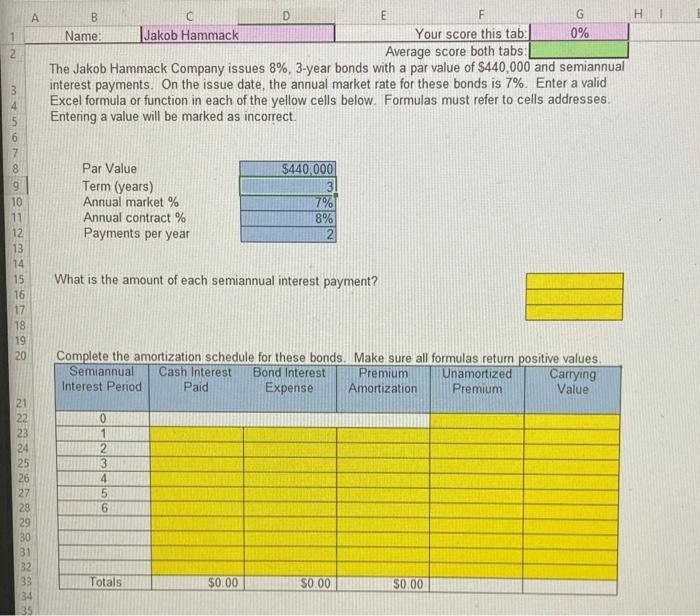

21 3456789 SENS 10 12 13 14 561839 17 20 2222228885883 26 27 B Name: Par Value Term (years) Annual market % Annual contract

21 3456789 SENS 10 12 13 14 561839 17 20 2222228885883 26 27 B Name: Par Value Term (years) Annual market % Annual contract % Payments per year W C Jakob Hammack The Jakob Hammack Company issues 7%, 3-year bonds with a par value of $490,000 and semiannual interest payments. On the issue date, the annual market rate for these bonds is 8%. Enter a valid Excel formula or function in each of the yellow cells below. Formulas must refer to cells addresses. Entering a value will be marked as incorrect. 0 1 What is the amount of each semiannual interest payment? Complete the amortization schedule for these bonds. Semiannual Cash Interest Bond Interest Interest Period Paid Expense 23456 Totals $490,000 3 8% 7% $0.00 E $0.00 F Your score this tab: Discount Amortization 0% $0.00 Unamortized Carrying Discount Value: H 13 345678 9016 11 13 14 17 18 19 20 21 A 26 27 29 F Your score this tab: Average score both tabs: The Jakob Hammack Company issues 8%, 3-year bonds with a par value of $440,000 and semiannual interest payments. On the issue date, the annual market rate for these bonds is 7%. Enter a valid Excel formula or function in each of the yellow cells below. Formulas must refer to cells addresses. Entering a value will be marked as incorrect. 30 B Name: . 3 - 456 Par Value Term (years) Annual market % Annual contract % Payments per year Interest Period What is the amount of each semiannual interest payment? 0 1 C Jakob Hammack 2 3 Complete the amortization schedule for these bonds. Make sure all formulas return positive values. Semiannual Premium Cash Interest Bond Interest Paid Expense Carrying Value Amortization Totals D $440,000 $0.00 7% 8% E $0.00 G 0% $0.00 Unamortized Premium H I

Step by Step Solution

★★★★★

3.33 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started