Answered step by step

Verified Expert Solution

Question

1 Approved Answer

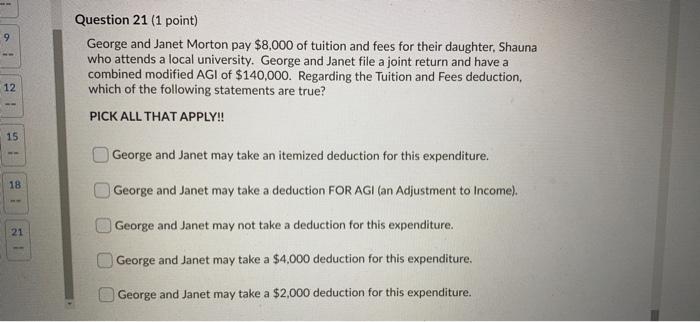

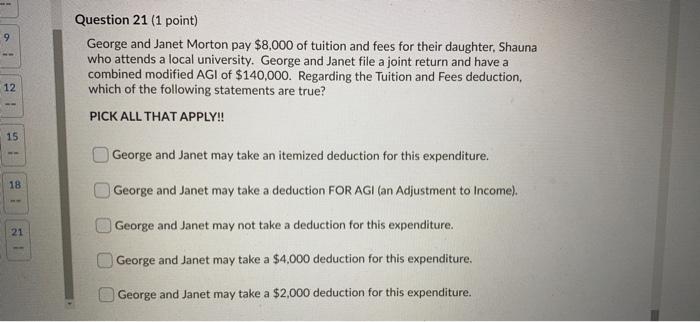

21 9 Question 21 (1 point) George and Janet Morton pay $8,000 of tuition and fees for their daughter, Shauna who attends a local university.

21

9 Question 21 (1 point) George and Janet Morton pay $8,000 of tuition and fees for their daughter, Shauna who attends a local university. George and Janet file a joint return and have a combined modified AGI of $140,000. Regarding the Tuition and Fees deduction, which of the following statements are true? PICK ALL THAT APPLY!! 12 15 George and Janet may take an itemized deduction for this expenditure. George and Janet may take a deduction FOR AGI (an Adjustment to Income). 18 George and Janet may not take a deduction for this expenditure. 21 George and Janet may take a $4.000 deduction for this expenditure. George and Janet may take a $2,000 deduction for this expenditure

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started