Answered step by step

Verified Expert Solution

Question

1 Approved Answer

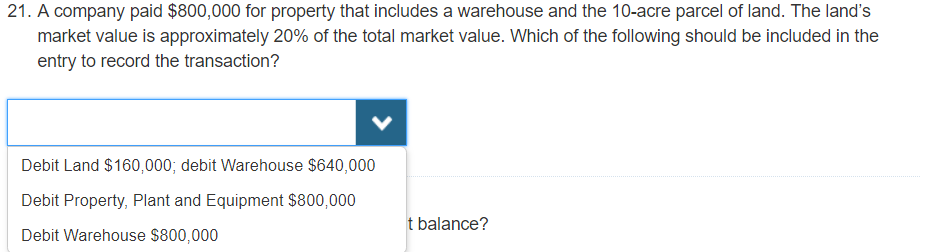

21. A company paid $800,000 for property that includes a warehouse and the 10-acre parcel of land. The land's market value is approximately 20% of

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started