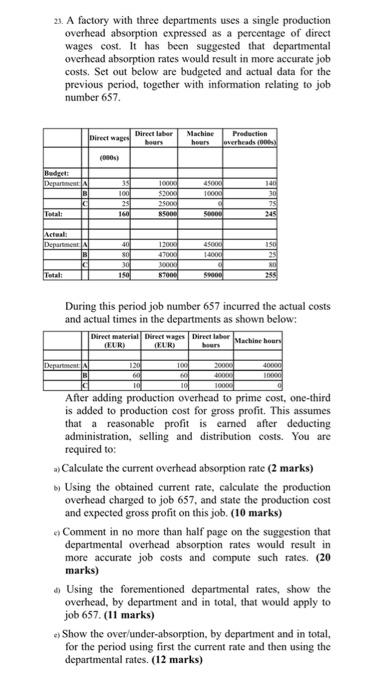

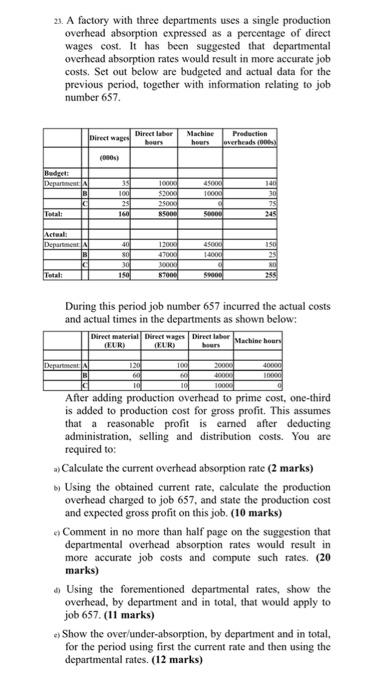

21. A factory with three departments uses a single production overhead absorption expressed as a percentage of direct wages cost. It has been suggested that departmental overhead absorption rates would result in more accurate job costs. Set out below are budgeted and actual data for the previous period, together with information relating to job number 657 Direct was Direct labor hours (000) Machine hours Production overheads Budget: Depart 4 OK 1000 B 35 100 29 160 1000 $2000 2500 5000 100 30 75 245 Total 50000 Actual Department B ASO 150 40 SO 1200 47000 30000 87000 Total 150 SW During this period job number 657 incurred the actual costs and actual times in the departments as shown below: Direct material Direct wages Direct labor Machine hours (EUR) (EUR) Departement 120 100 20000 40000 10 101 10000 After adding production overhead to prime cost, one-third is added to production cost for gross profit. This assumes that a reasonable profit is camed after deducting administration, selling and distribution costs. You are required to: - Calculate the current overhead absorption rate (2 marks) Using the obtained current rate, calculate the production overhead charged to job 657, and state the production cost and expected gross profit on this job. (10 marks) Comment in no more than half page on the suggestion that departmental overhead absorption rates would result in more accurate job costs and compute such rates. (20 marks) Using the forementioned departmental rates, show the overhead, by department and in total, that would apply to job 657. (11 marks) Show the over/under-absorption, by department and in total for the period using first the current rate and then using the departmental rates. (12 marks) 21. A factory with three departments uses a single production overhead absorption expressed as a percentage of direct wages cost. It has been suggested that departmental overhead absorption rates would result in more accurate job costs. Set out below are budgeted and actual data for the previous period, together with information relating to job number 657 Direct was Direct labor hours (000) Machine hours Production overheads Budget: Depart 4 OK 1000 B 35 100 29 160 1000 $2000 2500 5000 100 30 75 245 Total 50000 Actual Department B ASO 150 40 SO 1200 47000 30000 87000 Total 150 SW During this period job number 657 incurred the actual costs and actual times in the departments as shown below: Direct material Direct wages Direct labor Machine hours (EUR) (EUR) Departement 120 100 20000 40000 10 101 10000 After adding production overhead to prime cost, one-third is added to production cost for gross profit. This assumes that a reasonable profit is camed after deducting administration, selling and distribution costs. You are required to: - Calculate the current overhead absorption rate (2 marks) Using the obtained current rate, calculate the production overhead charged to job 657, and state the production cost and expected gross profit on this job. (10 marks) Comment in no more than half page on the suggestion that departmental overhead absorption rates would result in more accurate job costs and compute such rates. (20 marks) Using the forementioned departmental rates, show the overhead, by department and in total, that would apply to job 657. (11 marks) Show the over/under-absorption, by department and in total for the period using first the current rate and then using the departmental rates. (12 marks)