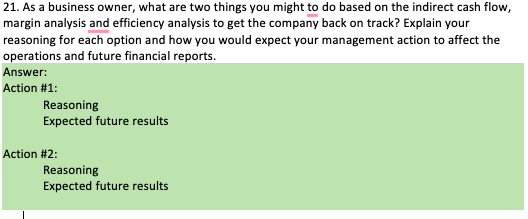

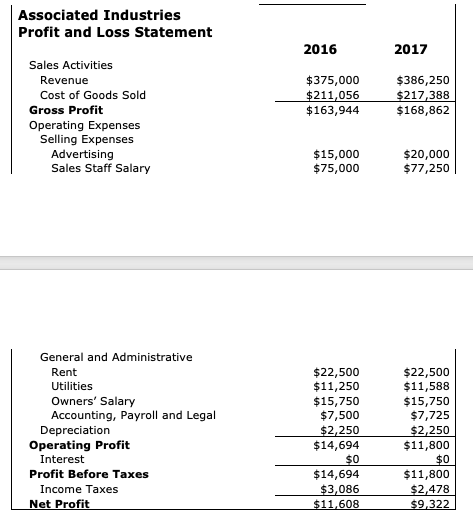

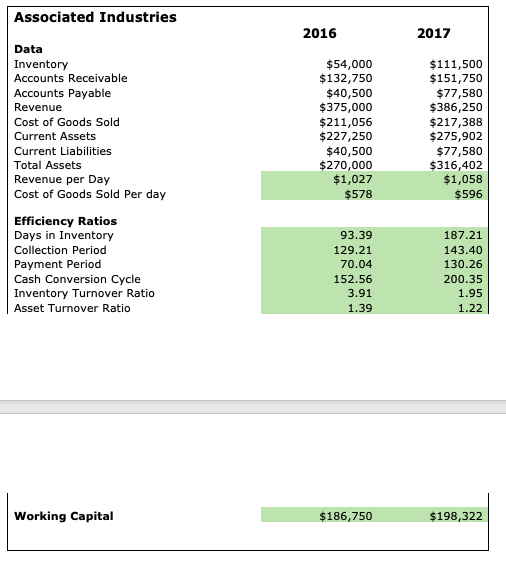

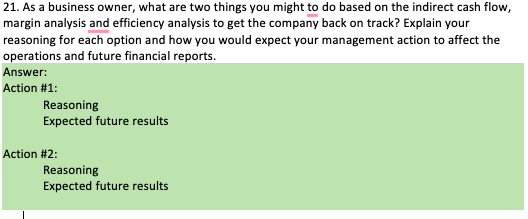

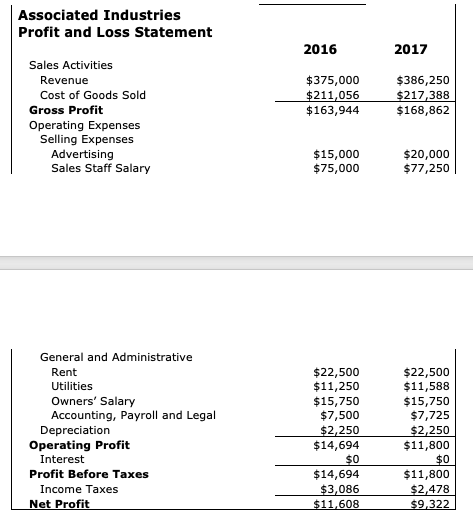

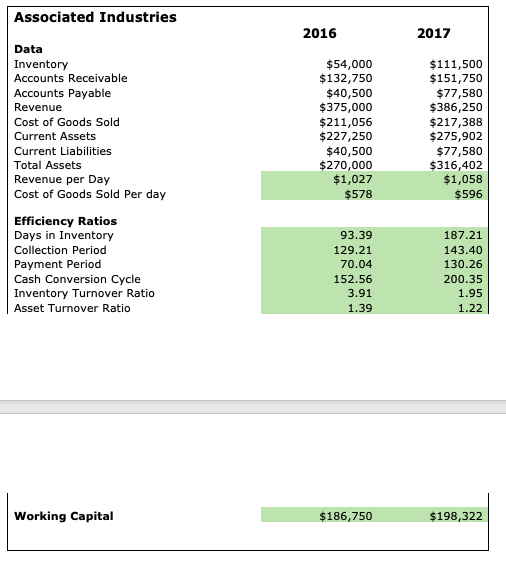

21. As a business owner, what are two things you might to do based on the indirect cash flow, margin analysis and efficiency analysis to get the company back on track? Explain your reasoning for each option and how you would expect your management action to affect the operations and future financial reports. Answer: Action #1: Reasoning Expected future results Action #2: Reasoning Expected future results \begin{tabular}{|lrr|} General and Administrative & & \\ Rent & $22,500 & $22,500 \\ Utilities & $11,250 & $11,588 \\ Owners' Salary & $15,750 & $15,750 \\ Accounting, Payroll and Legal & $7,500 & $7,725 \\ Depreciation & $2,250 & $2,250 \\ Operating Profit & $14,694 & $11,800 \\ Interest & $0 & $0 \\ Profit Before Taxes & $14,694 & $11,800 \\ Income Taxes & $3,086 & $2,478 \\ Net Profit & $11,608 & $9,322 \\ \hline \end{tabular} \begin{tabular}{|lrr|} \hline Associated Industries & & \\ Data & 2016 & 2017 \\ Inventory & & \\ Accounts Receivable & $54,000 & $111,500 \\ Accounts Payable & $132,750 & $151,750 \\ Revenue & $40,500 & $77,580 \\ Cost of Goods Sold & $375,000 & $386,250 \\ Current Assets & $211,056 & $217,388 \\ Current Liabilities & $227,250 & $275,902 \\ Total Assets & $40,500 & $77,580 \\ Revenue per Day & $270,000 & $316,402 \\ Cost of Goods Sold Per day & $1,027 & $1,058 \\ & $578 & $596 \\ Efficiency Ratios & & 187.21 \\ Days in Inventory & 93.39 & 143.40 \\ Collection Period & 129.21 & 130.26 \\ Payment Period & 70.04 & 200.35 \\ Cash Conversion Cycle & 152.56 & 1.95 \\ Inventory Turnover Ratio & 3.91 & 1.22 \end{tabular} Working Capital $186,750 $198,322 21. As a business owner, what are two things you might to do based on the indirect cash flow, margin analysis and efficiency analysis to get the company back on track? Explain your reasoning for each option and how you would expect your management action to affect the operations and future financial reports. Answer: Action #1: Reasoning Expected future results Action #2: Reasoning Expected future results \begin{tabular}{|lrr|} General and Administrative & & \\ Rent & $22,500 & $22,500 \\ Utilities & $11,250 & $11,588 \\ Owners' Salary & $15,750 & $15,750 \\ Accounting, Payroll and Legal & $7,500 & $7,725 \\ Depreciation & $2,250 & $2,250 \\ Operating Profit & $14,694 & $11,800 \\ Interest & $0 & $0 \\ Profit Before Taxes & $14,694 & $11,800 \\ Income Taxes & $3,086 & $2,478 \\ Net Profit & $11,608 & $9,322 \\ \hline \end{tabular} \begin{tabular}{|lrr|} \hline Associated Industries & & \\ Data & 2016 & 2017 \\ Inventory & & \\ Accounts Receivable & $54,000 & $111,500 \\ Accounts Payable & $132,750 & $151,750 \\ Revenue & $40,500 & $77,580 \\ Cost of Goods Sold & $375,000 & $386,250 \\ Current Assets & $211,056 & $217,388 \\ Current Liabilities & $227,250 & $275,902 \\ Total Assets & $40,500 & $77,580 \\ Revenue per Day & $270,000 & $316,402 \\ Cost of Goods Sold Per day & $1,027 & $1,058 \\ & $578 & $596 \\ Efficiency Ratios & & 187.21 \\ Days in Inventory & 93.39 & 143.40 \\ Collection Period & 129.21 & 130.26 \\ Payment Period & 70.04 & 200.35 \\ Cash Conversion Cycle & 152.56 & 1.95 \\ Inventory Turnover Ratio & 3.91 & 1.22 \end{tabular} Working Capital $186,750 $198,322