Question

In the summer of2008, at Heathrow airport inLondon, Bestofthebest(BB), a privatecompany, offered a lottery to win a Ferrari or 102,000 Britishpounds, equivalent at the time

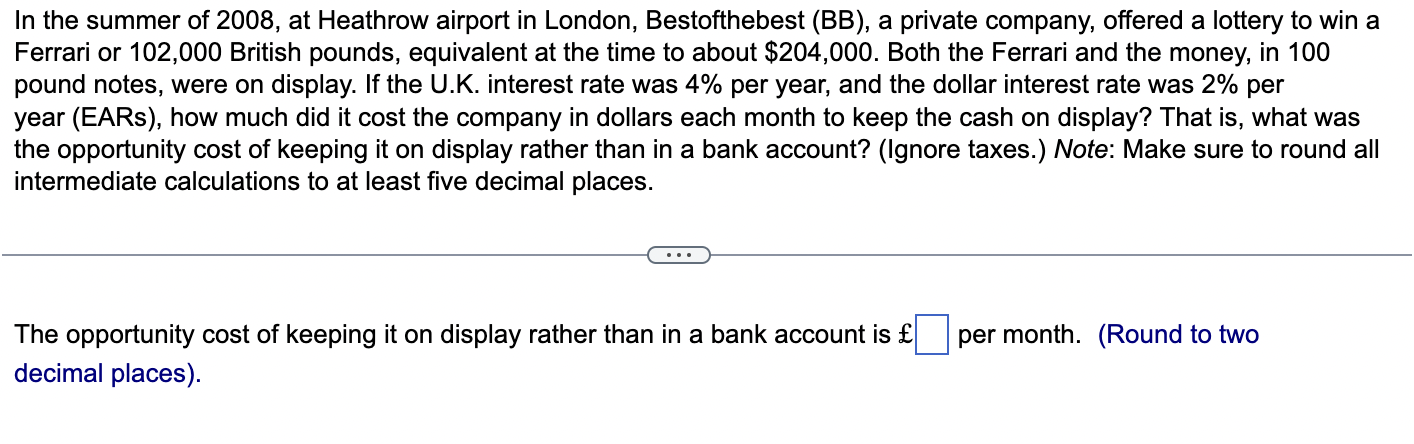

In the summer of2008, at Heathrow airport inLondon, Bestofthebest(BB), a privatecompany, offered a lottery to win a Ferrari or 102,000 Britishpounds, equivalent at the time to about $204,000. Both the Ferrari and themoney, in 100 poundnotes, were on display. If the U.K. interest rate was 4% peryear, and the dollar interest rate was 2% per year(EARs), how much did it cost the company in dollars each month to keep the cash ondisplay? Thatis, what was the opportunity cost of keeping it on display rather than in a bankaccount? (Ignoretaxes.) Note: Make sure to round all intermediate calculations to at least five decimal places. The opportunity cost of keeping it on display rather than in a bank account is ? enter your response here per month.(Round to two decimal places).

In the summer of 2008 , at Heathrow airport in London, Bestofthebest (BB), a private company, offered a lottery to win a Ferrari or 102,000 British pounds, equivalent at the time to about $204,000. Both the Ferrari and the money, in 100 pound notes, were on display. If the U.K. interest rate was 4% per year, and the dollar interest rate was 2% per year (EARs), how much did it cost the company in dollars each month to keep the cash on display? That is, what was the opportunity cost of keeping it on display rather than in a bank account? (Ignore taxes.) Note: Make sure to round all intermediate calculations to at least five decimal places. The opportunity cost of keeping it on display rather than in a bank account is per month. (Round to two decimal places)

In the summer of 2008 , at Heathrow airport in London, Bestofthebest (BB), a private company, offered a lottery to win a Ferrari or 102,000 British pounds, equivalent at the time to about $204,000. Both the Ferrari and the money, in 100 pound notes, were on display. If the U.K. interest rate was 4% per year, and the dollar interest rate was 2% per year (EARs), how much did it cost the company in dollars each month to keep the cash on display? That is, what was the opportunity cost of keeping it on display rather than in a bank account? (Ignore taxes.) Note: Make sure to round all intermediate calculations to at least five decimal places. The opportunity cost of keeping it on display rather than in a bank account is per month. (Round to two decimal places) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started