Question

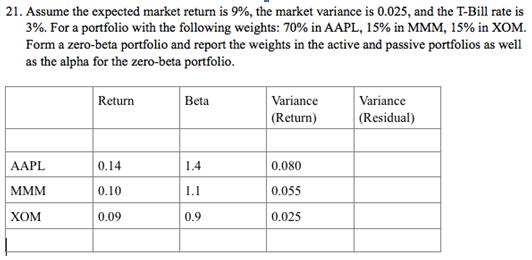

21. Assume the expected market return is 9%, the market variance is 0.025, and the T-Bill rate is 3%. For a portfolio with the

21. Assume the expected market return is 9%, the market variance is 0.025, and the T-Bill rate is 3%. For a portfolio with the following weights: 70% in AAPL, 15% in MMM, 15% in XOM. Form a zero-beta portfolio and report the weights in the active and passive portfolios as well as the alpha for the zero-beta portfolio. Beta Variance (Return) Return Variance (Residual) AAPL 0.14 1.4 0.080 0.10 1.1 0.055 0.09 0.9 0.025

Step by Step Solution

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Before I start Id like to point out that the portfolio weights exceed 1 in totality plea...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Finance Applications and Theory

Authors: Marcia Cornett

4th edition

1259691411, 978-1259691416

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App