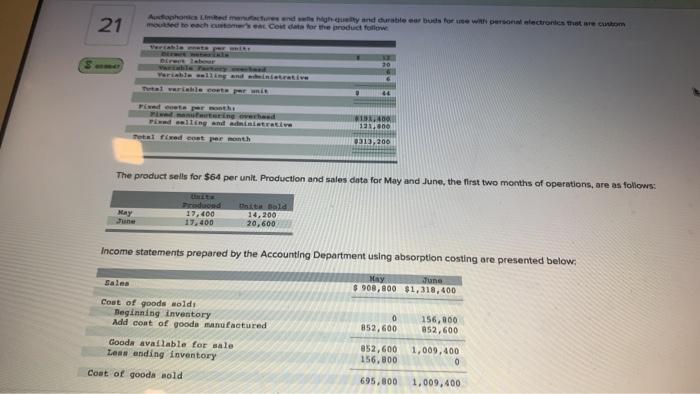

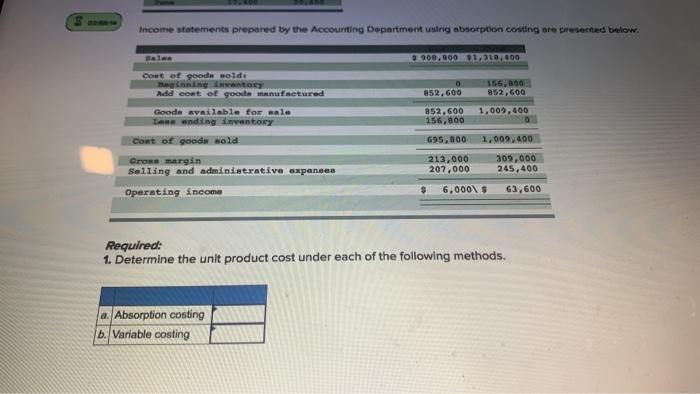

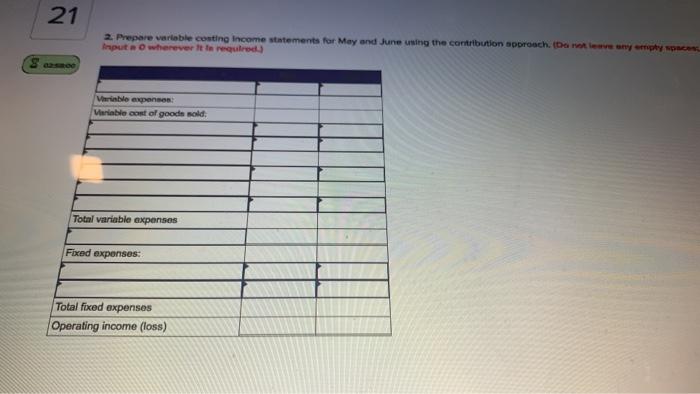

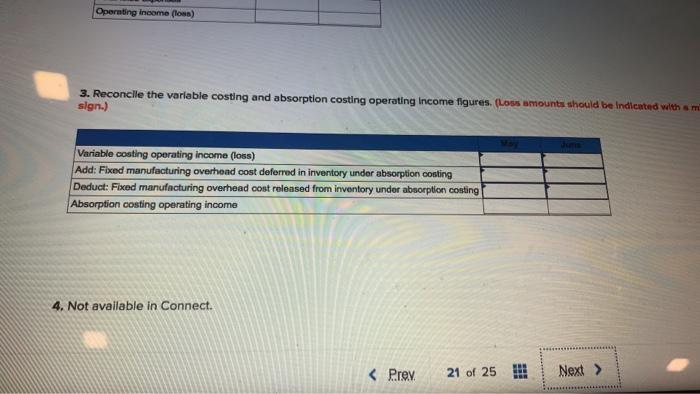

21 Audphones Limited me and why and durable or budstown personnalectronies that are com mustachment Coute for the product follow DE aber were tratta 6 40 antering wheed Podelling and administrative tal fixed ut per month 100 131.00 0313,200 The product sells for $64 per unit. Production and sales data for May and June, the first two months of operations, are as follows: May duod 17,400 17,400 Unit Bold 14,200 20,600 Income statements prepared by the Accounting Department using absorption costing are presented below. Sales May June $ 908,800 $1,318,400 852,600 156,000 852,600 Coot of goods wolde Beginning Inventory Add coat of goods manufactured Goods available for sale Less ending inventory Coat of goods sold 852,600 156,800 1,009,400 695,800 1,009,400 Income statements prepared by the Accounting Department using absorption costing are presented below. 900,000 1 10,400 0 852.600 156,00 852,600 1,009,400 Coat of good old Henning inventory Add cont of good manufactured Goode available for sale TARR ending inventory Cont of good old Gros margin Selling and administrative expenses Operating income 852.600 156,900 695,500 1,009.400 213,000 207.000 309,000 245,400 6,000 $ 63,600 Required: 1. Determine the unit product cost under each of the following methods. a. Absorption costing b. Variable costing 21 2. Prepare variable conting income statements for May and June using the contribution approach. (Demowe wyphy wonen Input whereverite required) Variable expenses Variable cost of goods sold. Total variable expenses Fixed expenses Total fixed expenses Operating income (loss) Operating Income (losa) 3. Reconcile the variable costing and absorption costing operating Income figures. (Lous amounts should be indicated with em sign.) Variable costing operating income (loss) Add: Fixed manufacturing overhead cost deferred in inventory under absorption costing Deduct: Fixed manufacturing overhead cost released from inventory under absorption costing Absorption costing operating income 4. Not available in Connect.