Question

2.1. Calculate the fixed portion of budgeted production overheads using the high-low method. 2.2. Calculate the break-even point (in units) for the business based on

2.1. Calculate the fixed portion of budgeted production overheads using the high-low method.

2.2. Calculate the break-even point (in units) for the business based on budgeted costs if lawnmowers sell for R3 000 per unit.

2.3. Prepare a flexible budget for Mr Trim (Pty) Ltd for the financial year ending 30 September 2022.

2.4. Discuss, with supporting reasons, whether a bonus should be paid to the production manager.

2.5. Calculate the total wage incentive that will be split amongst the factory workers. You can assume that all variable labour costs are related to factory workers.

2.6. Calculate the following using actual expenses for the year:

2.6.1 Total prime costs

2.6.2 Total conversion costs

2.6.3 Total period costs

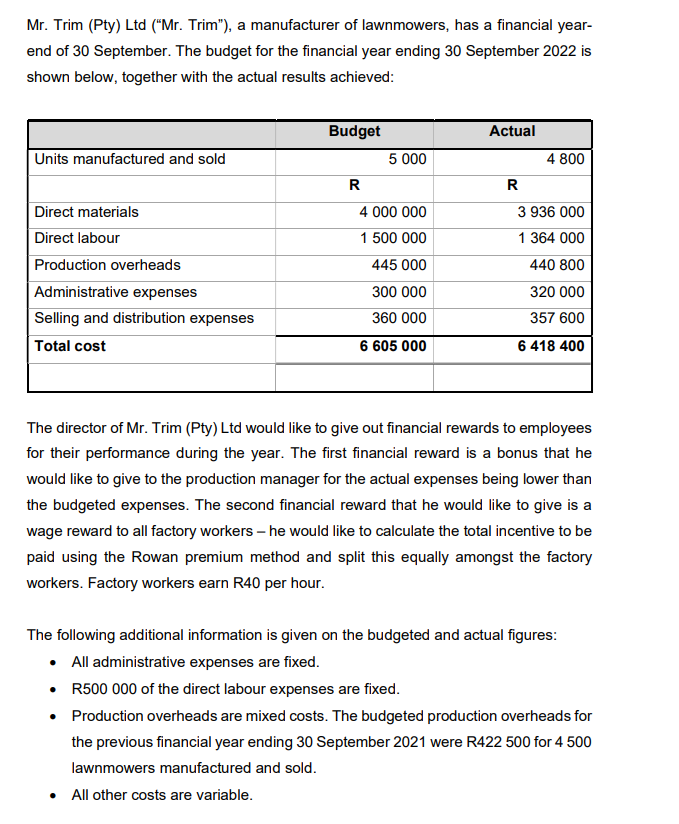

Mr. Trim (Pty) Ltd ("Mr. Trim"), a manufacturer of lawnmowers, has a financial yearend of 30 September. The budget for the financial year ending 30 September 2022 is shown below, together with the actual results achieved: The director of Mr. Trim (Pty) Ltd would like to give out financial rewards to employees for their performance during the year. The first financial reward is a bonus that he would like to give to the production manager for the actual expenses being lower than the budgeted expenses. The second financial reward that he would like to give is a wage reward to all factory workers - he would like to calculate the total incentive to be paid using the Rowan premium method and split this equally amongst the factory workers. Factory workers earn R40 per hour

Mr. Trim (Pty) Ltd ("Mr. Trim"), a manufacturer of lawnmowers, has a financial yearend of 30 September. The budget for the financial year ending 30 September 2022 is shown below, together with the actual results achieved: The director of Mr. Trim (Pty) Ltd would like to give out financial rewards to employees for their performance during the year. The first financial reward is a bonus that he would like to give to the production manager for the actual expenses being lower than the budgeted expenses. The second financial reward that he would like to give is a wage reward to all factory workers - he would like to calculate the total incentive to be paid using the Rowan premium method and split this equally amongst the factory workers. Factory workers earn R40 per hour Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started