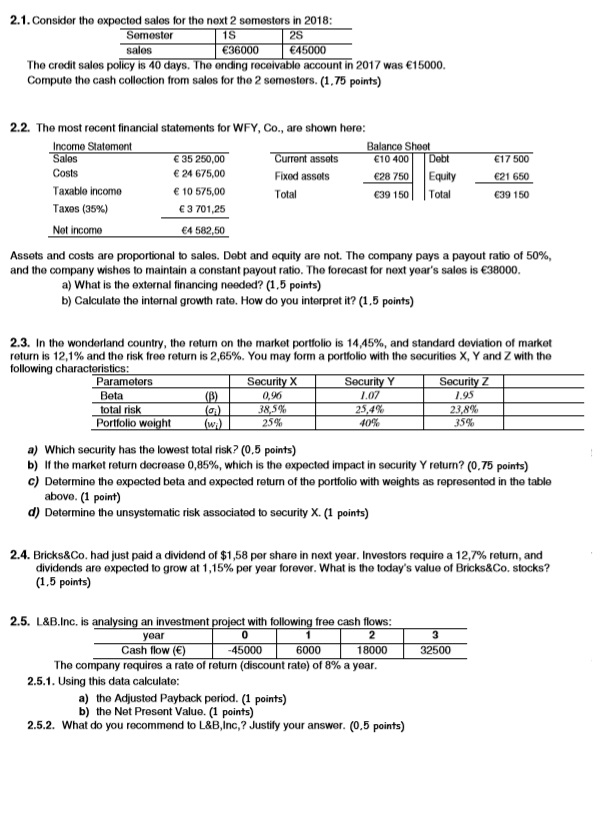

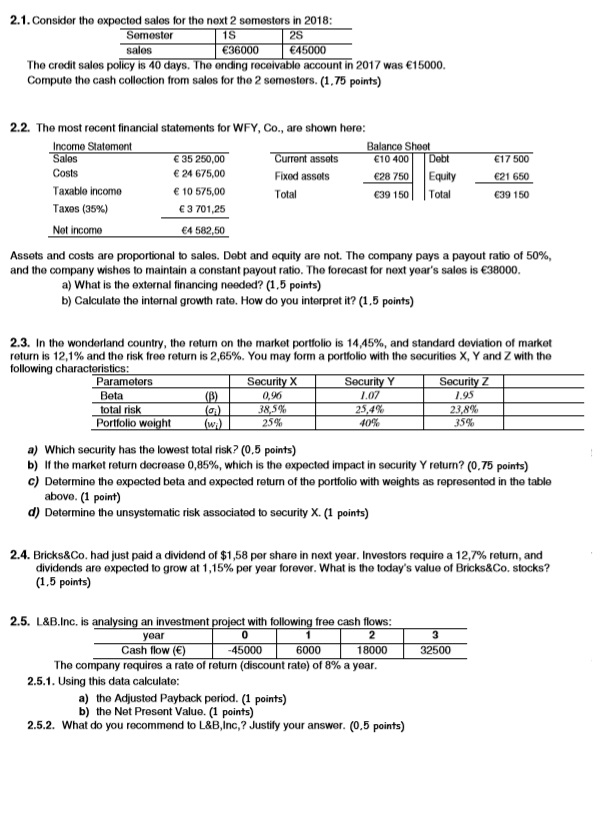

2.1. Consider the expected sales for the next 2 semesters in 2018: Semester 15 2 sales 36000 45000 The credit sales policy is 40 days. The onding receivable account in 2017 was 15000, Compute the cash collection from sales for the 2 semesters. (1,75 points) 2.2. The most recent financial statements for WFY, Co., are shown here: Income Statement Balance Sheet Sales 35 250,00 Current assets 10 400 Debt Costs 24 675,00 Fixed assets 28 750 Equity Taxable incomo 10 575,00 Total 39 150 Total Taxes (35%) 3 701,25 17500 21 650 39 150 Net income 4 582,50 Assets and costs are proportional to sales. Debt and equity are not. The company pays a payout ratio of 50%, and the company wishes to maintain a constant payout ratio. The forecast for next year's sales is 38000 a) What is the external financing needed? (1,5 points) b) Calculate the internal growth rate. How do you interpret it? (1,5 points) 2.3. In the wonderland country, the return on the market portfolio is 14,45%, and standard deviation of market return is 12,1% and the risk free return is 2,65%. You may form a portfolio with the securities X, Y and Z with the following characteristics: Parameters Security X Security Y Security Z Beta (B) 0,96 1.07 1.95 total risk o 38.5% 25,4% 23.8% Portfolio weight (w) 25% 40% 35% a) Which security has the lowest total risk? (0,5 points) b) If the market return decrease 0,85%, which is the expected impact in security Y return? (0.75 points) c) Determine the expected beta and expected return of the portfolio with weights as represented in the table above. (1 point) d) Determine the unsystematic risk associated to security X. (1 points) 2.4. Bricks&Co. had just paid a dividend of $1,58 per share in next year. Investors require a 12,7% return, and dividends are expected to grow at 1,15% per year forever. What is the today's value of Bricks&Co, stocks? (1,5 points) 3 3 2500 2.5. L&B.Inc. is analysing an investment project with following free cash flows: year 12 Cash flow () 45000 6000 18000 The company requires a rate of return (discount rate) of 8% a year. 2.5.1. Using this data calculate: a) the Adjusted Payback period. (1 points) b) the Net Present Value. (1 points) 2.5.2. What do you recommend to L&B, Inc, ? Justify your answer. (0,5 points)