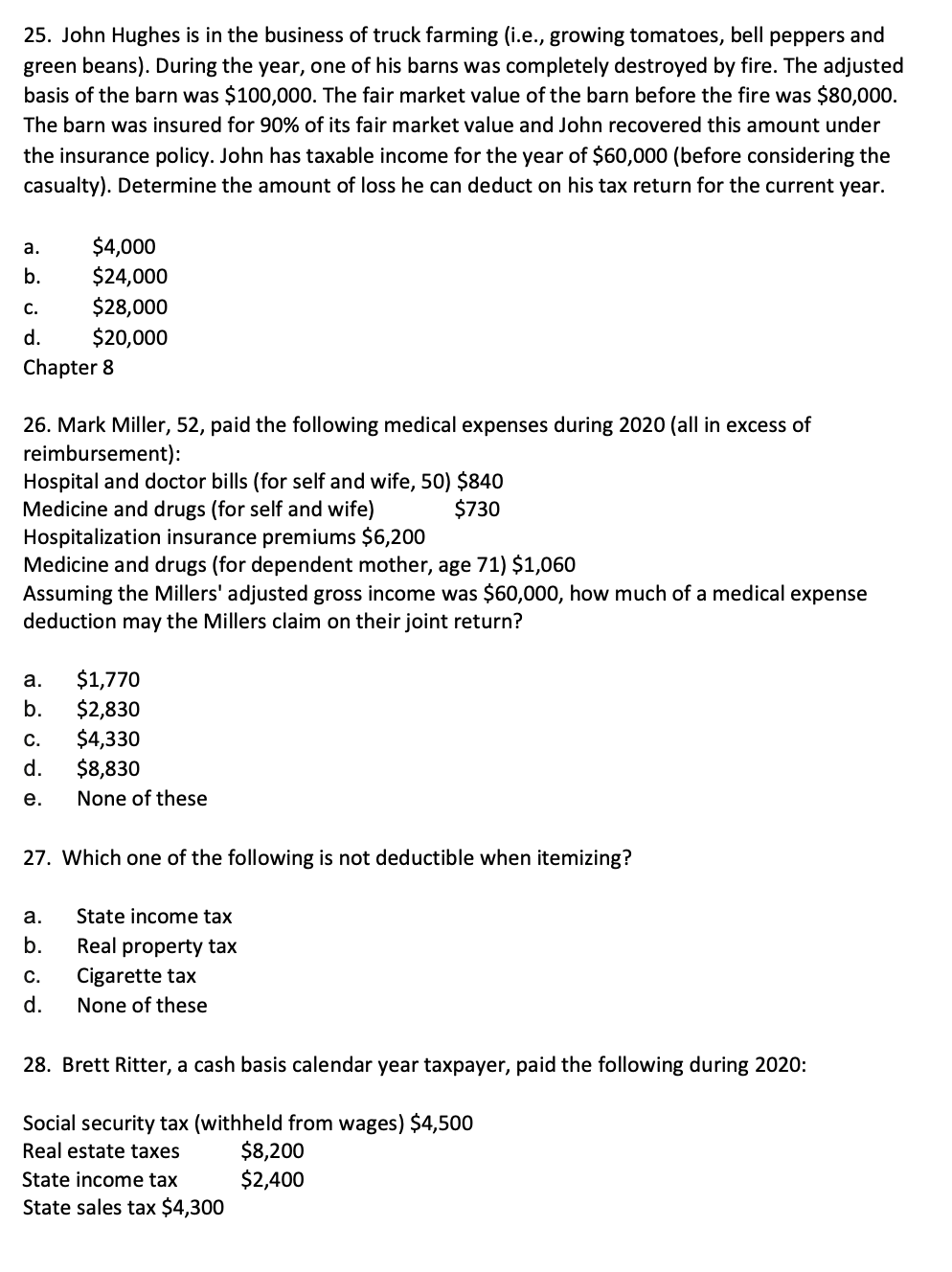

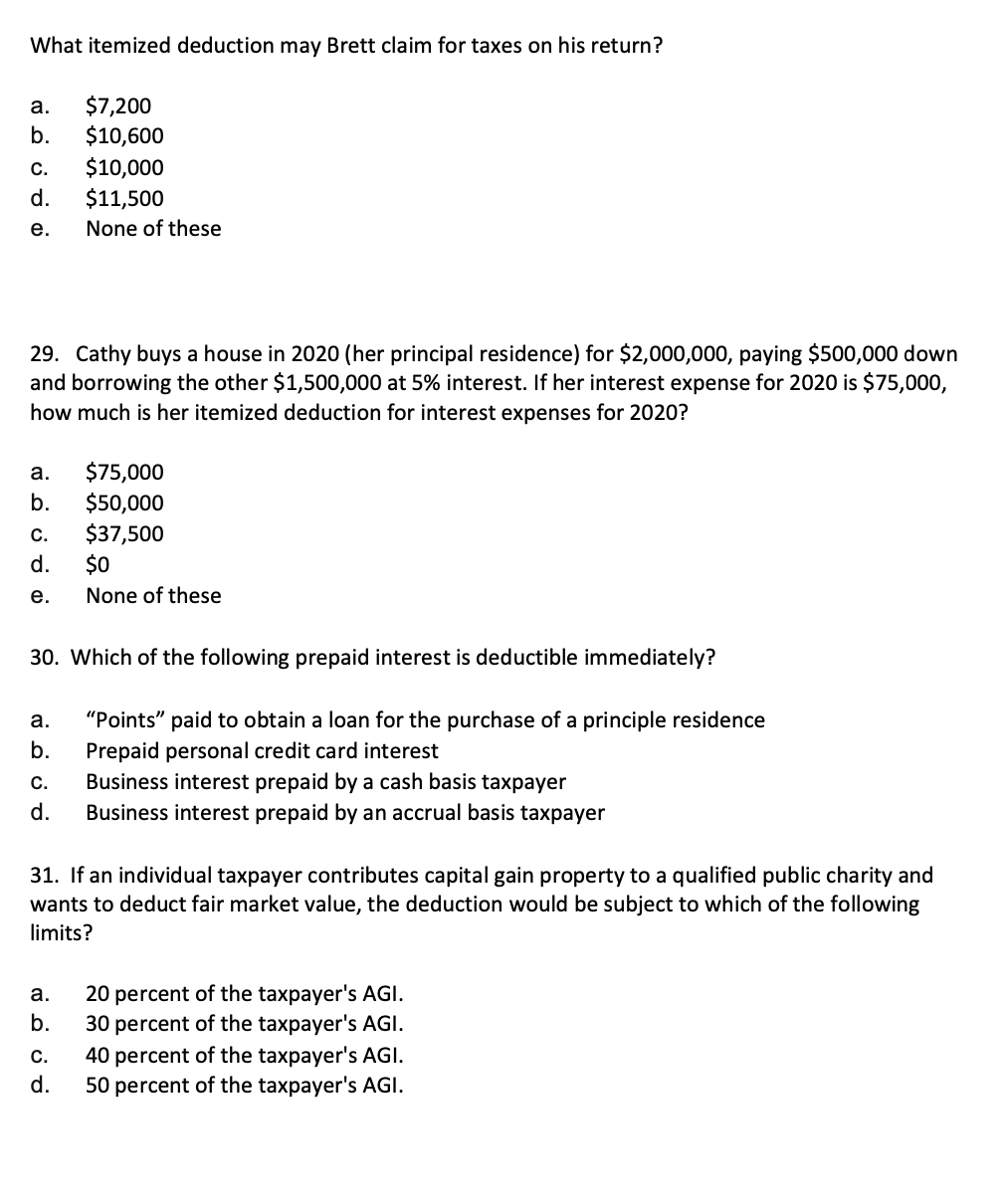

21. For MACRS depreciation purposes, autos and light-duty trucks are depreciated over what period? a. Three years b. Five years c. Ten years d. Fifteen years 22. During 2020, a corporation purchased machinery costing $205,000. This is the only acquisitions of depreciable property purchased by the corporation in 2020. The maximum deduction the corporation can claim under Code Sec. 179 in 2020 is: a. $25,000 b. $20,000 c. $205,000 d. $200,000 23. In January of this year, a corporation purchased residential real estate (an apartment building) at a total cost of $250,000. Of this amount, $50,000 was allocated to the underlying land, and therefore $200,000 was depreciable. What is the corporation's allowable depreciation deduction for the current year under MACRS? a. $5,128 b. $6,970 c. $4,915 d. $7,273 e. none of the above 24. Heizenburg Chemistry Labs Inc. purchased new five-year MACRS depreciable property in 2020 at a cost of $1,900,000. The property is eligible for section 179 depreciation and bonus depreciation, and Heizenburg elects to take the largest possible deduction. The property is depreciated using the standard MACRS half-year convention. What will be the deduction for bonus depreciation with respect to the property for 2020? a. $1,900,000 b. $860,000 c. $1,040,000 d. $500,000 e. $1,200,000 25. John Hughes is in the business of truck farming (i.e., growing tomatoes, bell peppers and green beans). During the year, one of his barns was completely destroyed by fire. The adjusted basis of the barn was $100,000. The fair market value of the barn before the fire was $80,000. The barn was insured for 90% of its fair market value and John recovered this amount under the insurance policy. John has taxable income for the year of $60,000 (before considering the casualty). Determine the amount of loss he can deduct on his tax return for the current year. a. $4,000 b. $24,000 c. $28,000 d. $20,000 Chapter 8 26. Mark Miller, 52, paid the following medical expenses during 2020 (all in excess of reimbursement): Hospital and doctor bills (for self and wife, 50) $840 Medicine and drugs (for self and wife) $730 Hospitalization insurance premiums $6,200 Medicine and drugs (for dependent mother, age 71) $1,060 Assuming the Millers' adjusted gross income was $60,000, how much of a medical expense deduction may the Millers claim on their joint return? a. b. C. d. $1,770 $2,830 $4,330 $8,830 None of these e. 27. Which one of the following is not deductible when itemizing? a. b. State income tax Real property tax Cigarette tax None of these c. d. 28. Brett Ritter, a cash basis calendar year taxpayer, paid the following during 2020: Social security tax (withheld from wages) $4,500 Real estate taxes $8,200 State income tax $2,400 State sales tax $4,300 What itemized deduction may Brett claim for taxes on his return? a. b. C. d. $7,200 $10,600 $10,000 $11,500 None of these e. 29. Cathy buys a house in 2020 (her principal residence) for $2,000,000, paying $500,000 down and borrowing the other $1,500,000 at 5% interest. If her interest expense for 2020 is $75,000, how much is her itemized deduction for interest expenses for 2020? a. b. C. d. $75,000 $50,000 $37,500 $0 None of these e. 30. Which of the following prepaid interest is deductible immediately? a. b. "Points paid to obtain a loan for the purchase of a principle residence Prepaid personal credit card interest Business interest prepaid by a cash basis taxpayer Business interest prepaid by an accrual basis taxpayer C. d. 31. If an individual taxpayer contributes capital gain property to a qualified public charity and wants to deduct fair market value, the deduction would be subject to which of the following limits? a. b. 20 percent of the taxpayer's AGI. 30 percent of the taxpayer's AGI. 40 percent of the taxpayer's AGI. 50 percent of the taxpayer's AGI. c. d