Answered step by step

Verified Expert Solution

Question

1 Approved Answer

21. Given an interest rate of zero percent, the future value of a lump sum invested today will always a remain constant, regardless of the

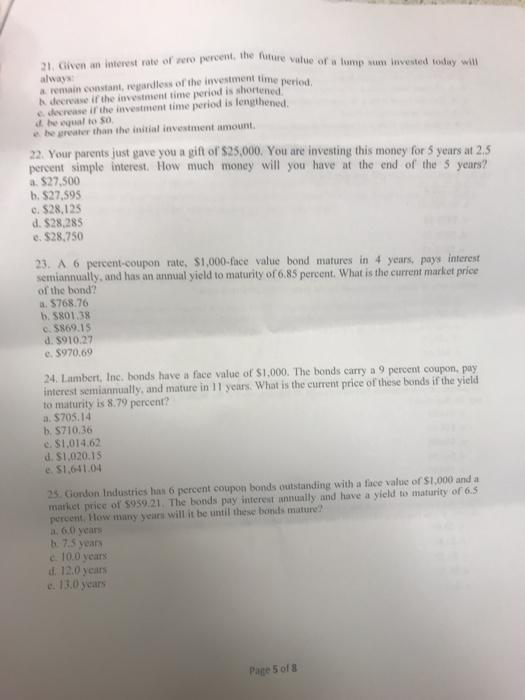

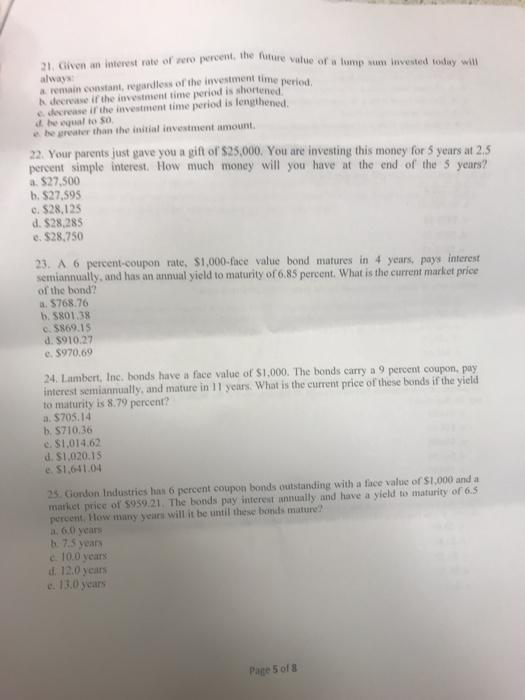

21. Given an interest rate of zero percent, the future value of a lump sum invested today will always a remain constant, regardless of the investment time peris b decrease if the investment time period is shortened e, decrease if the investment time period is lengthened. d. be equal to So e be greater than the initial investment amount 22. Your parents just gave you a gift of $25,000. You are investing this money for 5 years at 2.5 percent simple interest. How much money will you have at the end of the 5 years? a. $27,500 b. $27,595 c. $28,125 d. $28,285 e. $28,750 23. A 6 percent-coupon rate, $1,000-face value bond matures in 4 years, pays interest semiannually, and has an annual yield to maturity of 6.85 percent. What is the current market price of the bond? a. $768.76 b. $801.38 c. $869.15 d. $910.27 e.$970.69 24. Lambert, Inc. bonds have a face value of $1,000. interest semiannually, and mature in 11 years. What is the current price of these bonds if the yield to maturity is 8.79 percent? a. $705.14 b. $710.36 The bonds carry a 9 percent coupon, pay c. $1,014.62 d. $1,020.15 e. $1,641.04 25, Gordon Industries has 6 percent coupon bonds outstanding with a face value of SL000 and a market price of $959.21. The bonds pay interest annually and have a yield to maturity of 6.5 percent. How many years will it be until these bonds mature? a. 6.0 years b. 7.5 years c. 10.0 years d. 12.0 years e. 13.0 years Page S of 8 21. Given an interest rate of zero percent, the future value of a lump sum invested today will always a remain constant, regardless of the investment time peris b decrease if the investment time period is shortened e, decrease if the investment time period is lengthened. d. be equal to So e be greater than the initial investment amount 22. Your parents just gave you a gift of $25,000. You are investing this money for 5 years at 2.5 percent simple interest. How much money will you have at the end of the 5 years? a. $27,500 b. $27,595 c. $28,125 d. $28,285 e. $28,750 23. A 6 percent-coupon rate, $1,000-face value bond matures in 4 years, pays interest semiannually, and has an annual yield to maturity of 6.85 percent. What is the current market price of the bond? a. $768.76 b. $801.38 c. $869.15 d. $910.27 e.$970.69 24. Lambert, Inc. bonds have a face value of $1,000. interest semiannually, and mature in 11 years. What is the current price of these bonds if the yield to maturity is 8.79 percent? a. $705.14 b. $710.36 The bonds carry a 9 percent coupon, pay c. $1,014.62 d. $1,020.15 e. $1,641.04 25, Gordon Industries has 6 percent coupon bonds outstanding with a face value of SL000 and a market price of $959.21. The bonds pay interest annually and have a yield to maturity of 6.5 percent. How many years will it be until these bonds mature? a. 6.0 years b. 7.5 years c. 10.0 years d. 12.0 years e. 13.0 years Page S of 8

21. Given an interest rate of zero percent, the future value of a lump sum invested today will always a remain constant, regardless of the investment time peris b decrease if the investment time period is shortened e, decrease if the investment time period is lengthened. d. be equal to So e be greater than the initial investment amount 22. Your parents just gave you a gift of $25,000. You are investing this money for 5 years at 2.5 percent simple interest. How much money will you have at the end of the 5 years? a. $27,500 b. $27,595 c. $28,125 d. $28,285 e. $28,750 23. A 6 percent-coupon rate, $1,000-face value bond matures in 4 years, pays interest semiannually, and has an annual yield to maturity of 6.85 percent. What is the current market price of the bond? a. $768.76 b. $801.38 c. $869.15 d. $910.27 e.$970.69 24. Lambert, Inc. bonds have a face value of $1,000. interest semiannually, and mature in 11 years. What is the current price of these bonds if the yield to maturity is 8.79 percent? a. $705.14 b. $710.36 The bonds carry a 9 percent coupon, pay c. $1,014.62 d. $1,020.15 e. $1,641.04 25, Gordon Industries has 6 percent coupon bonds outstanding with a face value of SL000 and a market price of $959.21. The bonds pay interest annually and have a yield to maturity of 6.5 percent. How many years will it be until these bonds mature? a. 6.0 years b. 7.5 years c. 10.0 years d. 12.0 years e. 13.0 years Page S of 8 21. Given an interest rate of zero percent, the future value of a lump sum invested today will always a remain constant, regardless of the investment time peris b decrease if the investment time period is shortened e, decrease if the investment time period is lengthened. d. be equal to So e be greater than the initial investment amount 22. Your parents just gave you a gift of $25,000. You are investing this money for 5 years at 2.5 percent simple interest. How much money will you have at the end of the 5 years? a. $27,500 b. $27,595 c. $28,125 d. $28,285 e. $28,750 23. A 6 percent-coupon rate, $1,000-face value bond matures in 4 years, pays interest semiannually, and has an annual yield to maturity of 6.85 percent. What is the current market price of the bond? a. $768.76 b. $801.38 c. $869.15 d. $910.27 e.$970.69 24. Lambert, Inc. bonds have a face value of $1,000. interest semiannually, and mature in 11 years. What is the current price of these bonds if the yield to maturity is 8.79 percent? a. $705.14 b. $710.36 The bonds carry a 9 percent coupon, pay c. $1,014.62 d. $1,020.15 e. $1,641.04 25, Gordon Industries has 6 percent coupon bonds outstanding with a face value of SL000 and a market price of $959.21. The bonds pay interest annually and have a yield to maturity of 6.5 percent. How many years will it be until these bonds mature? a. 6.0 years b. 7.5 years c. 10.0 years d. 12.0 years e. 13.0 years Page S of 8

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started