Answered step by step

Verified Expert Solution

Question

1 Approved Answer

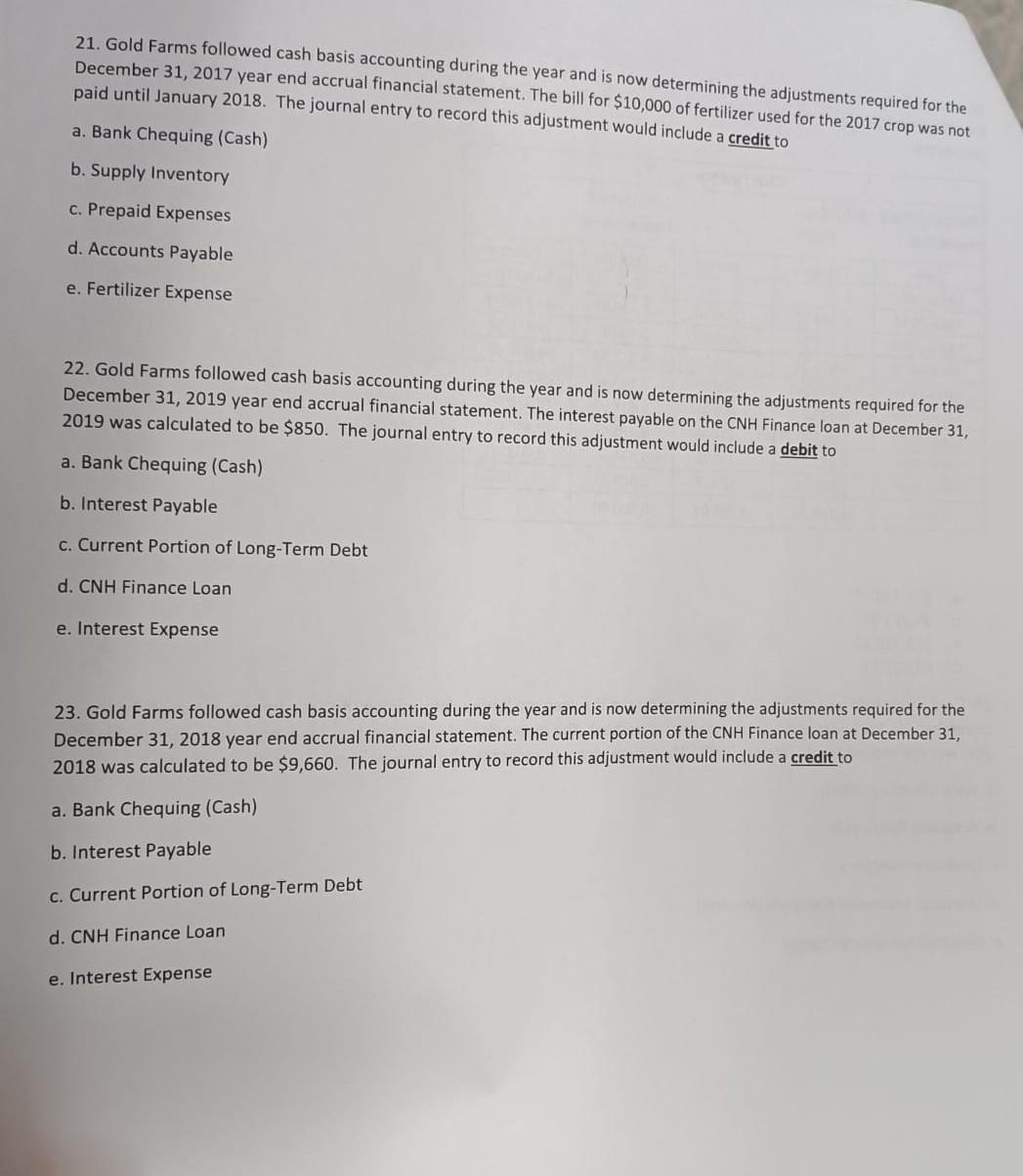

21. Gold Farms followed cash basis accounting during the year and is now determining the adjustments required for the December 31, 2017 year end accrual

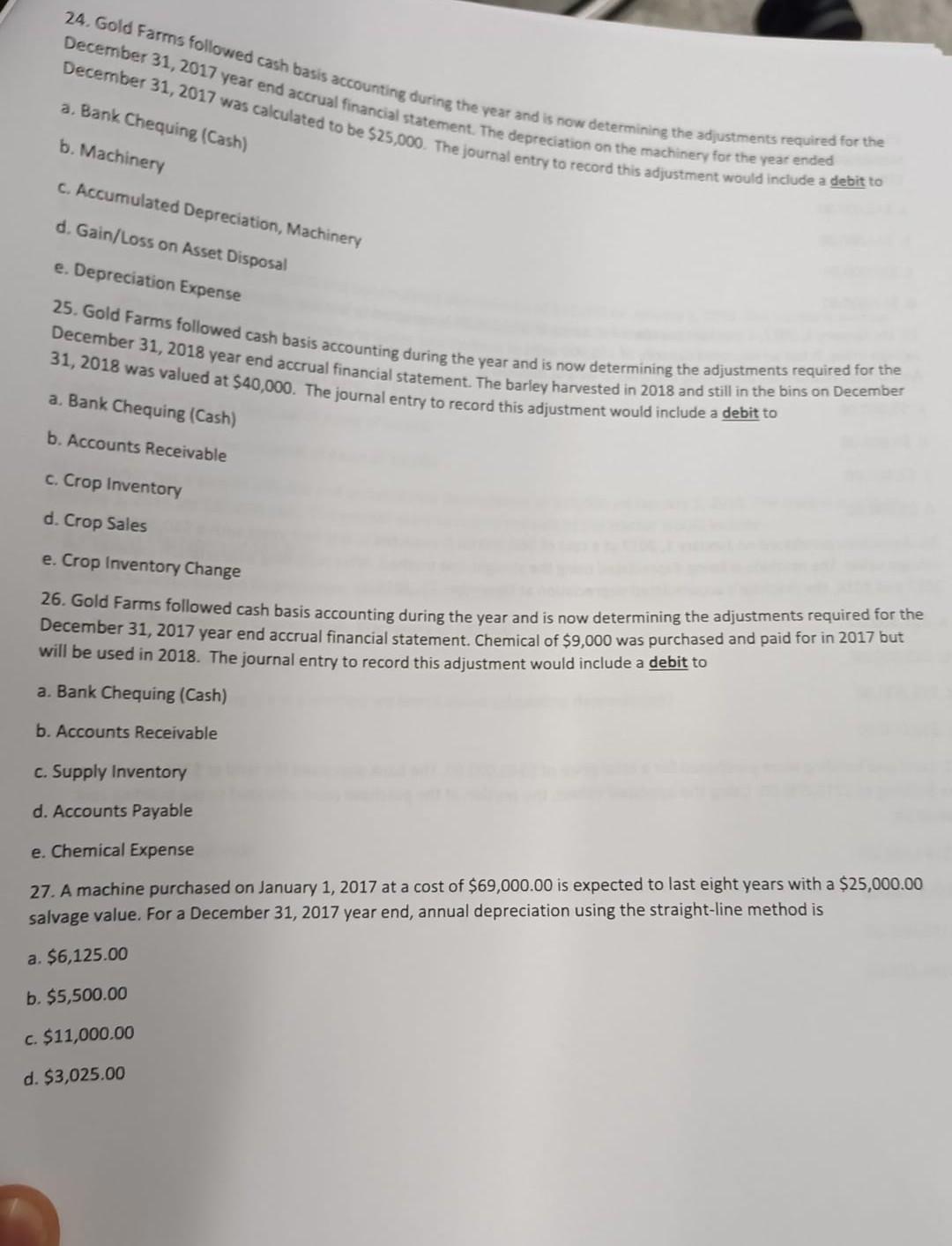

21. Gold Farms followed cash basis accounting during the year and is now determining the adjustments required for the December 31, 2017 year end accrual financial statement. The bill for $10,000 of fertilizer used for the 2017crop was not paid January 2018 . The journal entry to record this adjustment would include a credit to a. Bank Chequing (Cash) b. Supply Inventory c. Prepaid Expenses d. Accounts Payable e. Fertilizer Expense 22. Gold Farms followed cash basis accounting during the year and is now determining the adjustments required for the December 31, 2019 year end accrual financial statement. The interest payable on the CNH Finance loan at December 31 , 2019 was calculated to be $850. The journal entry to record this adjustment would include a debit to a. Bank Chequing (Cash) b. Interest Payable c. Current Portion of Long-Term Debt d. CNH Finance Loan e. Interest Expense 23. Gold Farms followed cash basis accounting during the year and is now determining the adjustments required for the December 31, 2018 year end accrual financial statement. The current portion of the CNH Finance loan at December 31 , 2018 was calculated to be $9,660. The journal entry to record this adjustment would include a credit to a. Bank Chequing (Cash) b. Interest Payable c. Current Portion of Long-Term Debt d. CNH Finance Loan e. Interest Expense 24. Gold Farms followed cash basis accounting during the vear and is now determining the adjustments required for the December 31, 2017 year end accrual financial statement. The depreciation on the machinery for the year ended a. Bank Chequing (Cash) b. Machinery c. Accumulated Depreciation, Machinery d. Gain/Loss on Asset Disposal e. Depreciation Expense 25. Gold Farms followed cash basis accounting during the year and is now determining the adjustments required for the December 31, 2018 year end accrual financial statement. The barley harvested in 2018 and still in the bins on December a. Bank Chequing (Cash) $40,000. The journal entry to record this adjustment would include a debit to b. Accounts Receivable c. Crop inventory d. Crop Sales e. Crop Inventory Change 26. Gold Farms followed cash basis accounting during the year and is now determining the adjustments required for the December 31, 2017 year end accrual financial statement. Chemical of $9,000 was purchased and paid for in 2017 but will be used in 2018 . The journal entry to record this adjustment would include a debit to a. Bank Chequing (Cash) b. Accounts Receivable c. Supply Inventory d. Accounts Payable e. Chemical Expense 27. A machine purchased on January 1, 2017 at a cost of $69,000.00 is expected to last eight years with a $25,000.00 salvage value. For a December 31, 2017 year end, annual depreciation using the straight-line method is a. $6,125.00 b. $5,500.00 c. $11,000.00 d. $3,025.00 21. Gold Farms followed cash basis accounting during the year and is now determining the adjustments required for the December 31, 2017 year end accrual financial statement. The bill for $10,000 of fertilizer used for the 2017crop was not paid January 2018 . The journal entry to record this adjustment would include a credit to a. Bank Chequing (Cash) b. Supply Inventory c. Prepaid Expenses d. Accounts Payable e. Fertilizer Expense 22. Gold Farms followed cash basis accounting during the year and is now determining the adjustments required for the December 31, 2019 year end accrual financial statement. The interest payable on the CNH Finance loan at December 31 , 2019 was calculated to be $850. The journal entry to record this adjustment would include a debit to a. Bank Chequing (Cash) b. Interest Payable c. Current Portion of Long-Term Debt d. CNH Finance Loan e. Interest Expense 23. Gold Farms followed cash basis accounting during the year and is now determining the adjustments required for the December 31, 2018 year end accrual financial statement. The current portion of the CNH Finance loan at December 31 , 2018 was calculated to be $9,660. The journal entry to record this adjustment would include a credit to a. Bank Chequing (Cash) b. Interest Payable c. Current Portion of Long-Term Debt d. CNH Finance Loan e. Interest Expense 24. Gold Farms followed cash basis accounting during the vear and is now determining the adjustments required for the December 31, 2017 year end accrual financial statement. The depreciation on the machinery for the year ended a. Bank Chequing (Cash) b. Machinery c. Accumulated Depreciation, Machinery d. Gain/Loss on Asset Disposal e. Depreciation Expense 25. Gold Farms followed cash basis accounting during the year and is now determining the adjustments required for the December 31, 2018 year end accrual financial statement. The barley harvested in 2018 and still in the bins on December a. Bank Chequing (Cash) $40,000. The journal entry to record this adjustment would include a debit to b. Accounts Receivable c. Crop inventory d. Crop Sales e. Crop Inventory Change 26. Gold Farms followed cash basis accounting during the year and is now determining the adjustments required for the December 31, 2017 year end accrual financial statement. Chemical of $9,000 was purchased and paid for in 2017 but will be used in 2018 . The journal entry to record this adjustment would include a debit to a. Bank Chequing (Cash) b. Accounts Receivable c. Supply Inventory d. Accounts Payable e. Chemical Expense 27. A machine purchased on January 1, 2017 at a cost of $69,000.00 is expected to last eight years with a $25,000.00 salvage value. For a December 31, 2017 year end, annual depreciation using the straight-line method is a. $6,125.00 b. $5,500.00 c. $11,000.00 d. $3,025.00

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started