Answered step by step

Verified Expert Solution

Question

1 Approved Answer

2.1 Heights LTD is considering a cash purchase of Horizontal Ltd. During the year just completed, Horizontal Ltd earned R5 per share and paid cash

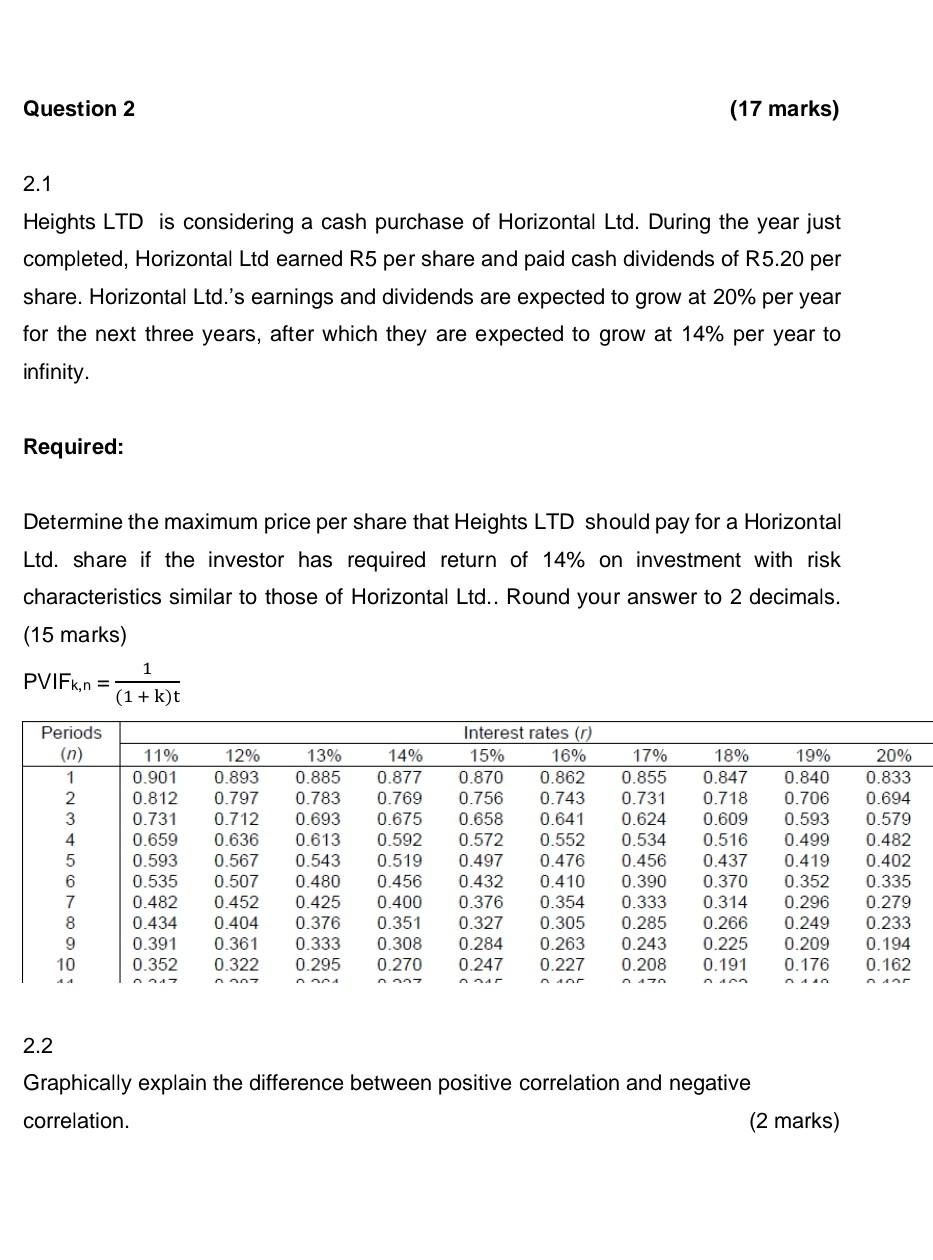

2.1 Heights LTD is considering a cash purchase of Horizontal Ltd. During the year just completed, Horizontal Ltd earned R5 per share and paid cash dividends of R5.20 per share. Horizontal Ltd.'s earnings and dividends are expected to grow at 20% per year for the next three years, after which they are expected to grow at 14% per year to infinity. Required: Determine the maximum price per share that Heights LTD should pay for a Horizontal Ltd. share if the investor has required return of 14% on investment with risk characteristics similar to those of Horizontal Ltd.. Round your answer to 2 decimals. (15 marks) PVIFk,n=(1+k)t1 2.2 Graphically explain the difference between positive correlation and negative correlation. (2 marks) 2.1 Heights LTD is considering a cash purchase of Horizontal Ltd. During the year just completed, Horizontal Ltd earned R5 per share and paid cash dividends of R5.20 per share. Horizontal Ltd.'s earnings and dividends are expected to grow at 20% per year for the next three years, after which they are expected to grow at 14% per year to infinity. Required: Determine the maximum price per share that Heights LTD should pay for a Horizontal Ltd. share if the investor has required return of 14% on investment with risk characteristics similar to those of Horizontal Ltd.. Round your answer to 2 decimals. (15 marks) PVIFk,n=(1+k)t1 2.2 Graphically explain the difference between positive correlation and negative correlation. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started