Question

21! I need the answer and explanation! thank you An entrepreneur recently purchased Cocoon's, a local deli, on the beach. To operate the business, she

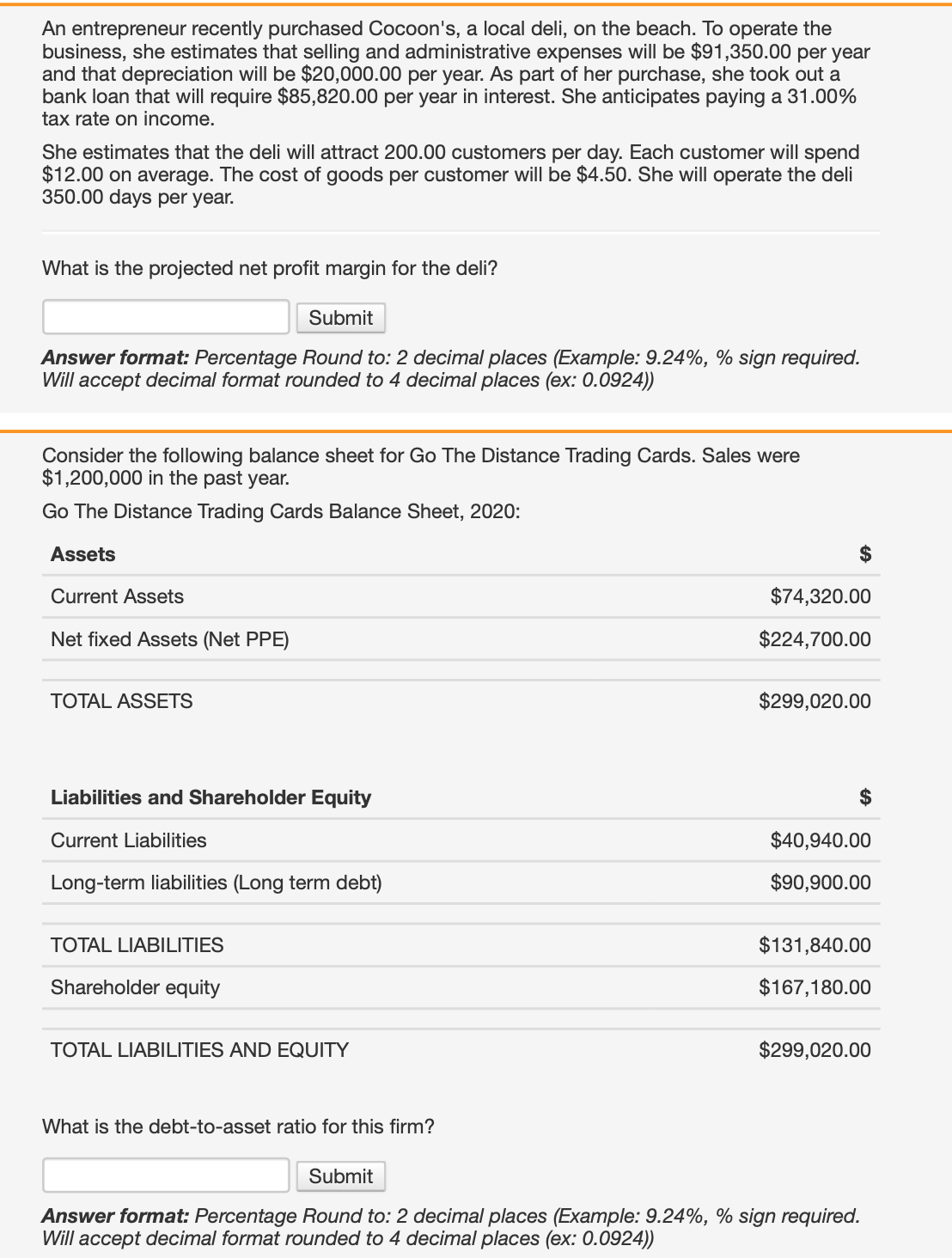

21! I need the answer and explanation! thank you  An entrepreneur recently purchased Cocoon's, a local deli, on the beach. To operate the business, she estimates that selling and administrative expenses will be $91,350.00 per year and that depreciation will be $20,000.00 per year. As part of her purchase, she took out a bank loan that will require $85,820.00 per year in interest. She anticipates paying a 31.00% tax rate on income. She estimates that the deli will attract 200.00 customers per day. Each customer will spend $12.00 on average. The cost of goods per customer will be $4.50. She will operate the deli 350.00 days per year. What is the projected net profit margin for the deli? Answer format: Percentage Round to: 2 decimal places (Example: 9.24\%, \% sign required. Will accept decimal format rounded to 4 decimal places (ex: 0.0924)) Consider the following balance sheet for Go The Distance Trading Cards. Sales were $1,200,000 in the past year. Go The Distance Trading Cards Balance Sheet, 2020: What is the debt-to-asset ratio for this firm? Answer format: Percentage Round to: 2 decimal places (Example: 9.24\%, % sign required. Will accept decimal format rounded to 4 decimal places (ex: 0.0924))

An entrepreneur recently purchased Cocoon's, a local deli, on the beach. To operate the business, she estimates that selling and administrative expenses will be $91,350.00 per year and that depreciation will be $20,000.00 per year. As part of her purchase, she took out a bank loan that will require $85,820.00 per year in interest. She anticipates paying a 31.00% tax rate on income. She estimates that the deli will attract 200.00 customers per day. Each customer will spend $12.00 on average. The cost of goods per customer will be $4.50. She will operate the deli 350.00 days per year. What is the projected net profit margin for the deli? Answer format: Percentage Round to: 2 decimal places (Example: 9.24\%, \% sign required. Will accept decimal format rounded to 4 decimal places (ex: 0.0924)) Consider the following balance sheet for Go The Distance Trading Cards. Sales were $1,200,000 in the past year. Go The Distance Trading Cards Balance Sheet, 2020: What is the debt-to-asset ratio for this firm? Answer format: Percentage Round to: 2 decimal places (Example: 9.24\%, % sign required. Will accept decimal format rounded to 4 decimal places (ex: 0.0924))

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started