Answered step by step

Verified Expert Solution

Question

1 Approved Answer

21 In 2020, the Turnerts' 25-year-old daughter, Victoria, is a full-time student at Acicora State University but she plans to return home after the school

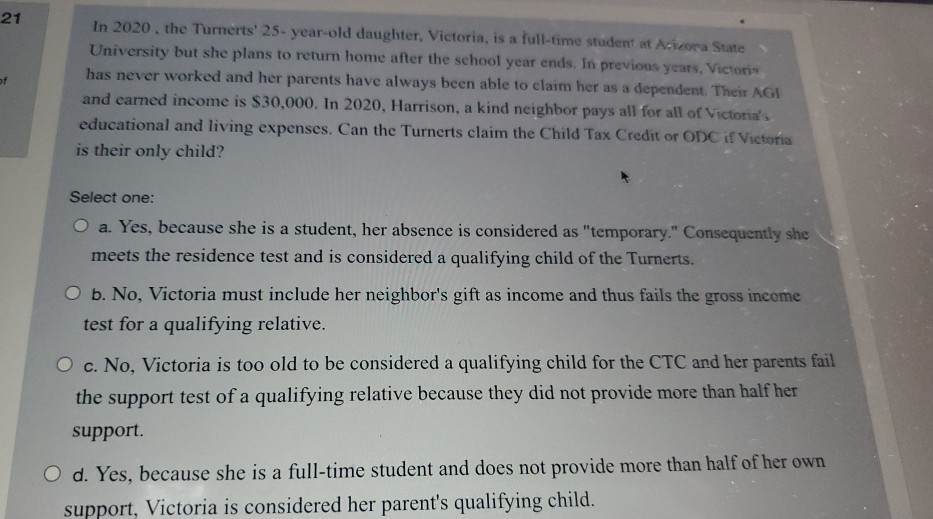

21 In 2020, the Turnerts' 25-year-old daughter, Victoria, is a full-time student at Acicora State University but she plans to return home after the school year ends. In previous years, Victoria has never worked and her parents have always been able to claim her as a dependent. Their AGI and earned income is $30,000. In 2020, Harrison, a kind neighbor pays all for all of Victoria's educational and living expenses. Can the Turnerts claim the Child Tax Credit or ODC if Victoria is their only child? Select one: O a. Yes, because she is a student, her absence is considered as "temporary." Consequently she meets the residence test and is considered a qualifying child of the Turnerts. O b. No, Victoria must include her neighbor's gift as income and thus fails the gross income test for a qualifying relative. O c. No, Victoria is too old to be considered a qualifying child for the CTC and her parents fail the support test of a qualifying relative because they did not provide more than half her support. O d. Yes, because she is a full-time student and does not provide more than half of her own support, Victoria is considered her parent's qualifying child

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started