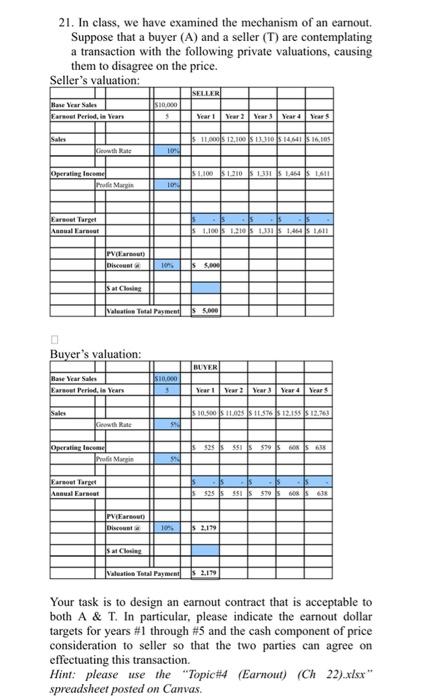

21. In class, we have examined the mechanism of an earnout. Suppose that a buyer (A) and a seller (T) are contemplating a transaction with the following private valuations, causing them to disagree on the price. Seller's valuation: Base Year Sales Earnout Period, in Years Sales Kiowth Rate Operating Income Profit Margin Earnoet Target Annual Earnest Sales PV(Earnout) Discount 0 Buyer's valuation: Sat Closing Base Year Sales Earnout Period, in Years Operating Income Keowth Rate Earnout Target Annual Earneat Profit Margin PV(Earnout) Discount $10,000 5 at Choling 10% 1000 10% Valuation Total Payment 5.000 $10,000 3 5%9 5% SELLER 10% Year 1 Year 2 Year 3 Year 4 Year 5 $ 11,000 $ 12,100 $ 13,310 514,641 5 16,105 $1.100 1.210 1331 5 1464 $1611 1.100 1.210 1.331 5 1,4645 1611 s 5,000 BUYER Year 1 Year 2 Year 3 Year 4 Year 5 $10.500 525 551 579 6085 638 11.025s 11.576 5 12.155 $12.763 Is -s -$ -S 15 525 5551S 5795 608 638 2.179 Valuation Total Payment 2.179 Your task is to design an earnout contract that is acceptable to both A & T. In particular, please indicate the earnout dollar targets for years #1 through # 5 and the cash component of price consideration to seller so that the two parties can agree on effectuating this transaction. Hint: please use the "Topic#4 (Earnout) (Ch 22).xlsx" spreadsheet posted on Canvas. 21. In class, we have examined the mechanism of an earnout. Suppose that a buyer (A) and a seller (T) are contemplating a transaction with the following private valuations, causing them to disagree on the price. Seller's valuation: Base Year Sales Earnout Period, in Years Sales Kiowth Rate Operating Income Profit Margin Earnoet Target Annual Earnest Sales PV(Earnout) Discount 0 Buyer's valuation: Sat Closing Base Year Sales Earnout Period, in Years Operating Income Keowth Rate Earnout Target Annual Earneat Profit Margin PV(Earnout) Discount $10,000 5 at Choling 10% 1000 10% Valuation Total Payment 5.000 $10,000 3 5%9 5% SELLER 10% Year 1 Year 2 Year 3 Year 4 Year 5 $ 11,000 $ 12,100 $ 13,310 514,641 5 16,105 $1.100 1.210 1331 5 1464 $1611 1.100 1.210 1.331 5 1,4645 1611 s 5,000 BUYER Year 1 Year 2 Year 3 Year 4 Year 5 $10.500 525 551 579 6085 638 11.025s 11.576 5 12.155 $12.763 Is -s -$ -S 15 525 5551S 5795 608 638 2.179 Valuation Total Payment 2.179 Your task is to design an earnout contract that is acceptable to both A & T. In particular, please indicate the earnout dollar targets for years #1 through # 5 and the cash component of price consideration to seller so that the two parties can agree on effectuating this transaction. Hint: please use the "Topic#4 (Earnout) (Ch 22).xlsx" spreadsheet posted on Canvas