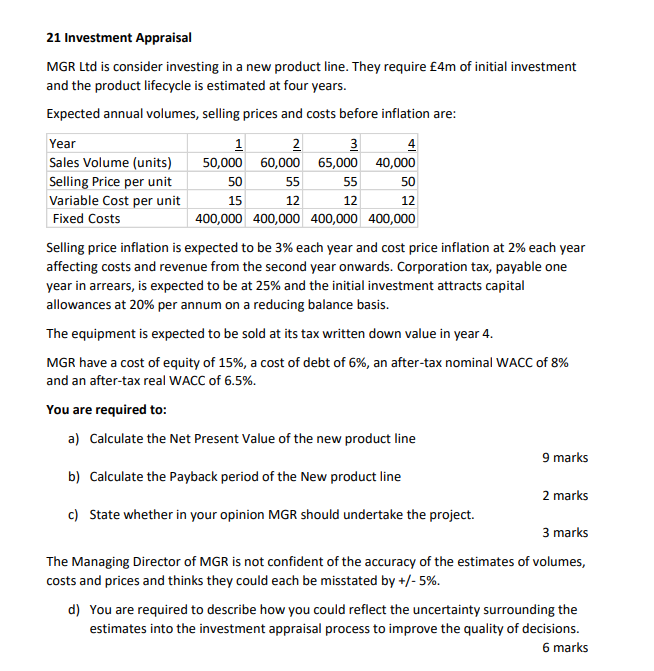

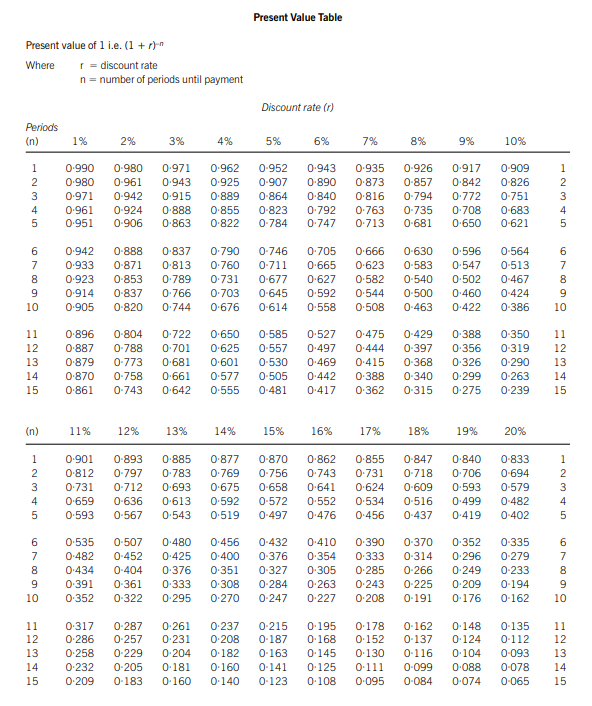

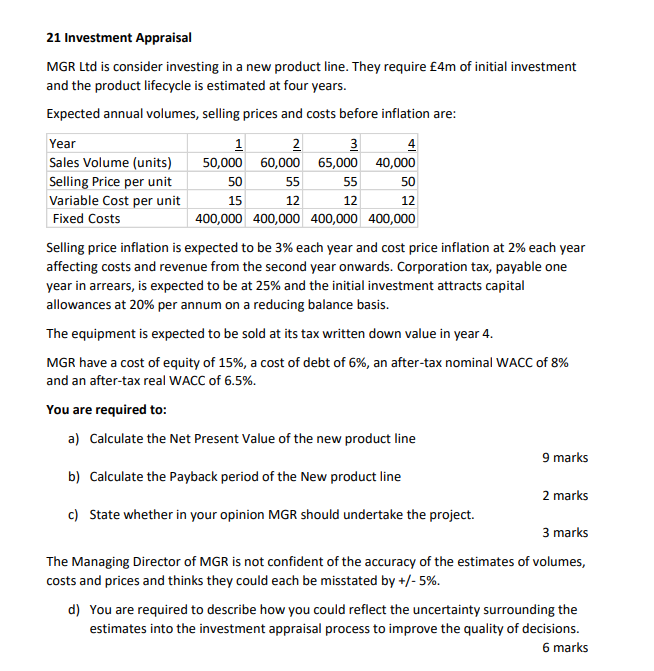

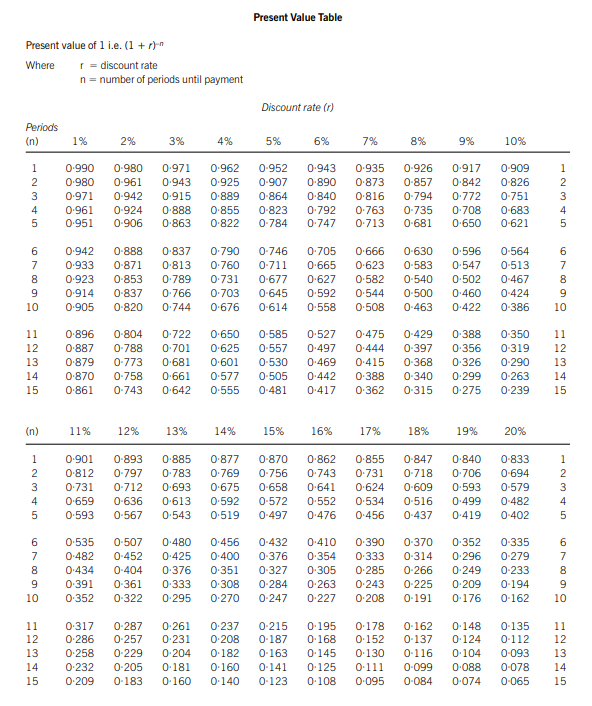

21 Investment Appraisal MGR Ltd is consider investing in a new product line. They require 4m of initial investment and the product lifecycle is estimated at four years. Expected annual volumes, selling prices and costs before inflation are: Year 1 2 3 4 Sales Volume (units) 50,000 60,000 65,000 40,000 Selling Price per unit 50 55 55 50 Variable Cost per unit 15 12 12 12 Fixed Costs 400,000 400,000 400,000 400,000 Selling price inflation is expected to be 3% each year and cost price inflation at 2% each year affecting costs and revenue from the second year onwards. Corporation tax, payable one year in arrears, is expected to be at 25% and the initial investment attracts capital allowances at 20% per annum on a reducing balance basis. The equipment is expected to be sold at its tax written down value in year 4. MGR have a cost of equity of 15%, a cost of debt of 6%, an after-tax nominal WACC of 8% and an after-tax real WACC of 6.5%. You are required to: a) Calculate the Net Present Value of the new product line 9 marks b) Calculate the Payback period of the New product line 2 marks c) State whether in your opinion MGR should undertake the project. 3 marks The Managing Director of MGR is not confident of the accuracy of the estimates of volumes, costs and prices and thinks they could each be misstated by +/- 5%. d) You are required to describe how you could reflect the uncertainty surrounding the estimates into the investment appraisal process to improve the quality of decisions. 6 marks Present Value Table Present value of 1 i.e. (1 + r)* r = discount rate n=number of periods until payment Where Discount rate (1) Period's (n) 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 1 2 3 4 5 0.990 0.980 0.971 0.961 0.951 0-980 0.961 0.942 0.924 0.906 0.971 0.943 0.915 0.888 0-863 0.962 0.925 0.889 0.855 0-822 0.952 0.907 0-864 0-823 0-784 0.943 0-890 0-840 0.792 0.747 0.935 0-873 0.816 0.763 0.713 0.926 0-857 0-794 0.735 0-681 0.917 0.842 0.772 0.708 0.650 0.909 0-826 0-751 0-683 0-621 1 2 3 4 5 6 7 8 9 10 0.942 0.933 0.923 0.914 0.905 0-888 0-871 0-853 0-837 0-820 0-837 0-813 0.789 0.766 0.744 0.790 0.760 0.731 0.703 0.676 0-746 0-711 0-677 0-645 0-614 0-705 0-665 0.627 0.592 0-558 0.666 0.623 0-582 0-544 0-508 0-630 0-583 0-540 0-500 0-463 0.596 0-547 0-502 0-460 0-422 0-564 0-513 0-467 0-424 0-386 6 7 8 9 10 11 12 13 14 15 0-896 0-887 0-879 0-870 0.861 0-804 0-788 0.773 0.758 0-743 0.722 0.701 0-681 0-661 0-642 0-650 0.625 0.601 0-577 0-555 0-585 0-557 0-530 0-505 0-481 0.527 0-497 0-469 0-442 0-417 0.475 0.444 0.415 0-388 0-362 0-429 0-397 0-368 0-340 0-315 0-388 0-356 0-326 0.299 0 275 0-350 0 319 0-290 0-263 0-239 11 12 13 14 15 (n) 11% 12% 13% 14% 15% 16% 17% 18% 19% 20% 1 1 2 3 4 5 0.901 0-812 0.731 0.659 0:593 0-893 0-797 0.712 0-636 0-567 0.885 0.783 0-693 0-613 0-543 0-877 0.769 0.675 0.592 0-519 0-870 0-756 0-658 0-572 0-497 0.862 0.743 0-641 0-552 0-476 0.855 0.731 0.624 0.534 0.456 0-847 0-718 0-609 0-516 0-437 0-840 0.706 0.593 0-499 0-419 0-833 0-694 0-579 0-482 0-402 UN 6 7 8 9 10 0.535 0.482 0-434 0-391 0-352 0-507 0-452 0-404 0-361 0-322 0-480 0-425 0.376 0-333 0 295 0.456 0.400 0-351 0-308 0-270 0-432 0-376 0-327 0-284 0-247 0-410 0-354 0-305 0.263 0-227 0-390 0-333 0-285 0-243 0 208 0-370 0-314 0-266 0-225 0-191 0-352 0 296 0-249 0 209 0-176 0-335 0-279 0-233 0-194 0-162 6 7 8 9 10 11 12 13 14 15 0-317 0.286 0.258 0.232 0-209 0-287 0-257 0-229 0-205 0-183 0.261 0 231 0.204 0.181 0.160 0 237 0 208 0.182 0.160 0.140 0-215 0-187 0-163 0-141 0-123 0.195 0.168 0.145 0.125 0.108 0-178 0.152 0 130 0.111 0 095 0-162 0-137 0-116 0-099 0-084 0.148 0.124 0.104 0.088 0.074 0-135 0-112 0-093 0-078 0-065 11 12 13 14 15