Answered step by step

Verified Expert Solution

Question

1 Approved Answer

21. Kiely has a machine that cost $100,000 with accumulated depreciation of $60,000 on Dec 31, Year 1. On that date, Kiely determines that

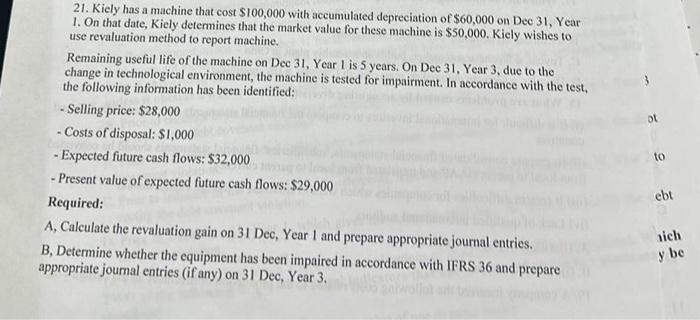

21. Kiely has a machine that cost $100,000 with accumulated depreciation of $60,000 on Dec 31, Year 1. On that date, Kiely determines that the market value for these machine is $50,000. Kiely wishes to use revaluation method to report machine. Remaining useful life of the machine on Dec 31, Year 1 is 5 years. On Dec 31, Year 3, due to the change in technological environment, the machine is tested for impairment. In accordance with the test, the following information has been identified: - Selling price: $28,000 . - Costs of disposal: $1,000 - Expected future cash flows: $32,000 - Present value of expected future cash flows: $29,000 Required: A, Calculate the revaluation gain on 31 Dec, Year 1 and prepare appropriate journal entries. B, Determine whether the equipment has been impaired in accordance with IFRS 36 and prepare appropriate journal entries (if any) on 31 Dec, Year 3. 3. ot to ebt nich y be

Step by Step Solution

There are 3 Steps involved in it

Step: 1

A Revaluation Gain calculation and Journal Entries 31 Dec Year 1 1 Calculate Revaluation Gain Carryi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started