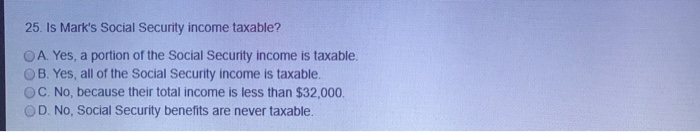

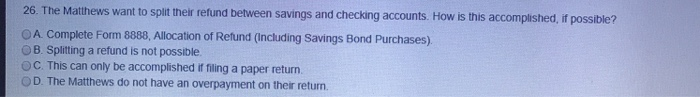

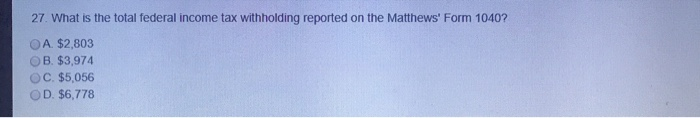

21. Since the Matthews did not itemize for 2018, their state refund is not reported on Form 1040. True False 22. What is the amount of taxable interest reported on the Matthews' Form 1040? OA. $50 OB. $250 OC. $300 OD. $350 23. What is the total net amount of capital gain reported on Form 1040? OA. $308 OB. $2,411 C. $2,719 OD. $2,900 24. What is the taxable portion of Mark's pension from Pine Corporation using the simplified method? $ (Do not enter dollar signs, commas, periods, or decimal points in your answer.) [1] 25. Is Mark's Social Security income taxable? O A. Yes, a portion of the Social Security income is taxable. OB. Yes, all of the Social Security income is taxable. OC. No, because their total income is less than $32,000. OD. No, Social Security benefits are never taxable. 26. The Matthews want to split their refund between savings and checking accounts. How is this accomplished, if possible? OA Complete Form 8888, Allocation of Refund (Including Savings Bond Purchases). OB. Splitting a refund is not possible. OC. This can only be accomplished if filing a paper return. OD. The Matthews do not have an overpayment on their return. 27. What is the total federal income tax withholding reported on the Matthews' Form 1040? OA. $2,803 OB. $3,974 OC. $5,056 OD. $6,778 21. Since the Matthews did not itemize for 2018, their state refund is not reported on Form 1040. True False 22. What is the amount of taxable interest reported on the Matthews' Form 1040? OA. $50 OB. $250 OC. $300 OD. $350 23. What is the total net amount of capital gain reported on Form 1040? OA. $308 OB. $2,411 C. $2,719 OD. $2,900 24. What is the taxable portion of Mark's pension from Pine Corporation using the simplified method? $ (Do not enter dollar signs, commas, periods, or decimal points in your answer.) [1] 25. Is Mark's Social Security income taxable? O A. Yes, a portion of the Social Security income is taxable. OB. Yes, all of the Social Security income is taxable. OC. No, because their total income is less than $32,000. OD. No, Social Security benefits are never taxable. 26. The Matthews want to split their refund between savings and checking accounts. How is this accomplished, if possible? OA Complete Form 8888, Allocation of Refund (Including Savings Bond Purchases). OB. Splitting a refund is not possible. OC. This can only be accomplished if filing a paper return. OD. The Matthews do not have an overpayment on their return. 27. What is the total federal income tax withholding reported on the Matthews' Form 1040? OA. $2,803 OB. $3,974 OC. $5,056 OD. $6,778