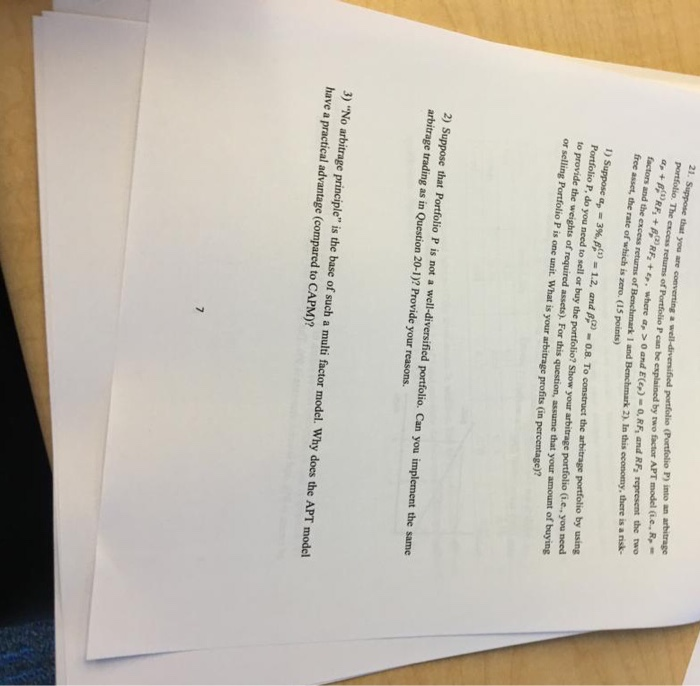

21. Suppose that you are con portfolio. The cross return of Portfolio Yogare converting wildfied folio Portfolio P a rase con refums of Portfolio Poube plained by two factor APT modele. + RF, + * RF,+ RE. wherea> and (e)-0, RF, and RF, represent the two e excess returns of Benchmark and Benchmark 2). In this economy, there is a risk- free asset, the rate of which is zero (15 points) factors and the excess o Suppose a - 3%, p = 1.2, and 0.8. To construct the arbitrage portfolio by using Portfolio P. do you need to sell or buy the portfolio Show your arbitrage portfolio (ie, you need to provide the weights of required assets). For this question, assume that your amount of buying or selling Portfolio P is one unit. What is your arbitrage profits in percentage)? 2) Suppose that Portfolio P is not a well-diversified portfolio. Can you implement the same arbitrage trading as in Question 20-1) Provide your reasons. 3) "No arbitrage principle" is the base of such a multi factor model. Why does the APT model have a practical advantage (compared to CAPM)? 21. Suppose that you are con portfolio. The cross return of Portfolio Yogare converting wildfied folio Portfolio P a rase con refums of Portfolio Poube plained by two factor APT modele. + RF, + * RF,+ RE. wherea> and (e)-0, RF, and RF, represent the two e excess returns of Benchmark and Benchmark 2). In this economy, there is a risk- free asset, the rate of which is zero (15 points) factors and the excess o Suppose a - 3%, p = 1.2, and 0.8. To construct the arbitrage portfolio by using Portfolio P. do you need to sell or buy the portfolio Show your arbitrage portfolio (ie, you need to provide the weights of required assets). For this question, assume that your amount of buying or selling Portfolio P is one unit. What is your arbitrage profits in percentage)? 2) Suppose that Portfolio P is not a well-diversified portfolio. Can you implement the same arbitrage trading as in Question 20-1) Provide your reasons. 3) "No arbitrage principle" is the base of such a multi factor model. Why does the APT model have a practical advantage (compared to CAPM)